Classical Theory of Employment

Classical Theory of Employment/ Classical theory of income and employment

- The classical theory is the basis of Say’s Law of Markets, “Supply creates own demand” When a producer produces goods and pays wages to workers, the workers, in turn, buy those goods in the market. Thus the very act of supplying (producing) goods implies a demand for them. It is in this way that supply creates its own demand.

- And the problem of overproduction and unemployment does not arise. Thus there is always full employment in the economy. If there are overproduction and unemployment, the automatic forces of demand and supply in the market will bring back full employment.

- Full employment exists “when everybody is willing to work at the existing wage rate.” The Unemployment results due to the fixed (rigidity) in the wage structure and interference in the working of the free-market system in the form of trade union legislation, minimum wage legislation, etc.

- Those who are not prepared to work at the existing wage rate are not unemployed because they are voluntarily unemployed (A situation when the worker chooses not to work because of a low wage).

Assumptions of Classical Theory of Employment:

- There is the existence of full employment without inflation.

- There is perfect competition in labour and product markets.

- Labour is homogeneous.

- It assumes a long run.

- The quantity of money is given and money is only the medium of exchange.

- Wages and prices are perfectly flexible.

- The total output of the economy is divided between consumption and investment expenditures.

- There is perfect information on the part of all market participants.

- Money wages and real wages are directly related and proportional.

- Savings are automatically invested and equality between the two is brought about by the rate of interest

- In Classical theory, the determination of output and employment takes place in labour, goods, and money market of the economy.

- In the classical analysis, output and employment in the economy are determined by the aggregate production function, demand for labour, and supply of labour. Given the stock of capital, technical knowledge, and other factors, there is a precise relation between total output and employment. This expresses as Q = f(K,TN).

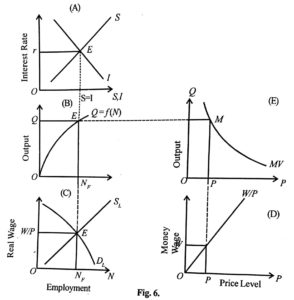

- In other words, total output (Q) is a function (f) of capital stock (K), technical knowledge T, and a number of workers (TV). Given K and T, total output (Q) is an increasing function of the number of workers (N): Q=f (N) as shown in Panel (B). At point E, ONF workers produce OQ output. But beyond point E, as more workers are employed, diminishing marginal returns start.

Labour Market Equilibrium:

- In the labour market, the demand for and supply of labour determine output and employment in the economy. The demand for labour depends on total output. As production increases, the demand for labour also increases.

- The demand for labour, depends on the marginal productivity (MP) of labour which declines as more workers are employed. The supply of labour depends on the wage rate, SL = f (W/P), and is an increasing function of the wage rate.

- The demand for labour also depends on the wage rate, DL =f (W/P), and is a decreasing function of the wage rate. Thus both the demand for and supply of labour are the functions of the real wage rate (W/P). The intersection point E of DL and SL curves at W/ P wage rate in Panel (C) of the figure determines the full-employment level ONF.

Goods Market Equilibrium:

- The goods market is in equilibrium when saving and investment are in equilibrium (S=I). This equality is brought by the mechanism of the interest rate at the full employment level of output so that the quantity of goods demanded is equal to the number of goods supplied. This is shown in Panel (A) of the figure where S=I at point E when the interest rate is Or.

Money Market Equilibrium:

- The money market is in equilibrium when the demand for money equals the supply of money. This is explained by the Quantity Theory of Money, which states that the quantity of money is a function of the price level, P=f (MV). Changes in the general price level are proportional to the quantity of money.

- The equilibrium in the money market is shown by the equation MV = PT where MV is the supply of money and PT is the demand for money. The equilibrium of the money market explains the price level corresponding to the full employment level of output which relates Panel (E) and Panel (B) with the MQ line.

- The price level OP is determined by total output (Q) and the quantity of money (MV), as shown in Panel (E). Then the real wage corresponding with the money wage is determined by the (W/P) curve, as shown in Panel (D).

- When the money wage increases, the real wage also increases in the same proportion and there is no effect on the level of output and employment. It follows that the money wage should be reduced in order to attain the full employment level in the economy. Thus the classicists favored a flexible price-wage policy to maintain full employment.

The classical theory of employment, the classical theory of employment pdf, the classical theory of employment and output, the classical theory of employment, explain the classical theory of employment, the classical theory of employment macroeconomics Business Economic Notes Click Here

Reference: ML JHINGAN, economicsdiscussion.net