Secretarial Practice: secretarial practice 12th commerce important questions

Secretarial Practice

Sample Paper of SP – HSC Board Exam 2021

Important Question

Q.1 A) A select the correct option ad rewrite the sentence [5]

- ……………… refers to capital made up of Equity and preference shares a) Share capital b) Debt capital c) Reserve fund

- ………………is related to money and money management. a) Production b) Marketing c) Finance

- ……………..is the smallest unit in the total share capital of the company. a) Debenture b) Bonds c) Share

- A company can issue ……………… convertible debentures. a) Only partly b) Only fully c) Partly or fully

- The holder of preference share has the right to receive……………..rate of divided. a) fixed b) fluctuating c) lower

Q.1 B) Match the pairs [5]

| Group ‘A’ | Group ‘B’ | ||

| a) | Capital budgeting | 1) | Sum of current assets |

| b) | Fixed capital | 2) | Deals with acquisition and use of capital |

| c) | Working capital | 3) | Fixed liabilities |

| d) | Capital structure | 4) | Sum of current liabilities |

| e) | Corporate finance | 5) | Fixed assets |

| 6) | Investment decision | ||

| 7) | Financing decision | ||

| 8) | Deals with acquisition and use of assets | ||

| 9) | Mix up of various sources of funds | ||

| 10) | Product mix | ||

Q.1 C) Give one word or phrase or term [5]

- Offering of shares by a company to the public for the first time.

- A document of title of ownership of shares.

- The holders of these shares are entitled to participate in the surplus profit.

- Name the shareholders who participate in the management.

- Account to be created for the redemption of debentures.

Q.1 D) State True or False [5]

- Equity share capital is known as venture capital.

- Equity shareholders enjoy a fixed rate of dividends.

- Only fully paid-up shares can be forfeited.

- Bondholders are owners of the company.

- Debenture holders have the right to vote at the general meeting of the company.

Q2. Explain the following terms/concepts (any4) [8]

- Borrowed Capital

- Employees Stock Option Scheme

- Debenture

- Renewal of Deposit

- Dematerialization

Q3. Study the following case/situation and express your opinion (Any 2) [6]

- The Balance-sheet of a Donald Company for the year 2018-19 reveals equity share capital of Rs. 25, 00,000, and retained earnings of Rs. 50, 00,000.

- Is the company financially sound?

- Can the retained earnings be converted into capital?

- What type of source retained earnings is?

2. The management of ‘Maharashtra State Road Transport Corporation’, wants to determine the size of working capital.

- Being a public utility service provider, will it need less working capital or more?

- Being a public utility service provider, will it need more Fixed Capital?

- Give one example of public utility service that you come across on a day-to-day basis.

3. Eva Ltd. Company’s capital structure is made up of 1, 00,000 Equity shares having a face value of ` 10 each. The company has offered to the public 40,000 Equity shares and out of this, the public has subscribed for 30,000 Equity shares. State the following in `.

- Authorised capital

- Subscribed capital

- Issued capital

Q4 Distinguish between (Any 3) [12]

- Fixed Capital and Working Capital.

- Transfer of Shares and Transmission of Shares

- Equity shares and Preference shares.

- Final Dividend and Interim Dividend

Q5. Answer in brief (Any 2) [8]

- State any four factors affecting fixed capital requirements.

- What is Global Depository Receipt?

- State any four provisions of Companies Act 2013 for the issue of debentures.

Q6. Justify the following statement (Any 2) [8]

- The firm has multiple choices of sources of financing.

- A company can issue a duplicate share certificate.

- Equity share capital is risk capital.

- Debenture trustees are appointed by a company issuing debentures.

Q7. Attempt the following (Letter Writing) (Any2) [10]

- Write a letter to the shareholder regarding the issue of Bonus Shares.

- Draft a letter of allotment to the debenture holder.

- Draft a letter of thanks to the depositor of a company.

Q8. Answer the following (Any 1) [8]

Define preference shares. What are the different types of preference shares?

