Principles of Maximum Social Advantages: Business Economics

Principles of Maximum Social Advantages

- According to Hugh Dalton, the main objective of public finance is to maximization of social advantages and the Principle he uses to explain the achievement of this objective is the Principle of Maximum Social Advantage.

- According to Hugh Dalton, that system of public finance is the best which secures maximum social advantage to the community. The fiscal operation of the state should therefore be determined by the principle of maximum social advantage.

- Hugh Dalton explains the principle of maximum social advantage with reference to:-

- Marginal Social Sacrifice

- Marginal Social Benefits

Assumptions:

- All taxes result in sacrifice and all public expenditures lead to benefit.

- Public revenue consists of only taxes and there is no other source of income to the government.

- The govt. has no surplus or deficit budget but only a balanced budget.

- Public expenditure is subjected to diminishing marginal social benefits.

- They are subjected to increasing marginal social sacrifice.

Marginal Social Sacrifice (MSS)

- Marginal Social Sacrifice (MSS) refers to the amount of social sacrifice experience by the public due to the imposition of an additional unit of tax.

- The marginal social sacrifice of taxation increase as the revenue collected by the government from taxes becomes larger. As the community pays more and more taxes to the government, they sacrifice the experience of paying every additional unit of money in the form of a tax increase.

- Thus taxes are subjected to increasing marginal social sacrifice. Every additional unit of taxation creates a greater amount of impact and a greater amount of sacrifice on society. That is why the marginal social sacrifice goes on increasing.

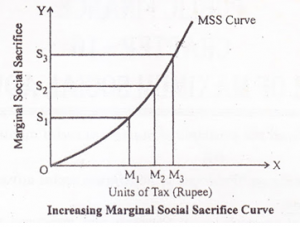

The Marginal social sacrifice is illustrated in the following diagram:-

- The above diagram shows the X-axis unit of tax in Rupee and Y-axis marginal social sacrifice.

- The above diagram indicates that the Marginal Social Sacrifice (MSS) curve rises upwards from left to right.

- This indicates that with each additional unit of taxation, the level of sacrifice also increases.

- When the unit of taxation was OM1, the marginal social sacrifice was OS1, and with the increase in taxation at OM2, the marginal social sacrifice rises to OS2.

Marginal Social Benefit (MSB)

- While the imposition of tax puts the burden on the people, public expenditure confers benefits. The benefit conferred on the society, by an additional unit of public expenditure is known as Marginal Social Benefit (MSB).

- Just as the marginal utility from a commodity to a consumer declines as more and more units of the commodity is made available to him, the social benefit from each additional unit of public expenditure declines as more and more units of public expenditure is spent.

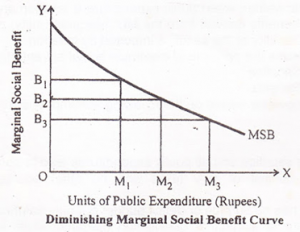

- In the beginning, the units of public expenditure are spent on the most essential social activities. Subsequent doses of public expenditure are spent on less and less important social activities. As a result, the curve of marginal social benefits slopes downward from left to right as shown in the figure below.

- The above diagram indicates the X-axis unit of Public Expenditure in Rupee and Y-axis Marginal Social Benefit

- In the above diagram, the marginal social benefit (MSB) curve slopes downward from left to right.

- This indicates that the social benefit derived out of public expenditure is reducing at a diminishing rate.

- When the public expenditure was OM1, the marginal social benefit was OB1, and when the public expenditure is OM2, the marginal social benefit is reduced at OB2.

The Point of Maximum Social Advantage

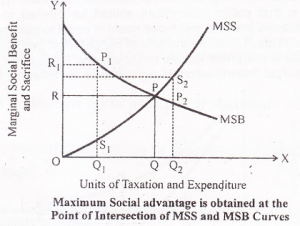

- The social advantage is maximized at the point where marginal social sacrifice cuts the marginal social benefits curve.

- This is at point P. At this point, the marginal disutility or social sacrifice is equal to the marginal utility or social benefit. Beyond this point, the marginal disutility or social sacrifice will be higher, and the marginal utility or social benefit will be lower.

- At point P social advantage is maximum. Now consider Point P1. At this point marginal social benefit is P1Q1. This is greater than the marginal social sacrifice S1Q1. Since the marginal social sacrifice is lower than the marginal social benefit, it makes more sense to increase the level of taxation and public expenditure.

- This is due to the reason that additional units of revenue raised and spent by the government leads to an increase in the net social advantage. This situation of increasing taxation and public expenditure continues, as long as the levels of taxation and expenditure are towards the left of the point P.

- At point P, the level of taxation and public expenditure moves up to OQ. At this point, the marginal utility or social benefit becomes equal to marginal disutility or social sacrifice. Therefore at this point, the maximum social advantage is achieved.

- At point P2, the marginal social sacrifice S2Q2 is greater than the marginal social benefit P2Q2. Therefore, beyond point P, any further increase in the level of taxation and public expenditure may bring down the social advantage. This is because; each subsequent unit of additional taxation will increase the marginal disutility or social sacrifice, which will be more than marginal utility or social benefit.

- This shows that maximum social advantage is attained only at point P & this is the point where the marginal social benefit of public expenditure is equal to the marginal social sacrifice of taxation.

Conclusion

- Maximum Social Advantage is achieved at the point where the marginal social benefit of public expenditure and the marginal social sacrifice of taxation are equated, i.e. where MSB = MSS.

- This shows that to obtain a maximum social advantage, the public expenditure should be carried up to the point where the marginal social benefit of the last rupee or dollar spent becomes equal to the marginal social sacrifice of the last unit of rupee or dollar taxed.

For more Business Economics Notes Click Here

Reference: ML Jhingan, Manan Prakashan

wonderful

Sir your videos is so helpful for me because i studied before 1 day of exam and i pass

Notes language is hard to remember please do it easy

Thankyou so much

It’s is very helpful for self study

Sir your economic lecture are great to understands

thank you