HSC Accounts Notes: Important Question of Accounts Class 12

HSC Accounts Notes

Prepare a bill of exchange from the following information :

Drawer : Dinesh, P. R. Road, Andheri West.

Drawee: Mahesh, L. B. S. Road, Mulund.

Payee: Amit, Thane West.

Amount: ₹ 9,500

Period of Bill: 4 months after sight.

Date of Bill: 26th Nov. 2019.

Date of acceptance: 29th Nov. 2019.

Q.2 Solve Any one from the following Admission of Partner/Retirements of Partner

Q.2 The Balances sheet of Adil and Sameer who share profits in the ratio of 2:1 as on 31st March, 2018

Balance Sheet As on 31st March 2018

| Particulars | Amt (₹) | Particulars | Amt (₹) |

| Capitals: | Land & Building | 75,000 | |

| Adil | 90,000 | Investment | 1,08,000 |

| Sameer | 48,600 | Debtors | 39,000 |

| Investment Fluctuation Reserve | 15,000 | Goodwill | 12,000 |

| General Reserve | 12,000 | Profit and Loss A/c | 12,000 |

| Sundry Creditors | 63,000 | Advertisement Suspense | 12,000 |

| Bills Payable | 60,000 | Cash | 30,600 |

| 2,88,600 | 2,88,600 |

On 1.4.2018 Raju was admitted into partnership on the following terms :

- Raju pays ₹ 30,000 as his capital for 1/4th

- Raju pays ₹ 15,000 for Half of the sum is to be withdrawn by Adil and Sameer.

- RDD is created @ 10%.

- The value of land and building is appreciated by ₹ 30,000.

- Investments were reduced by ₹ 22,500.

- Sundry creditors are to be valued at ₹ 62,250.

- Capitals of Adil and Sameer to be adjusted taking Raju’s capital as the Adjustment of capitals is to be made through cash.

Prepare Revaluation Account, Partner’s Capital Account and Balance Sheet of the New Firm as on 1st April, 2018

Q.2 Following is the Balance Sheet of the firm of Nana, Nani and Sona who share Profits and Losses in the ratio of their Capital

Balance Sheet as on 31st March 2019

| Liability | Amt (₹) | Assets | Amt (₹) | |

| Capital A/c: | Machinery | 20,000 | ||

| Nana | 50,000 | Building | 55,000 | |

| Nani | 20,000 | Stock | 12,000 | |

| Sona | 30,000 | Debtors | 12,000 | |

| Creditors | 10,000 | Less: R.D.D. | 1,000 | 11,000 |

| Bills Payable | 5,000 | Cash | 17,000 | |

| 1,15,000 | 1,15,000 | |||

Sona retires from the business on 1st April 2019 and the following Adjustment were agreed.

- Stock is to be valued at 92% of its Book Value

- R.D.D. is to be maintained at 10% on debtors

- The value of the Building is to be appreciated by 20%

- The Goodwill of the firm be fixed at ₹ 12,000. Sona’s share in the same be adjusted in the accounts of continuing partners in Gain Ratio.

- The entire Capital of the new firm be fixed at ₹ 1,60,000 between Nana and Nani in their New Profit sharing ratio which is fixed at 3:1 making adjustments in cash.

- The amount payable to Sona paid in cash

Prepare : Revaluation A/c, Partnership Capital A/c , Balance Sheet as on 1st April 2019.

Q.3 Solve Any one from the following Dissolution of partnership firms/Bills of Exchange

Q.3 Dinesh, Mangesh and Ramesh are partners sharing Profits and Losses in the ratio 2:2:1. They decided to dissolved the firm on 31st March When their position was as under.

Balance Sheet as on 31st March 2018.

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Capital : | Building | 78,000 | |

| Dinesh | 26,000 | Computer | 45,000 |

| Mangesh | 22,000 | Debtors | 20,000 |

| Ramesh | 18,000 | Goodwill | 35,000 |

| Creditors | 80,000 | Bank | 8,000 |

| Bill Payable | 40,000 | ||

| 1,86,000 | 1,86,000 |

The firm was dissolved on above date and the following is the result of realisation.

- The assets were realised as Building ₹ 40,000, Computer ₹ 30,000, Debtors ₹ 10,000.

- Realisation expenses amounted to ₹ 2,000.

- All partners were insolvent. The following amount was recovered from them Dinesh ₹ 2,000 and Mangesh ₹ 2,000.

Prepare necessary ledger account to close the books of the firm.

Q.3 Journalise the following transaction in the books of Abhishek:-

- Siddhant informs Abhishek that Vineet’s acceptance for ₹ 23,000 endorsed to Siddhant has been dishonoured. Nothing Charges amounted to ₹430.

- Kajal renews her acceptance to Abhishek for ₹ 39,000 by paying 3,000 in cash and accepting a fresh bill for the balance along with interest at 11.5 % p.a. for 3 months.

- Radhika retired her acceptance to Abhishek for ₹ 23,000 by paying ₹22,250 by cheque.

- Abhishek sent a bill of Subodh for ₹ 9,000 to bank for collection. Bank informed that the bill has been dishonoured by Subodh.

