Absolute Income Hypothesis : Macroeconomics Theory

Absolute Income Hypothesis:

- Keynes’ consumption function is also known as the ‘absolute income hypothesis’ or theory. The relation between consumption and income is based on Keynes’s fundamental “Psychological Law of Consumption” which states that when income increases consumption expenditure also increases but at a diminishing rate.

- The Keynesian consumption function is written as:

C = a + cY, a > 0 and 0 < c < 1. - Where constant measures consumption at a zero level of disposable income. c is the Marginal Propensity to Consume (MPC) and Y is the disposal income.

The above relation that consumption is a function of current disposal income whether linear (functions have a constant slope) or non-linear (functions have a slope that varies between points) is called as absolute income hypothesis.

The consumption function has the following properties:

- As income increases Average Propensity to Consume (APC=C/Y) falls.

- The Marginal Propensity to Consume (MPC) is positive but less than unity (0 < b < 1) so that higher income leads to higher consumption.

- The consumption expenditure increases or decreases with increases or decreases in income but non proportionally. The non-proportionally consumption implies that in the short-run average and marginal propensity do not coincide (APC>MPC).

- This consumption function is stable both in the short-run and long run.

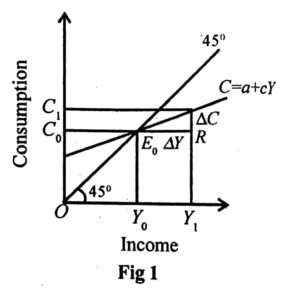

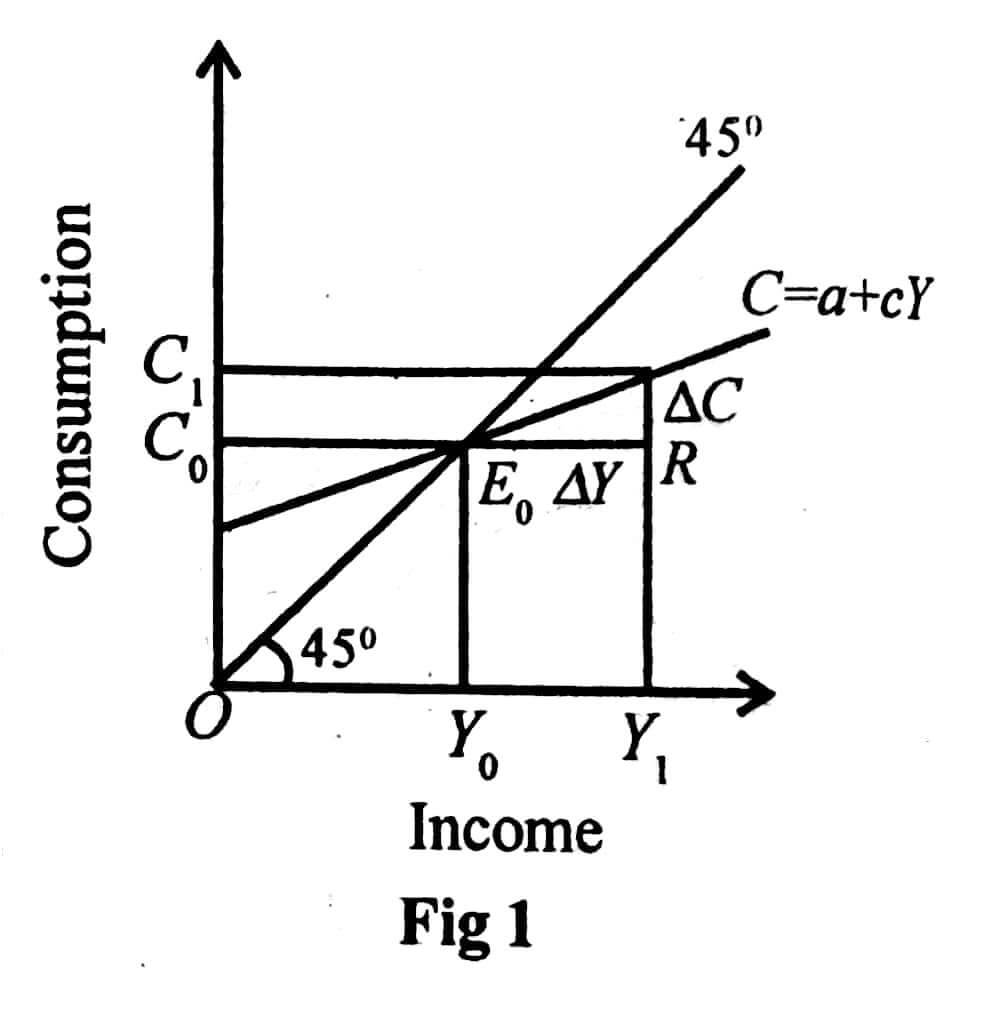

- This consumption function is explained in fig.1 where C = a + cY is consumption function. At point E on the C curve, the level is OY1. At this point APC>MPC where APC = OC1/OY1 and MPC = ∆C/∆Y. this shows disproportional consumption function.

- The intercept shows the level of consumption corresponding to a zero level of income. At income level OY0 where the curve C intersects the 450 lines, point E0 shows APC = OC0/OY0.

- Below the income level, OY0 consumption is more than income. Above the income level, OY0 consumption increases the diminishing rate with income so that APC declines and it is less than one.

Relative Income Hypothesis

Developed by James Duesenberry, the relative income hypothesis states that an individual’s attitude toward consumption and saving is directed more by his income in relation to others. The percentage of income consumed by an individual depends on his percentile position within the income distribution.

It hypothesizes that the present consumption is not influenced merely by present levels of absolute and relative income, but also by levels of consumption attained in a previous period. It is difficult for a family to reduce the level of consumption once attained.

Relative income determines the consumption expenditure in a community. A rich person will have a lower APC because he will need a smaller portion of his income to his consumption pattern. On other hand, a relatively poor man has high APC because he tries to keep up with the consumption standards of his neighbors or associates. This provides the explanation of the constancy of the long run APC because lower and higher APCs would balance out in the aggregate.

The Ratchet Effect

The hypothesis state that during a period of prosperity, consumption will increase and gradually adjust itself to a higher level. Once people reach a particular peak income level and become normal to this standard of living, they are not prepared to reduce their consumption pattern during the recession.

As income falls consumption decreases but proportionally less than the decrease in income because the consumer dissaves to sustain consumption. On another hand when income increases during the recovery period, consumption rises gradually with a rapid increase in saving it is called Ratchet Effect.

Duesenberry combines his two related hypotheses in the following form: Ct/Yt = a – c Yt/Y0

For any doubts and question add a comment below

Reference: ML JHINGAN, Economics discussion

Best mentor trainden and good speaker thank you sir