Inflation: Types of inflation, Causes of inflation and Measures to Control of Inflation

Inflation

- Increase in the general price level of goods and services. It is a situation of rising prices in the economy and a decrease in purchasing power of the currency

- Johnson defines “inflation as a sustained rise” in prices. Brooman defines “a continuing increase in the general price level. According to Keynes increases in money supply beyond the full employment level, output comes to an end to rise, and prices rise in proportion with the money supply.

Types of inflation by the rate of increase

- Creeping inflation: when the rise in prices is very slow it is called creeping inflation. An increase in the price of less than 3% a year is characterized as creeping inflation.

- Walking Inflation: The rate of rising prices is in single digit (3% to 7%) or less than 10% it is called walking inflation. Walking inflation is referred to as moderate inflation. Walking inflation is a warning signal for the government to control it before it turns into running inflation.

- Running inflation: When prices rise rapidly like the running of a horse at a rate of speed of 10% to 20% a year, it is called running inflation. Such inflation affects the poor and middle class adversely. The strong monetary policy and fiscal policy may control running inflation.

- Hyperinflation and Galloping inflation: When prices rise very fast at double or triple-digit rates from 20% to 100% a year it is called runaway or galloping inflation. Hyperinflation is a situation when the rate of inflation becomes immeasurable and absolutely uncontrollable. Prices rise many times every day.

Causes of Demand-Pull inflation:

- Demand-pull inflation is also called demand-side inflation when aggregate demand is increasing while the available supply of goods is becoming less. There is a shortfall in goods supply either because resources are fully utilized or production cannot be increased rapidly (very fast) to meet the increasing demand. As a result, prices begin to rise in response to a situation.

There are two principal theories about the demand full inflation —one is the classical 0r monetarist view and the other is the Keynesian.

- The monetarist emphasizes the role of money as the principal cause of demand-pull inflation. Inflation is always and everywhere a monetary phenomenon. According to classical economists or monetarists, Inflation is caused by an increase in the money supply.

- According to Keynesians, aggregate demand may rise due to a rise in consumer demand or investment demand, or government expenditure to meet the civil and military requirements of the country. Thus the aggregate demand comprises consumption, investment, and government expenditure.

- When the value of aggregate demand exceeds the value of aggregate supply at the full employment level, the inflationary gap arises. The larger the gap between aggregate demand and aggregate supply, the more rapid the inflation. Such a situation is called Demand-Pull Inflation.

- Repayment of Public Debt: Public debt is a common feature of modern government. When public debt increases people have more income at their disposal. Additional disposal income ends to raise the demand for goods and services.

- Black Money: Social and economic evils like corruption, tax evasion, smuggling, and other illegal activities give rise to black money. It affects demand and thus price level.

- Increase in population: the size of the population is one of the important determinants of demand. In developing countries like India where demand increases faster than supply due to the large and increasing population.

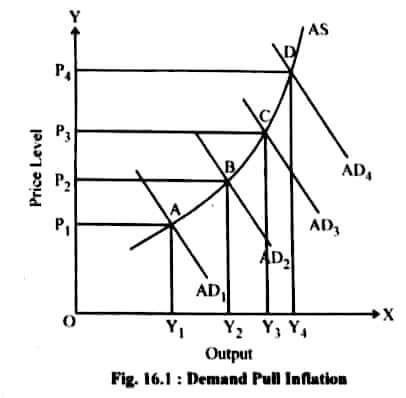

- The diagram explains an increase in price level due to demand pull.

- AS is the supply curve. OP1 is the price determined by the interaction of the demand curve – AD1 and supply curve AS.

- Demand curve shifts from AD1 to AD2 ……. AD4. Accordingly, the price level increases from P1 to P2 …… P4. Supply responds to an increase in demand up to Y4.

- The shift in demand from AD1 to AD4 results in an increase in price as well as supply. However additional supply is not enough especially after Y3 or point C to prevent the prices from rising.

Cost-Push Inflation:

- Inflation need not necessarily be due to an increase in demand. Prices may increase even when demand does not increase. It is also possible that prices may increase even when the economy experiences a decline in demand. Here the main cause is an increase in cost.

- An increase in the prices of inputs including labour, an increase in profit margin by business firms, and a monopoly in the factor market may push up prices as they are in a position to influence the supply price.

- Supply shocks such as a decline in food grain supply due to monsoon failure, the oil crisis experienced in the 1970s and thereafter due to the crude oil cartel (OPEC), and shortages due to natural calamities may affect the cost of supply.

- Under the above circumstance, the same quantity of goods and services or even the reduced quantity is supplied at higher prices due to an increase in cost. The supply curve shifts to the left, with a new equilibrium with a higher price.

Factors of Cost-Push inflation

- Factors of Cost-Push Inflation

- Increase in Wages: when prices increase due to an increase in wages it is called wage-push inflation. Wages rate increases due to many factors such as improvements in productivity or higher profit margins. The higher wages burden shifted to consumption in the form of higher prices.

- Increase in Material Cost: An increase in the prices of raw materials and components because of a rise in global commodity prices such as oil, gas copper, and agricultural products used in food processing, etc. For example, by administrative order, the government may hike the price of petrol or diesel or freight rate.