Q.4 Solve Any one from the following Issue of Shares/Computer Accounting

Q.4 Pass Journal entries for the forfeiture and re-issue of shares in the following

- Asha Ltd. forfeited 100 equity shares of ₹ 20 each fully called up for non-payment of first call of ₹ 3 per share and final call of ₹ 5 per share. 80 shares of these were reissued at ₹15 per share fully paid.

- Bhakti Ltd. forfeited 100 equity shares of ₹ 10 each, ₹ 6 called-up on which the shareholder paid application and allotment of ₹ 5 per share. Of these 80 shares were re-issued as fully paid-up for 16 per share.

- Konark Ltd. forfeited 50 shares of ₹ 10 each, ₹8 called-up. The shareholder failed to pay first call of ₹ 3 per share. Later on 30 shares of these were re-issued at ₹ 7 per share.

Q.4 Write the steps to create Ledger account in tally?

Q.5 Solve Any one from the following Death of a Partner/ Analysis of Financial Statement

Q.5 Rajesh, Rakesh and Mahesh were equal Partner on 31st March 2019. Their Balance Sheet was as follows 31st March 2019

Balance Sheet as on 31st March 2019

| Liabilities | Amt ₹ | Assets | Amt ₹ |

| Capital Account : | Land and Building | 4,00,000 | |

| Rajesh | 5,00,000 | Furniture | 3,00,000 |

| Rakesh | 2,00,000 | Debtors | 3,00,000 |

| Mahesh | 2,00,000 | Stock | 1,00,000 |

| Sundry creditors | 90,000 | Cash | 1,00,000 |

| Bills Payable | 60,000 | ||

| Bank loan | 1,50,000 | ||

| 12,00,000 | 12,00,000 |

Mr. Rajesh died on 30th June 2019 and the following adjustment were agreed as

- Furniture was to be adjusted to its market price of 3,40,000

- Land and Building was to be depreciated by 10%

- Provide R.D.D 5% on debtors

- The Profit upto the date of death of Rajesh is to be calculated on the basis of last years profit which was 1,80,000

Prepare 1) Profit and Loss adjustment A/c , 2) Partners capital account, 3) Balance sheet of the continuing firm

Q.5 Following is the Balance Sheet of Sakshi Prepare cashflow statement.