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

Q.1 A) A select the correct option ad rewrite the sentence [5]

- Company has to pay……………..to government. a) Taxes b) dividend c) interest

- A company cannot issue ……………… with voting rights. a) Equity shares b) Debentures c) Securities

- The accumulated dividend is paid to…………….preference shares. a) Redeemable b) cumulative c) convertible

- ………………is offered to existing equity shareholders. a) IPO b) ESOS c) Rights Issue

- Deposit is a type of………………………………………….. a) Owned capital b) Short term loan c) Long term loan

Q.1 B) Find the odd one [5]

- ESOS, ESPS, Rights Shares, Sweat Equity.

- Secured Debentures, Convertible debentures, Irredeemable debentures.

- Bonus shares, Rights Shares, ESOS.

- Debenture Capital, Equity Share Capital, Preference Share Capital.

- Debenture, Public deposit, Retained earnings.

- Face value, Market value, Redemption value.

Q.1 C) Complete the sentences [5]

- Return on investment on debenture is called………………………

- Share capital refers to capital made up of Equity shares and………………………

- Initial planning of capital requirement is made by………………………

- The convertible preference shareholders have a right to convert their shares into…………

- Equity shareholders elect their representatives called…………………….. .

Q.1 D) Select the correct option from the bracket [5]

| Group ‘A’ | Group ‘B’ | ||

| a) | Financing decision | 1) | …………………………………………….. |

| b) | ……………………………. | 2) | Longer period of time. |

| c) | Investment decision | 3) | …………………………………………….. |

| d) | ……………………………. | 4) | Circulating capital |

| e) | Combination of various

sources of funds |

5) | …………………………………………….. |

( To have right amount of capital, Deploy funds in systematic manner, Fixed capital, Working capital, Capital structure )

| Group ‘A’ | Group ‘B’ | ||

| a) | Equity shares | 1) | …………………………………………….. |

| b) | ……………………………. | 2) | Dividend at fixed rate |

| c) | Debentures | 3) | …………………………………………….. |

| d) | ……………………………. | 4) | Accumulated corporate profit |

| e) | Public Deposit | 5) | …………………………………………….. |

(Fluctuating rate of dividend, Preference shares, Interest at a fixed rate, Retained earnings,

Short-term loan. )

Q2. Explain the following terms/concepts (any 4)[8]

- Trade credit

- Initial Public Offer

- Debenture holders

- Depositor

- Financial market

- Commercial bills

Q3. Study the following case/situation and express your opinion (Any 2) [6]

- Satish is a speculator. He desires to take advantage of the growing market for the company’s product and earn handsomely.

- According to you which type of share Mr. Satish will choose to invest?

- What does he receive as a return on investment?

- State any one right which he will enjoy as a shareholder.

2. TRI Ltd. Company is a newly incorporated public company and wants to raise capital by selling Equity shares to the public. The Board of Directors is considering various options for this. Advise the Board on the following matters :

- What should the company offer – IPO or FPO?

- Can the company offer Bonus Shares to raise its capital?

- Can the company enter into an Underwriting Agreement?

3. A company is planning to enhance its production capacity and is evaluating the possibility of purchasing new machinery whose cost is ` 2 crore or has an alternative of machinery available on a lease basis.

- What type of asset is machinery?

- Capital used for the purchase of machinery is fixed capital or working capital?

- Does the size of a business determine the fixed capital requirement?

Q4 Distinguish between (Any 3) [12]

- Share and Debenture.

- Final Dividend and Interim Dividend

- Primary market and Secondary market.

- Transfer of Shares and Transmission of Shares

Answer in brief (Any 2) [8]

- Discuss the importance of corporate finance.

- Explain the statutory provisions for allotment of shares.

- Explain briefly the procedure for the issue of debentures.

Q6. Justify the following statement (Any 2) [8]

- There are various factors affecting the requirement of fixed capital.

- The company has to fulfill certain provisions while making the Right Issue.

- Preference shares do not carry any voting rights.

- All companies cannot accept deposits from the public.

Q7. Attempt the following (Letter Writing) (Any 2) [10]

- Draft a letter to the depositor regarding the repayment of his deposit.

- Write a letter to the member for the issue of the Share Certificate.

- Draft a letter to the debenture holder informing him about the redemption of debentures.

Q8. Answer the following (Any 1) [8]

- What is an equity share? Explain its features.