- Increase in profit Margin: Firms operating under oligopoly or enjoying monopoly (petroleum firms in the public sector) may have ‘administered prices’ with a higher profit margin. The desire to have higher profit margins by all those who have the power to do so becomes the cause of the inflationary trend.

- Other factors: cost of production may increase when input prices go up due to scarcity-natural or artificial. Natural calamities like drought or floods adversely affect the supplies of raw materials thus making them dearer. Firms operating with excess capacity either because of a monopolistic competitive market or any other reason produces at a higher cost.

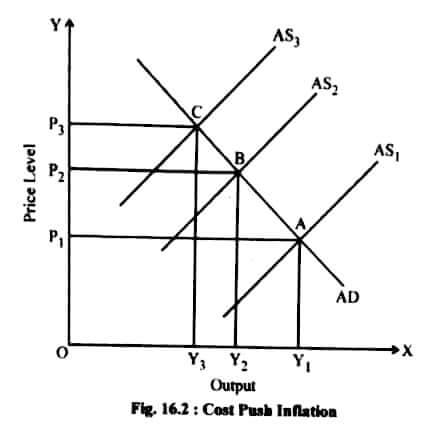

- In the above diagram, the initial price OP1 is determined by the interaction of demand (AD) and supply (AS1) at point A, the output level Y1, which we may assume as full employment output.

- The supply curve shifts up to the left because of the increase in cost. The new supply curve AS1 intersects the demand curve at point B, establishing a new higher price P2. As the supply curve shifts further, price increases, and output decreases. The increase in price is mainly due to cost-push factors.

Measures to control inflation

- Monetary Measures

- Fiscal measures

- Other measures

- Credit Control: One of the important monetary measures is monetary policy. The center of the country adopts a number of methods to control the quantity and quality of credit. For this purpose, it raises the bank rates, sells the securities in the open market, raises the reserve ratio, and adopts a number of selective credit control measures, such as raising margin requirements and regulating consumer credit.

- Bank rate policy: The bank rate is the rate charged by the Central Bank for rediscounting the bills of exchange presented by the commercial banks. When the bank rate increases, the interest rate of the commercial banks will also increase. As a result, the borrower has to pay a high rate of interest and therefore he will demand less. Through changes in bank rates, RBI affects the interest rate in the money market.

- Open Market Operations: This refers to the buying and selling of securities by RBI in the open market. RBI reduces credit by selling securities to the public. When it sells a security to the public, money flows from the public to RBI. It reduces credit. It can expand credit by purchasing securities from the market. When it purchases a security, money flows from RBI to the public. It leads to credit creation.

- Cash Reserve Ratio: Cash reserve ratio (CCR) refers to the proportion of the total deposit that commercial banks have to keep with the Central bank. When the CCR is increased, the cash reserve of commercial banks will reduce which in turn will reduce the lending capacity of banks. This will lead to a decrease in the volume of credit creation by the bank. This policy is adopted during inflation.

- Margin Requirement: A bank requires security such as gold, and a house, against loans sanctioned. No bank gives loans equal security. Suppose a person presents security of ₹ 1 lakh then he may be given a loan up to ₹75, 000. This difference between the actual value and the sectioned value is known as the margin. RBI directs the commercial bank to keep a lower margin against loans for agriculture etc.

- The ceiling on Credit: It means fixing a limit for the different types of loans sanctioned by commercial banks.

- Demonetization of currency: One of the monetary measures is to demonetize the currency of higher denominations. Such measures are adopted when there is more black money in the country.

Issue of new currency: one new note is exchanged for a number of notes of the old currency. Such measures are adopted when there is an excessive issue of notes and there is hyperinflation in the country. It is a very effective measure.

Fiscal measures

-

- Reduction in Expenditure: The government should reduce unnecessary expenditure on non-development activities in order to control inflation.

- Increase in Taxes: The tax rate of personal, corporate, and commodity should be raised to cut personal consumption expenditure, but the rates of taxes should not be so high as to discourage saving, investment, and production. The government should penalize tax evasion (= illegally not paying tax) by imposing heavy fines. Such a measure is effective in controlling inflation.

- Increase in Savings: Increasing savings will reduce the disposable income of the people, hence personal consumption expenditure will decrease. According to Keynes, the saver gets his money back after some years. The government should increase the interest rate on public loans, saving schemes with prize money for long periods provident funds, pension schemes, etc. increase savings, which helps in effectively controlling inflation.

- Surplus budget: The Government should give up deficit financing and instead have surplus budgets. It means collecting more in revenue and spending less.

- Public debt: The Government should stop repayment of public debt and postpone it to a future date till inflationary pressure is controlled within the economy. Instead, the government should borrow more to reduce the money supply to the public.

Other measures

- To increase production: One of the important measures to control inflation is to increase the production of essential consumer goods like clothing, sugar, vegetable oil, etc.

- Rational wages policy: Another important measure is to adopt a rational wage and income policy. Under hyperinflation, the government should freeze wages, income, profits, dividends bonuses, etc. for a short period to control inflation.

- Price control: Price control means fixing an upper limit for the prices of essential consumer goods. It’s difficult to administer price control.

For more Business Economics Notes Click Here

Reference: ML Jhingan, Manan Prakashan, economicsdiscussion.net

Thank you sir 👍😊 nice

Tysm sir this means alot….ty once again

Crisp notes✨🎊