| Liabilities | 31.3.17

(₹) |

31.3.18

(₹) |

Assets | 31.3.17

(₹) |

31.3.18

(₹) |

| Share Capital | 2,00,000 | 3,00,000 | Cash | 20,000 | 30,000 |

| Creditors | 60,000 | 90,000 | Debtors | 1,40,000 | 2,50,000 |

| Profit and Loss A/c | 40,000 | 70,000 | Stock | 80,000 | 70,000 |

| Land | 60,000 | 1,10,000 | |||

| 3,00,000 | 4,60,000 | 3,00,000 | 4,60,000 |

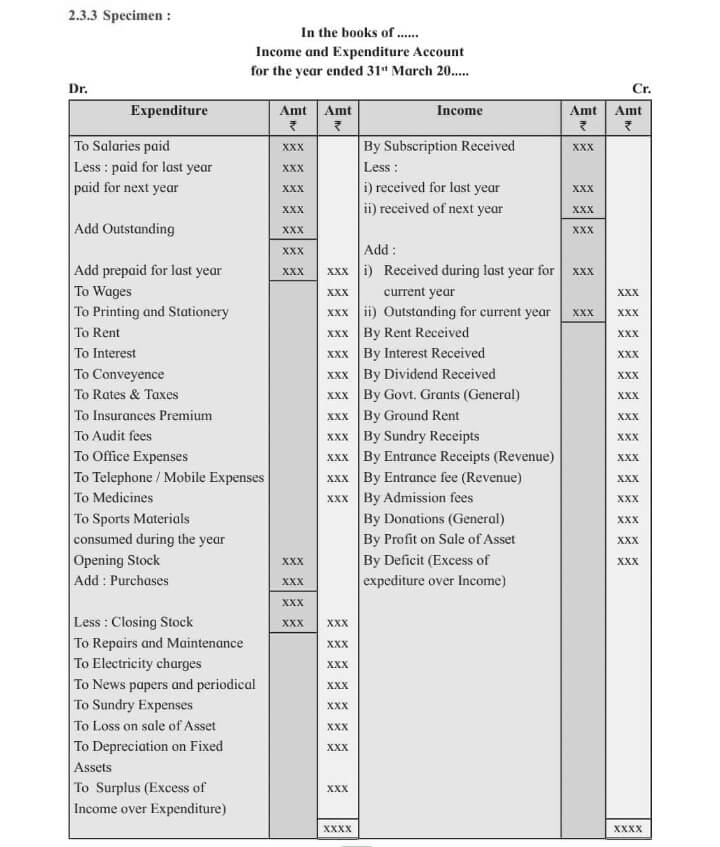

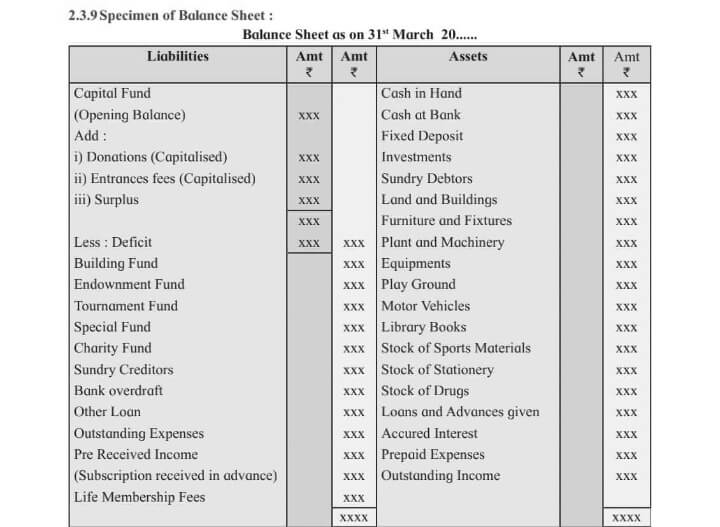

Q.6 From the following transactions of Receipts and Payments Account of “Pavan – putra Hanuma Vyayamshala” Parbhani, and the adjustments given, you are required to prepare Income and Expenditure Account and Balance Sheet as on 31st March

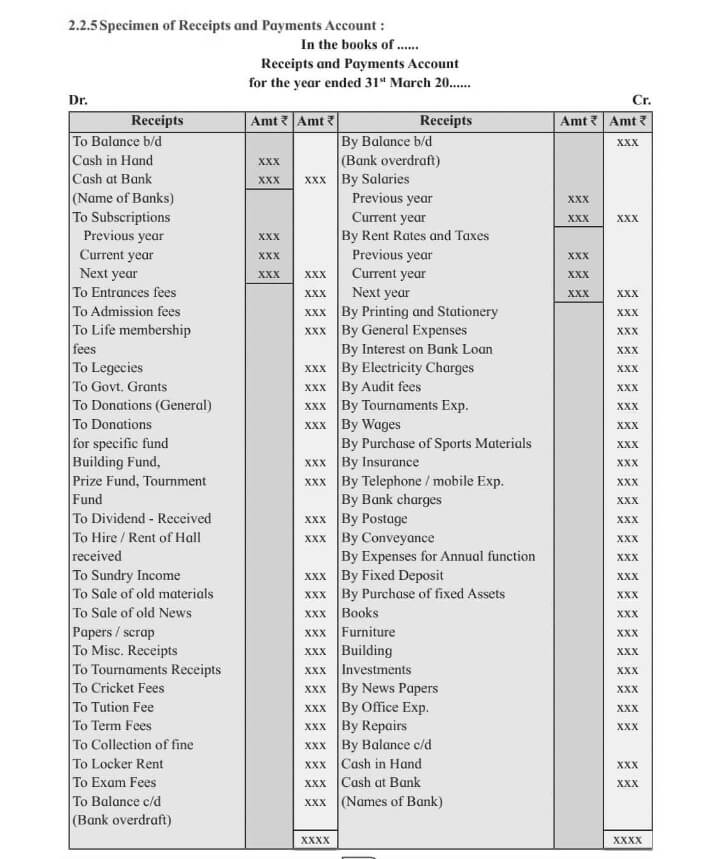

Receipts and payments Account for the year ending 31.03.2019.

Dr. Cr.

| Receipts | Amount ₹ | Payments | Amount ₹ | |

| To Balance b/d | By Salaries | 6,000 | ||

| Cash in Hand | 5,000 | By Entertainment Expenses | 2,480 | |

| To Subscriptions | By Sundry Expenses | 1,300 | ||

| 2018 – 19 | 18,000 | By Electricity Charges | 1,200 | |

| 2019 – 20 | 410 | 18,410 | By Rent | 700 |

| 6,000 | By Investment | 15,000 | ||

| To Donations | ||||

| To Receipts from Entertainment | 5,400 | By Printing and Stationery | 800 | |

| To Interest | 400 | By Postage | 3,200 | |

| To Entrance fees | 6,200 | By Fixed Deposit | 3,900 | |

| By Balance c/d | ||||

| Cash in Hand 830 | ||||

| Cash at Bank 6000 | 6,830 | |||

| 41,410 | 41,410 | |||

Adjustments :

- There are 500 members paying an annual Subscription of ₹ 50 each

- Outstanding Salary was ₹ 1,200

- The Assets on 01.04.2018 were as follows: Building ₹ 50,000, Furniture ₹ 15,000

- Provide depreciation on Building and Furniture at 5 % and 10 %

- 50 % Entrance Fees is to be capitalized.

- Interest on Investment at 5 % a. has accrued for 6 months.

- Capital Fund ₹ 70,000 on 01.04.2018

(Ans. : Surplus ₹ 19,395, Total of Balance Sheet ₹ 94, 105)

Q.7 Kshipra and Manisha are Partners sharing Profit and Losses in their Capital You are required to prepare Trading Account and Profit and Loss Account for the year ended 31st March 2019 and Balance Sheet as on that date.

