Exchange Rate Determination: F.Y.B.A. Economics Paper-1

Exchange Rate Determination

Foreign Exchange Market

The foreign exchange foreign market is the international or overseas market wherein foreign currencies are purchased and sold. It is an arrangement for purchasing and selling foreign currencies in which exporters sell the foreign currencies and importers purchased them.

The major parts of the foreign exchange market are exports and importers, travelers land investors, traders, speculators and brokers, commercial banks, and central banks of various nations countries of the world.

The US Dollar was traded for 47.05 Indian rupees on 02nd June 2006. The rupee-dollar conversion standard was Rs.47.05 for one US Dollar or One Indian rupee would get 0.02 US Dollars. On 31st May 2019, the INR-USD exchange rate was Rs. 69.68 for one USD or one INR would get 0.014 USD.

In the foreign exchange market, there are two different rates for purchasing and selling foreign currencies. These differences arise because of transaction costs in dealing with foreign currencies.

Fixed exchange rate systems

Under the fixed exchange rate system, the foreign exchange rate is fixed by the public authority(government). The fixed exchange rate was set up in the year 1944 under an agreement reached at Bretton Woods in New Hampshire, USA.

Under this system, at the fixed exchange rate if there is disequilibrium in the balance of payments giving rise to either excess demand or supply of foreign exchange, the Central Bank of the country has to purchase and sell the required quantities of foreign exchange to eliminate the excess demand or supply.

In the case of a fixed exchange rate system, the central bank has to purchase or sell foreign exchange so that the exchange rate is maintained at the secured or fixed level. However, the fixed exchange rate could be changed through devaluation or revaluation only with permission from the IMF in case of a fundamental disequilibrium in the balance of payments.

In order to maintain the exchange rate at a given level, the central banks of different countries were required to maintain reserves of foreign currencies. The international reserve currencies are the US dollar, UK Pound Sterling, German Deutsche marks, and the Japanese Yen.

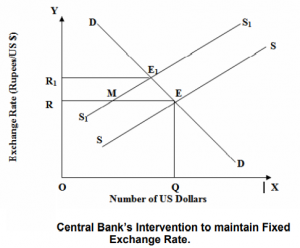

- Let us assume that the government of India is committed to maintaining the exchange rate of its currency at OR.

- Now suppose the American demand for Indian goods declines sharply. Such a decline in demand will reduce the supply of US dollars and the supply curve will shift towards the left and the new supply curve will be S1S1.

- The demand curve DD for dollars remaining constant at the fixed exchange rate OR, the quantity supplied of dollars falls to RM and ME is, therefore, the excess demand for dollars.

- If the central bank does not intervene the equilibrium exchange rate will be determined at OR1. The US dollar will appreciate in terms of rupees and in order to prevent the dollar from appreciating or the rupee from depreciating from the original exchange rate OR, the Reserve bank will have to sell dollars from its reserves by the amount ME and restore the demand-supply equilibrium

Flexible or floating exchange rate systems

The system of the exchange rate in which the exchange value of a currency is determined by the market forces of demand and supply of foreign exchange is known as a flexible or floating exchange rate system.

The flexible exchange rate system came into existence after the fall of the fixed exchange rate system in 1977. The changes in the exchange value of a currency in the foreign exchange market are known by the terms appreciation and depreciation.

For example, if the rupee-dollar trade rates become Rs.48.05 in a couple of days, the rupee would be said to have depreciated against the dollar. Alternately, assuming the rupee-dollar trade rates become Rs.46.05, the rupee would be said to have appreciated against the dollar. The changes in the exchange rate are determined by the market forces in a flexible exchange rate system.

Free Market Exchange Rate Determination

The free market exchange rate of a currency is determined by the market influences of demand and supply of foreign exchange.

If there are two countries, India and the USA, the exchange rate of their currencies (rupee and dollar) will be determined by American demand for Indian exports and Indian demand for American exports. Indian demand for American exports implies Indian demand for US dollars. Likewise, American demand for Indian exports implies American demand for Indian rupees.

Demand for Foreign Exchange (US Dollars)

- The demand for US dollars in India is a component of the demand for US products and services by Indian firms and people. There is a direct relationship between demand for US exports from India and the demand for US dollars.

- The demand for dollars may emerge(arise) because of Indian residents and firms needing to buy assets in the United States to give credits or send gifts to friends in the United States.

- The demand for dollars can be acknowledged by exchanging rupees for dollars with the central bank. The demand curve for US dollars will be downward sloping as the demand for US dollars will be inversely proportionate to the rupee-dollar exchange rate.