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

Q.1 A) A select the correct option ad rewrite the sentence [5]

- Bonus shares are issued free of cost to………………. a) Existing Equity shareholders b) existing employees c) Directors

- Letter of ……………… is sent to applicants who have been given shares by the company. a) Regret b) Renunciation c) Allotment

- Debenture holders are……………..of the company. a) Creditors b) owners c) suppliers

- ……………..are the creditors of the company. a) Shareholders b) Debenture holders c) Directors

- The deposit can be accepted for a minimum of 6 months and a maximum for…….months a) 36 b) 3 c) 30

Q.1 B) Answer in one sentences [5]

- Define corporate finance.

- What is a share?

- What is a share certificate?

- Who are debenture holders?

- What is Public Issue?

Q.1 C) Correct the underlined word and rewrite the following sentence [5]

- Retained earnings are the external sources of finance.

- Preference shares get dividend at fluctuating

- Depository Receipt traded in the USA is called Global Depository Receipt.

- Issued capital is the maximum capital which a company can raise by issuing

- Government Company can accept deposit from

Q.1 D) Arrange in proper order [5]

- a) Share certificate b) Allotment letter c) Application form

- a) Appoint Deposit Trustee. b) Hold General Meeting. c) Create charge on assets.

- a) Board Resolution b) Allotment of Debentures c) Board meeting

- a) Renewal of Deposit b) Acceptance of Deposits c) Deposit Receipt

- a) Gets Statement of Accounts b) Open Demat Account c) Submit DRF

- a) Recommendation of Dividend. b)Checking sufficiency of profits c)Board Meeting

Q2. Explain the following terms/concepts (any 4) [8]

- Ploughing back of profit

- Rights Issue

- Redemption of debentures

- Depository system

- Money market

- Treasury bills

Q3. Study the following case/situation and express your opinion (Any 2) [6]

- Rohit, an individual investor, invests his own funds in the securities. He depends on investment income and does not want to take any risk. He is interested in a definite rate of income and safety of principal.

- Name the type of security that Mr. Rohit will opt for.

- What does he receive as a return on his investment?

- The return on investment which he receives is fixed or fluctuating?

2. X owns 100 shares while Y owns 500 shares of Red Tubes Ltd. The company has asked all its shareholders to pay the balance unpaid amount of ` 20. X pays the full money demanded by the company. Y, who is in a bad financial position is unable to pay any money.

- Can the company forfeit the shares of Y?

- Can the company forfeit the shares of X?

- Can X transfer his shares?

3. Violet Ltd. Company plans to raise ` 10 crores by issuing debentures. The Board of Directors has some queries. Please advise them on the following

- Can the company issue unsecured debentures?

- Can they issue irredeemable debentures?

- As the company is offering debentures to its members, can such debentures have normal voting rights?

Q4 Distinguish between (Any 3) [12]

- Equity shares and Preference shares.

- Owned capital and borrowed capital.

- Initial Public Offer and Further Public Offer

- Money market and Capital market.

Q5. Answer in brief (Any 2) [8]

- Explain any 4 types of money market instruments

- State the features of Bonds.

- Explain the functions of the financial market.

Q6. Justify the following statement (Any 2) [8]

- The bondholder is a creditor of the company.

- A company can issue only certain types of debentures.

- There is a limit or restriction on the amount that a company can collect as Deposits.

- There are certain circumstances when a secretary has to correspond with

Q7. Attempt the following (Letter Writing) (Any 2) [10]

- Write a letter to the member for the payment of dividend through Dividend Warrant.

- Write a letter to the debenture holder regarding payment of interest electronically.

- Write a letter to the depositor regarding the renewal of his deposit.

Q8. Answer the following (Any 1) [8]

- What is Debenture? Discuss the different types of debentures.

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

Introduction to Corporate Finance

- The term finance is related to money and money management. It is related to the inflow and outflow of money. The success of any business organization depends upon the efficiency with which it is able to generate and use funds.

- Corporate finance deals with the raising and use of finance by a corporation. It deals with financing the activities of the corporation, capital structuring, and making investment decisions.

- The term corporate finance also includes financial planning, the study of the capital market, money market, and share market. It also covers the capital formation and foreign capital. Even financial organizations and banks play a vital role in corporate financing.

The following two decisions are the basis of corporate finance.