Trial Balance as on 31st March, 2019

| Debit Balance | Amount ₹ | Credit Balance | Amount ₹ |

| Sundry Debtors | 28,000 | Sales | 1,20,000 |

| Purchases | 55,000 | Rent | 1,800 |

| Furniture | 38,500 | Sundry Creditors | 38,500 |

| Plant & Machinery | 60,000 | Purchase Return | 1,000 |

| Wages | 800 | Discount | 500 |

| Salaries | 3,500 | Bills Payable | 9,000 |

| Discount | 800 | Capital A/c : | |

| Bills Receivable | 14,400 | Kshipra | 90,000 |

| Carriage Outward | 1,000 | Manisha | 30,000 |

| Postage | 500 | Current A/c : | |

| Sales Return | 500 | Kshipra | 5,000 |

| Cash in Hand | 4,000 | Manisha | 3,000 |

| Cash at Bank | 47,000 | ||

| Insurance | 2,000 | ||

| Opening Stock | 17,800 | ||

| Trade Expenses | 1,500 | ||

| Ware house Rent | 2,500 | ||

| Advertisement | 1,000 | ||

| Building | 20,000 | ||

| 2,98,800 | 2,98,800 |

Adjustments :

- Stock on 31st March 2019 was at ₹ 37,000.

- Sales includes, sale of machinery of ₹ 2,000, which is sold on 1st April

- Depreciation on fixed assets @ 5%.

- Each Partners is entitled to get Commission at 1% of Gross Profit and Interest on Capital 5%a.

- Outstanding Expenses Wages ₹ 200 & Salaries ₹ 500

- Create provision for doubtful debts @ 3% on Sundry

(Ans : G.P. ₹ 81,700, N.P. ₹ 56,401 Balance Sheet Total ₹ 2,40,235)

Prepare a format of bill of exchange from the followings:

Drawer: Kashmira Shah, Partner M/S Shah and Shah, 2-C, Matruchaya Building, Akola.

Drawee: Dhanashree Traders, Bangalore Road, Belgaum. (Signed by Jayashree, Partner)

Payee: M/S Janki Traders, Akola.

Amount: ₹ 64,500 Period of Bill : 3 months

Date of drawing: 12th Sept. 2019

Date of acceptance: 15th Sept. 2019

Q.2 Solve Any one from the following Admission of Partner/Retirements of Partner

Q.2 The following is the Balance Sheet of Om and Jay on 31st March 2018, they share profits and losses in the ratio 3:2

Balance Sheet as On 31st March 2018

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| Creditors | 30,000 | Cash | 3,000 |

| Capital A/c | Building | 15,000 | |

| Om | 21,000 | Machinery | 21,000 |

| Jay | 21,000 | Furniture | 900 |

| Current A/c | Stock | 12,300 | |

| Om | 3,750 | Debtors | 27,000 |

| Jay | 3,450 | ||

| 79,200 | 79,200 |

They take Jagdish into partnership on 1st April 2018 the terms being

- Jagdish should pay ₹ 3,000 as his share of Goodwill. 50% of goodwill withdrawn by partners in cash.

- He should bring ₹ 9,000 as capital for 1/4th share in future

- Building to be valued at ₹ 18,000, Machinery and Furniture to be reduced by 10%

- A Provision of 5% on debtors to be made for doubtful

- Stock is to be taken at the value of ₹ 15,000.

Prepare profit and loss A/c, Partner’s Current A/c, Balance Sheet of the new firm.

Q.2 The Balance Sheet of Shyam Traders Pune is as follows, Partners share Profit and Losses as 5:2:3

Balance Sheet as on 31st March 2019

| Liabilities | Amt ₹ | Amt ₹ | Assets | Amt ₹ | Amt ₹ |

| Capital Account: | Plan & Machinery | 32,000 | |||

| Rambha | 36,000 | Building | 40,000 | ||

| Menka | 32,000 | Stock | 20,400 | ||

| Urvashi | 17,600 | Debtors | 16,800 | ||

| Creditors | 20,000 | Less: R. D. D. | 800 | 16,000 | |

| Bill Payable | 1,200 | Bank | 12,400 | ||

| General Reserve | 14,000 | ||||

| 1,20,800 | 1,20,800 |

Menka retired from the business on 1st April 2019 on the following terms. The assets were revalued as under.

- Stock at ₹ 28,000

- The building is appreciated by 10%

- D.D. is to be increased upto ₹ 1000

- Plant and Machinery is to be depreciated by 10%

- The Goodwill of retiring partner is valued at ₹ 8000 and the remaining Partners decided that Goodwill be written back in their New Profit sharing ratio which will be 5:3

- Amount due to Menka is to be transferred to her Loan Account

Prepare : Profit and Loss Adjustment A/c , Capital Account of partners, Balance Sheet of new firm.

Q.3 Solve Any one from the following Dissolution of partnership firms/Bills of Exchange

Q.3 Sangeeta, Anita and Smita were in partnership sharing Profits and Losses in the ratio 2:2:1. Their Balance Sheet as on 31st March 2019 was as under :

Balance Sheets as on 31st March 2019.

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Capital : | Land | 2,10,000 | |

| Sangeeta | 60,000 | Plant | 20,000 |

| Anita | 40,000 | Goodwill | 15,000 |

| Smita | 30,000 | Debtors | 1,25,000 |

| Sangeeta’s Loan A/c | 1,20,000 | Loans and Advances | 15,000 |

| Sundry Creditors | 1,20,000 | Bank | 5,000 |

| Bills Payable | 20,000 | ||

| 3,90,000 | 3,90,000 |

They decided to dissolve the firm as follows :

- Assets realised as; Land recovered ₹ 1,80,000; Goodwill for ₹ 75,000; Loans and Advances realised ₹ 12,000; 10% of the Debts proved bad;

- Sangeeta took Plant at book

- Creditors and Bills payable paid at 5% discount.