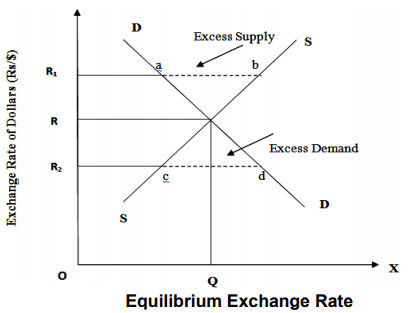

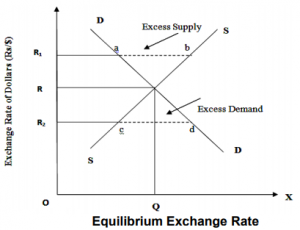

- The higher the exchange rate, the lower will be demand for US dollars and vice versa. The demand for US dollars is represented by the demand curve DD in the below graph.

Supply of Foreign Exchange (US Dollars)

- The supply of US dollars results from the demand for Indian exports from the USA. The supply of US dollars will be directly proportional to the supply of exports from India to the United States.

- The supply of US dollars may also arise from the demand for US citizens and firms to buy assets in India or to give loans and gifts to people in India.

- The supply of the US dollar is derived from the demand for Indian rupees or the demand for Indian exports. The supply curve of dollars in terms of rupees is positively sloping as shown in the below graph. The higher the rupee-dollar exchange rate, the higher will be the supply of US dollars and vice versa.

- The equilibrium exchange rate will be determined by the intersection of the demand for and supply curve of dollars. Such an equilibrium point in the above diagram is point ‘E’ and the equilibrium exchange rate is OR with OQ quantity of demand and supply of US dollars.

- At a higher price of dollars i.e. OR1, the quantity supplied of dollars is greater than the quantity demanded by ‘ab’. Excess supply of dollars will push the prices down back to the equilibrium level.

- Similarly, if the exchange rate is OR2, there will be excess demand for US dollars, and demand for dollars will exceed its supply by ‘cd’ causing the exchange rate to go up and stabilize at the equilibrium exchange rate OR.

Concept of Foreign Exchange Reserves and Its Components

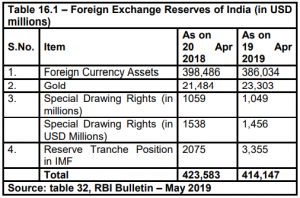

The foreign exchange reserve of a country consists of foreign currency assets held by the Central Bank, Gold holdings by the Central Bank, and Special Drawing Rights (SDRs).

For example, India’s foreign exchange reserve also consists of gold, SDRs, and foreign currency assets. Gold is not used for current transactions. It does not say anything about the balance of payment situation of the country. The net result of the external transactions of a country is indicated by changes in the foreign currency reserves and special drawing rights.

GOLD

As of 20th April 2018, the value of gold was USD 21,484 million. On 19th April 2019, the value of gold went up to USD 23,303 million. In percentage terms, gold reserves went up by 8.47% during the year.

Special Drawing Rights(SDR)

In 1969, the SDR was created by the IMF to supplement the reserve assets of member nations. Between 1970 and March 2016, the IMF has created 204.1 billion SDRs which are equal to USD 285 billion. These SDRs have been allocated to member countries.

SDRs can be exchanged for freely usable currencies. The value of the SDRs based on a basket of five major currencies: the US Dollar, Euro, the Chinese Renminbi (RMB), the Japanese Yen, and UK Pound Sterling as of1st October 2016.

Reserve Tranche Position in IMF

The reserve tranche is an emergency account that IMF members can access without agreeing to conditions or paying a service fee. It is a fraction of the required quota of currency that each member country of the IMF must provide to the IMF.

The member country can utilize the reserve tranche for its purpose. The reserve tranche fraction of the quota can be accessed by the member nation at any time. A member country can borrow more than her quota but must pay back principal with interest over a three-year period.

If the amount being sought by the member nation exceeds its reserve tranche position, it becomes a credit tranche. In the beginning, a member nation’s reserve tranche is 25% of her quota, but her reserve tranche position will change according to any lending that the IMF does with its holdings of the member’s currency.

The RTP position of India as of 20th April 2018 was USD 2075 million whereas on 19th April 2019, the RTP position improved to USD 3355 million.

Sources of Data:

www.rbi.org.in (RBI bulletins and Reports).

Indian Economic Survey various years

http://indiabudget.nic.in

http://finmin.nic.in

References: IDOL Mumbai University Books

More Economics Notes Click Here

Business Economics Click Here

Exchange Rate Determination, F.Y.B.A. Economics Paper-1, fyba idol economics, fyba economics, fixed exchange rate, flexible exchange rate