- Financing Decision: The business firm has access to the capital market to fulfill its financial needs. The finance manager ensures that the firm is well capitalized i.e. they have the right amount of capital and that the firm has the right combination of debt and equity. The firm has multiple choices of sources of financing. The firm can choose whether it wants to raise equity capital or debt capital. The firm can even opt for bank loans, public deposits, debentures, etc. to raise funds.

- Investment Decision: It relates how the funds of a firm are to be invested into different assets, so the finance manager has to make decisions regarding the use of the funds in a systematic manner so that it will bring a maximum return for its owners. For this, the firm has to take into consideration the cost of capital. Once they know the cost of capital, the firm can deploy or use the funds in such a way that returns are more than the cost of capital.

IMPORTANCE OF CORPORATE FINANCE

- Helps in decision making: Every decision in the business is needed to be taken keeping in view of its impact on profitability. Most of the important decisions of business enterprises are determined on the basis of the availability of funds. A business organization can give a green signal to the project only when it is financially viable. Thus corporate finance plays a significant role in the decision-making process.

- Helps in Raising Capital for a project: Whenever a business firm wants to start a new venture, it needs to raise capital. A business firm can raise funds by issuing shares, debentures, bonds, or even by taking loans from the banks.

- Helps in Research and Development: Research and Development must be undertaken for the growth and expansion of the business. Research and Development is a lengthy process and therefore funds have to be made available throughout the research work. This would require continuous financial support. Many a time, Company has to upgrade its old product or develop a new product to attract consumers. This company has to conduct surveys, market analyses, etc. which again requires financial support.

- Helps in the smooth running of the business firm: A smooth flow of corporate finance is needed so that salaries of employees are paid on time, loans are cleared on time, the raw material is purchased whenever required, sales promotion of existing products is carried out smoothly and new products can be launched effectively.

- Brings coordination between various activities: Corporate finance plays important role in the control and coordination of all activities in an organization. For e.g. Production will suffer if the finance department does not provide adequate finance for the purchase of raw materials and meeting other day-to-day financial requirements for the smooth running of the production unit. The efficiency of every department depends on effective financial management.

- Promotes expansion and diversification: Modern machines and modern techniques are required for expansion and diversification. Corporate finance provides money to purchase modern machines and technologies. Therefore finance becomes mandatory for the expansion and diversification of a company.

- Managing Risk: Company has to manage several risks, such as sudden fall in sales, loss due to natural calamity, loss due to strikes, etc. The company needs financial aid to manage such risks.

- Replace old assets: Assets such as plants and machinery become old and outdated over the years. They have to be replaced by new assets. Finance is required to purchase new assets.

- Payment of dividends and interest: Finance is needed to pay dividends to shareholders, interest to creditors, banks, etc.

- Payment of taxes/fees: Company has to pay taxes to the Government such as Income Tax, Goods and Service Tax (GST), and fees to the Registrar of Companies on various occasions. Finance is needed for paying these taxes and fees.

What is the factor that affects fixed capital?

Fixed capital is the capital that is used for buying fixed assets that are used for a longer period of time in the business. It stays in the business for a long period almost permanently.

Examples of fixed capital are – capital used for purchasing land and building, furniture, plant, and machinery, etc. Such capital is required usually at the time of the establishment of a new company. However, existing companies may also need such capital for their expansion and development, replacement of equipment, etc.

An entrepreneur obtains funds for the purchase of fixed assets from the capital market (Stock market). Funding can come from the issue of shares, debentures, bonds, or obtaining even long-term loans.

Factors affecting fixed capital requirement :

- Nature of business: Manufacturing industries and public utilities have to invest a huge amount of funds to acquire fixed assets. While a Trading business may not need huge investments in fixed assets.

- Size of business: Where a business firm is set up to carry on large-scale operations, its fixed capital requirements are likely to be high. It is because most of their production processes are based on automatic machines and equipment.

- Scope of business: There are business firms that are formed to carry on production or distribution on a large scale. Such businesses would require more amount of fixed capital.

- The extent of lease or rent: If an entrepreneur decides to acquire assets on the lease or on a rental basis, less amount funds for fixed assets will be needed for the business.