- Sandhya’s Loan was discharged along with ₹ 6,000 as interest.

- There was a contingent Liability in respect of bills of ₹ 1,00,000 which was under discount. Out of them, a holder of one bill of ₹ 20,000 became insolvent.

Show Realisation Account, Partners Capital Account and Bank Account.

Q.3 Sanjay sold goods of ₹ 45,000 to Govind at 10% Trade Discount. Govind paid 1/3rd of the amount immediately at a cash discount of ₹ 1,000 and for the balance accepted a bill for 3 months. Sanjay endorsed the bill to Aadesh on the same day in full settlement of his account ₹27,500. On the due date the bill was dishonoured by Govind and noting charges paid by Aadesh ₹450. Govind requested Sanjay to renew the bill. Sanjay agreed on condition that Govind should pay ₹5,250 immediately along with noting charges and for the balance Govind should accept a new bill for 2 months along with interest ₹ 1,500. Govind agreed to these contritions and these arrangements were carried through. Sanjay paid Aadesh balance due to him. On the due date of the new bill Govind dishonoured the bill.

Give journal entries in the books of Sanjay and prepare Sajnay’s account in the books of Govind.

Q.4 Solve Any one from the following Issue of Shares/Computer Accounting

Q.4 Subhash Company Limited issues 2000 Equity shares of ₹100 each payable as ₹30 on application, ₹30 on allotment, ₹40 on first and final call

All the shares were subscribed and duly allotted. Company made all the calls. All cash was duly received except the first & final call on 100 equity shares. These shares were forfeited by company and were re-issued as fully paid for ₹ 75 per share.

Show the Journal entries in the books of Subhash Company Ltd.

Q.5 Solve Any one from the following Death of a Partner/ Analysis of Financial Statement

Q.5 Ram, Madhav, and Keshav are partners sharing Profit and Losses in the ratio 5:3:2 respectively. Their Balance Sheet as on 31st March 2018 was as follows.

Balance Sheet as on 31st March 2018

| Liabilities | Amt ₹ | Assets | Amt ₹ |

| General Reserve | 25,000 | Goodwill | 50,000 |

| Creditors | 1,00,000 | Loose Tools | 50,000 |

| Unpaid Rent | 25,000 | Debtor | 1,50,000 |

| Capital Accounts | Live Stock | 1,00,000 | |

| Ram | 1,00,000 | Cash | 25,000 |

| Madhav | 75,000 | ||

| Keshav | 50,000 | ||

| 3,75,000 | 3,75,000 |

Keshav died on 31st July 2018 and the following Adjustment were agreed by as per partnership deed.

- Creditors have increased by 10,000

- Goodwill is to be calculated at 2 years purchase of average profits of 5 year.

- The Profits of the preceding 5 years was

| 2013-14 | ₹ 90,000 | 2014-15 | ₹ 1,00,000 |

| 2015-16 | ₹ 60,000 | 2016-17 | ₹ 50,000 |

| 2017-18 | ₹ 50,000 (Loss) |

Keshav share in it was to be given to him.

- Loose Tools and live stock were valued at ₹80,000 and ₹ 1,20,000 respectively

- R.D.D. was maintained at ₹ 10,000

- Commission ₹ 2000 p.m. was payable to Keshav Profit for 2018 -19 was estimated at ₹ 45000 and keshav’s share in it up to the date of his death was given to him.

Prepare Revaluation A/c , Keshav’s capital A/c showing the amount payable to his executors.

Q.5 Prepare Comparative Balance Sheet for the year ended 3.17 and 31.3.18

| Particulars | 31.3.17 (₹) | 31.3.18 (₹) |

| 1) Current liabilities | 60,000 | 48,000 |

| 2) Fixed Assets | 2,40,000 | 3,00,000 |

| 3) Loan | 68,000 | 1,02,000 |

| 4) Share Capital | 1,20,000 | 1,44,000 |

| 5) Reserve & Surplus | 48,000 | 60,000 |

| 6) Current Assets | 56,000 | 54,000 |

Q.6 From the following information supplied to you, prepare Income and Expenditure Account for the year ending on 31.03,2020 and Balance Sheet as on that date for “Morya Sports Club” Thane.

Balance Sheet as on 01.04.2019.

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Capital Fund | 64,500 | Machinery | 69,000 |

| Bank overdraft | 38,000 | Outstanding Subscriptions | 8,000 |

| Outstanding Salary | 4,000 | Prepaid Insurance Premium | 2,000 |

| Furniture | 15,000 | ||

| Cash in Hand | 12,000 | ||

| Outstanding Locker’s Rent | 500 | ||

| 1,06,500 | 1,06,500 |

Receipts and Payments Account for the year ended 31.03.2020

Dr. Cr.

| Liabilities | Amount ` | Payments | Amount ` |

| To Balance b/d | 12,000 | By Balance b/d (Bank Overdraft) | 38,000 |

| To Subscription | 1,05,000 | By Salary | 17,500 |

| To Entrance Fees (Capitalized) | 9,300 | By Insurance Premium | 11,000 |

| To Locker Rent | 1,500 | By Interest | 1,400 |

| To Donations (Capitalized) | 800 | By Refreshment Expenses | 4,200 |

| By Furniture | 30,000 | ||

| By Balance c/d | |||

| Cash in Hand | 6,500 | ||

| Cash at Bank | 20,000 | ||

| 1,28,600 | 1,28,600 |

Adjustments :

- Subscription received includes ₹ 3,000 for 2018 – 19 and Outstanding Subscription for 2019 – 20 was ₹ 14,000.

- On 31.03.2020, Prepaid Insurance Premium was ₹ 2,500.

- Depreciate Furniture by ₹ 3,000.

- Locker Rent Outstanding for 2019 – 20 is ₹ 400.

(Ans. : Surplus ₹ 84,800, Total of Balance Sheet ₹ 1,59,400)

Q.7 From the following Trial Balance and adjustments given below of Reena and Aarti, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as on that

Trial Balance as on 31st March, 2019

| Debit Balance | Amount ₹ | Credit Balance | Amount ₹ |

| Purchases | 35,500 | Sales | 58,200 |

| Sundry Debtors | 40,000 | Sundry Creditors | 25,700 |

| Sales Returns | 1,000 | Purchases Returns | 500 |

| Opening Stock | 18,100 | R.D.D | 800 |

| Bad debts | 500 | Discount | 50 |

| Land & Building | 25,000 | Commission | 250 |

| Furniture | 20,000 | Capital : | |

| Discount | 1,000 | Reena | 50,000 |

| Royalties | 700 | Aarti | 30,000 |

| Rent | 1,900 | ||

| Salaries | 3,000 | ||

| Wages | 800 | ||

| Insurance | 1,500 | ||

| Drawings : | |||

| Reena | 2,000 | ||

| Aarti | 1,000 | ||

| Cash at Bank | 11,500 | ||

| Cash in Hand | 2,000 | ||

| 1,65,500 | 1,65,500 |

Adjustments :

- Closing Stock valued at ₹ 22,000.

- Write off ` 900 for Bad & doubtful debts and create a provision for Reserve for doubtful debts ₹ 1,000.

- Create a provision for Discount on Debtors @ 3% and creditors @ 5%.

- Outstanding Expenses – Wages ₹ 700 and Salaries₹ 800

- Insurance is paid for 15 months, w.e.f. 1st April 2018

- Depreciate Land and Building @ 5%

- Reena & Aarti are Sharing Profits & Losses in their Capital

(Ans : G.P. ₹ 23,900, N.P. ₹13,592 Balance Sheet Total ₹ 1,16,507)

Kantilal, 343/D, Palm Heights, Jogeshwari, drew a bill on 10th 2019 for ` 63,490 for 45 days after date on Shantilal, B2, Himalaya Towers, Baramati, payable to Priyanksa, Satara.

The bill was accepted on 13th Oct. 2019 for 60 days.

Prepare a format of bill of exchange from the above detalis.

Q.2 Solve Any one from the following Admission of Partner/Retirements of Partner

Q.2 The Balance Sheet of Sahil and Nikhil who share profits in the ratio of 3:2 as on 31st March, 2017

Balance Sheet as on 31st March 2017

| Liabilities | Amt. (₹) | Amt. (₹) | Assets | Amt. (₹) | Amt. (₹) |

| Creditors | 60,000 | Furniture | 60,000 | ||

| Capitals: | Building | 72,000 | |||

| Sahil | 80,000 | Debtors | 40,000 | ||

| Nikhil | 1,00,000 | 1,80,000 | Closing Stock | 48,000 | |

| Cash in Hand | 20,000 | ||||

| 2,40,000 | 2,40,000 |

Varad admitted on 1St April 2017 on the following terms :

- Varad was to pay 1,00,000 for his share of capital.

- He was also to pay 40,000 as his share of goodwill.

- The new profit sharing ratio was 3:2:3

- Old partners decided to revalue the assets as follows: Building 1,00,000, Furniture- 48,000, Debtors – 38,000 (in view of likely bad debts)

- It was found that there was a liability for 3,000 for goods in March 2017 but recorded on 2nd April 2017.

You are required to prepare :

- Profit and Loss adjustment accounts

- Capital accounts of the partners

- Balance sheet after the admission of Varad

Q.2 Rohan, Rohit and Sachin are partners in a firm sharing profit and losses in the proportion 3:1:1 respectively. Their balance sheet as on 31st March 2018 is as shown below.

Balance Sheet as on 31 st March 2018

| Liabilities | Amt ₹ | Assets | Amt ₹ |

| Creditors | 40,000 | Bank | 12,500 |

| General Reserve | 50,000 | Debtors | 60,000 |

| Bills payable | 25,000 | Live Stock | 50,000 |

| Capital Accounts : | Building | 75,000 | |

| Rohan | 1,25,000 | Plant and Machinery | 35,000 |

| Rohit | 1,00,000 | Motor Truck | 1,00,000 |

| Sachin | 50,000 | Goodwill | 57,500 |

| 3,90,000 | 3,90,000 |

On 1st April, 2018 Sachin retired and the following adjustments have been agreed upon.

- Goodwill was revalued at ₹ 50,000

- Assets and Liabilities were revalued as follows: Debtors ₹ 50,000, Live Stock, ₹ 45,000; Building ₹ 1,25000, Plant and Machinery ₹ 30,000, Motor Truck ₹ 95,000 and Creditors ₹ 30,000

- Rohan and Rohit contributed additional capital through Net Banking of ₹ 50,000 and ₹ 25,000 respectively

- Balance of Sachin’s Capital Account is transferred to his Loan

Give Journal entries in the books of new firm.

Q.3 Solve Any one from the following Dissolution of partnership firms/Bills of Exchange

Q.3 Following is the Balance Sheet of Vaibhav, Sanjay and Santosh

Balance Sheets as on 31st March 2019

| Liabilities | Amount ` | Assets | Amount ` |

| Captital Accounts : | Machinery | 6,000 | |

| Vaibhav | 36,000 | Goodwill | 9,000 |

| Sanjay | 27,000 | Stock and Debtors | 57,000 |

| Creditors | 12,000 | Profit and Loss Account | 18,000 |

| Bank Overdraft | 18,000 | Santosh’s Capital | 3,000 |

| 93,000 | 93,000 |

Santosh is declared insolvent so firm is dissolved and assets realised as follows :

- Stock and Debtors ` 54,000, Goodwill – NIL, Machinery at Book

- Creditors allowed discount at 10%.

- Santosh could pay only 25 paise in rupee of the balance

- Profit sharing ratio was 8:4:3.

- A contingent liability against the firm ` 9,000 is

Give Ledger Account to close the books of the firm.

Q.3 Journalise the following transactions of Arvind as on 24th October, 2019

- Renewed Sainath’s acceptance of ₹ 18,000 with interest of ₹ 380 for 2

- Sahil informs Arvind that Meenal’s acceptaance of ₹ 13,000 endorsed to Sahil was dishonoured and noting charges paid ₹ 195

- Accepted a bill of ₹ 16,400 at 2 months drawn on Chand and Sons for the amount due to them₹ 19,000 and balance paid in cash.

- Bank informed that Vidya’s acceptance of ₹ 14,000 which was discounted was dishououred and bank paid noting charges ₹ 105. Renewed bill on Vidya’s request for 2 months with interest ₹ 295.

- Nandita retired her acceptance to Arvind of ₹ 13,550 by paying cash ₹ 13,000.

Q.4 Solve Any one from the following Issue of Shares/Computer Accounting

Q.4 Rakesh issued 2000 equity shares of 100 each at a premium of ₹ 20 per share payable as follows :

On Application ₹ 20

On Allotment ₹ 50 (including Premium)

On first Call ₹ 20

On final Call ₹ 30

Applications were received for 3000 shares, 2000 share allotted to the applicants for 2400 shares. The remaining applications for 600 shares being refused and application money there on was refunded. Excess money received on application was adjusted against allotment.

All amounts were duly received except Mr. Mandar to whom 80 shares were alloted.

Mandar fails to pay First and Final call. His shares were forfeited and were reissued to Mr. Ketan as fully paid at ₹ 80 per share.

Journalise the transactions in the books of the company.

Q.5 Solve Any one from the following Death of a Partner/ Analysis of Financial Statement

Q.5 Virendra, Devendra and Narendra were partners sharing Profit and Losses in the ratio of 3:2:1. Their Balance Sheet as on 31st March 2019 was as follows.

Balance Sheet as on 31st March 2019

| Liabilities | Amt ₹ | Assets | Amt ₹ |

| Bank Loan | 25,000 | Furniture | 50,000 |

| Creditors | 20,000 | Land & Building | 50,000 |

| Bills Payable | 5,000 | Motor Car | 20,000 |

| Reserve Fund | 30,000 | Sundry Debtors | 50,000 |

| Capital Account : | Bills Receivable | 20,000 | |

| Virendra | 90,000 | Investments | 50,000 |

| Devendra | 60,000 | Cash at Bank | 20,000 |

| Narendra | 30,000 | ||

| 2,60,000 | 2,60,000 |

Mr. Virendra died on 31st August 2019 and the Partnership deed provided that. That the event of the death of Mr. Virendra his executors be entitled to be paid out.

- The capital to his credit at the date of death

- His proportion of Reserve at the date of last Balance sheet

- His proportion of Profits to date of death based on the average profits of the last four years.

- His share of Goodwill should be calculated at two years purchase of the profits of the last four years for the year ended 31st March were as follows –

2016 ₹ 40,000 2017 ₹ 60,000

2018 ₹ 70,000 2019 ₹ 30,000

- Virendra has drawn ₹ 3000 p.m. to date of death, There is no increase and Decrease the value of assets and liabilities.

Prepare Mr. Virendras Executors A/c

Q.5 Following is the Balance Sheet of Sakshi Traders for the year ended 3.17 and 31.3.18

| Liabilities | 31.3.17

(₹) |

31.3.18

(₹) |

Assets | 31.3.17

(₹) |

31.3.18

(₹) |

| Equity Share Capital | 80,000 | 80,000 | Fixed Assets | 1,20,000 | 1,44,000 |

| Pref. Share Capital | 20,000 | 20,000 | Investment | 20,000 | 20,000 |

| Reserve & Surplus | 20,000 | 24,000 | Current Assets | 60,000 | 48,000 |

| Secured Loan | 40,000 | 16,000 | |||

| Unsecured Loan | 20,000 | 36,000 | |||

| Current Liabilities | 20,000 | 36,000 | |||

| 2,00,000 | 2,12,000 | 2,00,000 | 2,12,000 |

Prepare common size Balance-Sheet for the year 31.3.17 and 31.3.18

Q.6 From the following Receipts and Payments Account “K.B.P. Engineering College” Nashik for the year ending on 31.03.2019 and additional information, prepare Income and Expenditure Account for the year ending 03.2019 and Balance Sheet as on that date.

Receipts and payments Account for the year ending 31.03.2019.

Dr. Cr.

| Receipts | Amount ` | Payments | Amount ` |

| To Balance b/d | By Salaries to Teaching Staff | 11,70,000 | |

| Cash in Hand | 18,000 | By Electricity Charges | 55,000 |

| Cash at Bank | 1,00,400 | By Books | 61,000 |

| To Interest | 55,000 | By Furniture | 51,000 |

| To Subscriptions | 28,300 | By Stationery | 21,850 |

| To Life Membership fees | 25,000 | By Fixed Deposit (31.03.2019) | 8,50,000 |

| To Donation | 7,00,000 | By Balance c/d | |

| To Tution Fees | 12,30,000 | Cash in Hand | 16,650 |

| To Term Fees | 2,00,800 | Cash at Bank | 2,00,000 |

| To Sundry Receipts | 8,000 | ||

| To Admission Fees (Revenue) | 60,000 | ||

| 24,25,500 | 24,25,500 |

Additional Information :

| Particulars | 01.04.2018 ` | 31.03.2019 ` |

| Books | 6,00,000 | 6,00,000 |

| Furniture | 3,19,000 | 3,00,000 |

| Building Fund | 10,00,000 | ? |

| Fixed Deposit | 9,10,000 | ? |

| Capital Fund | 9,47,400 | ? |

- 50% of Donation are for Building Fund and the balance is to be treated Revenue Income

- Outstanding subscription ₹ 5,300

- Life membership fees are to capitalised

(Ans. : Surplus ` 5,59,550, Total of Balance Sheet ` 28,81,950)

Q. 7 Amitbhai and Narendrabhai are in Partnership Sharing Profits and Losses equally. From the following Trial Balance and Adjustments given below, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March 2019 and Balance Sheet as on that date.

Trial Balance as on 31st March, 2019

| Debit Balance | Amount ₹ | Credit Balance | Amount ₹ |

| Plant & Machinery | 2,80,000 | Capital A/c : | |

| Factory Building | 75,000 | Amitbhai | 3,50,000 |

| Sundry Debtors | 28,700 | Narendrabhai | 3,00,000 |

| Purchases | 85,500 | Sales | 1,80,000 |

| Bad Debts | 500 | Bills Payable | 8,500 |

| Sales Return | 2,200 | Discount | 1,200 |

| 10% Govt. Bond | 40,000 | Creditors | 38,500 |

| (Purchased on 1st Oct, 2018) | R.D.D. | 2,700 | |

| Import Duty | 1,800 | Bank Loan | 15,000 |

| Legal Charges | 2,000 | Purchases Return | 2,000 |

| Motive Power | 12,000 | ||

| Warehouse Rent | 1,800 | ||

| Cash in Hand | 20,000 | ||

| Cash at Bank | 70,000 | ||

| Advertisement | 10,000 | ||

| (for 2 years, w.e.f 1st Jan 2019) | |||

| Salaries | 3,800 | ||

| Rent | 1,500 | ||

| Drawings : | |||

| Amitbhai | 2,400 | ||

| Narendrabhai | 3,200 | ||

| Furniture | 1,95,800 | ||

| Bills Receivable | 20,700 | ||

| Free hold Property | 41,000 | ||

| 8,97,900 | 8,97,900 |

Adjustments :

- Stock on hand on 31st March 2019 was valued at ₹ 43,000.

- Uninsured Goods worth ` 8,000 were

- CreateD.D at 2% on Sundry debtors.

- Patil, our customer become insolvent and could not pay his debts of ₹ 500.

- Outstanding Expenses – Rent ₹ 800 and Salaries ₹ 300

- Depreciate Factory Building by ₹ 2,500 and Furniture by ₹ 1,800

Reference: MHSB

Thankyou sir

It is really good for your students

thank you

sir,

please post more format of another chapter of b.k so we can do easily

ok sure

Thanks 😊

sir adjustments video talo

Is it from new syllabus?

yes

Solution kidhar hai

Thank you sir

i want English more question paper

check out HSC section for more content already published

i want English more question paper

Sir what about computer ? Give us the important questions for this chapter

my suggestion refers to MCQ for IT paper and practicals which very easy if you give time for your study

Sir,

Death of partner ke imp questions bhi dijiye na please!!

sir, can u help us more like giving same extra question

if you have watched my youtube video and also read the post and sample question that is enough for preparation

Thanks

Thankyou so much Sir:)🥰😊God Bless you….❤️

Thank you sir

Hello sir

12 commerce account ka questions Patan with solutions ki pdf nahi hai .

Please dalo na

Hello sir

Give a account questions pattern with solutions pdf

on youtube

Sir how many days of gap will be there in papers since exams will be from 4march to 6april?

wait for timetable soon board will release timetable I will update

Please give me all questions of 12th HSC commarce

Plz provide important question for maths 😓🙏🙏

maths main important question nahi hote concept clear karo check playlist on youtube

Sir plzzz upload math imp question and question set

check-in HSC section and YouTube video