- Arrangement of sub-contract: If the business wants to sub-contract some processes of production to others, limited assets are required to carry out the production. It would minimize the fixed capital requirement of the business.

- Acquisition of old assets: If old equipment and plants are available at low prices, then it would reduce the need for investment in fixed assets.

- Acquisition of assets on concessional rate: With the view to foster industrial growth at the regional level, the government may provide land and building, materials at concessional rates. Plants and equipment may also be made available on an installment basis. Such facilities will reduce the requirement of fixed assets.

- International conditions: This factor is very significant particularly in large organizations carrying business on an international level. For example, companies expecting a war may decide to invest large funds to expand fixed assets before there is a shortage of materials.

- The trend in the economy: If the future of the company is anticipated to be bright, it gives a green signal to business entrepreneurs to carry out all sorts of expansion of the business firms. In that case, a large amount of funds are invested in fixed assets so as to reap the benefits in the future.

- Population trend: When the population is increasing at a high rate, certain manufactures find this as an opportunity to expand the business. For example- the automobile industry, electronic goods manufacturing industry, ready-made garments, etc. necessitates a huge amount of fixed capital.

- Consumer preference: Industries providing goods and services which are in good demand, will require a large amount of fixed capital. For example – Mobile phone manufactures as well as mobile network providers.

- Competitive factor: This factor is a prime element in decision-making regarding fixed capital requirements. If one of the competitors shifts to automation, the other companies in the same line of activity, will be compelled to follow that competitor.

What is the factor affecting working Capital?

Working capital is the capital that is used to carry out day-to-day business activities. After estimating the fixed capital requirement of the business firm, it is necessary to estimate the amount of capital, that would be needed to ensure the smooth functioning of the business firm.

A business firm requires funds to store adequate raw material in stock. A firm would need capital to maintain sufficient stock of finished goods.

Factors affecting working capital requirement :

- Nature of business: Firms engaged in manufacturing essential products of daily consumption would need relatively less working capital as there would be constant and sufficient cash inflow in the firm to take care of liabilities. Likewise, public utility concerns have to maintain small working capital because of the continuous flow of cash from their customers. if the business is dealing with luxurious products, it requires a huge amount of working capital, as the sale of luxurious items is not frequent.

- Size of business: The size of the business also affects the requirement of working capital. A firm with large-scale operations will require more working capital.

- The volume of sales: This is the most important factor affecting the size of working capital. The volume of sales and the size of working capital are directly related to each other. If the volume of sales increases, there is an increase in the amount of working capital and vice versa.

- Production cycle: The process of converting raw material into finished goods is called the production cycle. If the period of the production cycle is longer, then the firm needs more amount of working capital. If the manufacturing cycle is short, it requires less working capital.

- Business cycle: When there is a boom in the economy, sales will increase. This will lead to an increase in investment in stocks. This requires additional working capital. During a recession, sales will decline and hence the need for working capital will also decline.

- Terms of purchases and sales: If the firm does not get a credit facility for purchases but adopts a liberal credit policy for its sales, then it requires more working capital. On the other hand, if credit terms of purchases are favorable and terms of credit sales are less liberal, then the requirement of cash will be less. Thus working capital requirements will be reduced.

- Credit control: Credit control includes factors such as the volume of credit sales, the terms of credit sales, the collection policy, etc. If the credit-control policy is sound, it is possible for the company to improve its cash flow. If credit policy is liberal, it creates a problem with the collection of funds. It can increase the possibility of bad debts. Therefore a firm requires more working capital. The firm making cash sales requires less working capital.

- Growth and Expansion: The working capital requirement of a firm will increase with the growth of a firm. A growing company needs funds continuously to support large-scale operations.

- Management ability: The requirement of working capital is reduced if there is proper coordination between the production and distribution of goods. A firm stocking on heavy inventory calls for a higher level of working capital.

- External factors: If financial institutions and banks provide funds to the firm as and when required, the need for working capital is reduced.

What is capital structure?, Explain Components of Capital Structures

- Capital structure constitutes two wards i.e. Capital and Structure. Capital refers to the investment of funds in the business and structure means the arrangement of different parts of the capital in proportion.

- Once the capital requirement of a firm is decided, attention is given to various kinds of capital sources that can use to raise the funds to meet the requirements.

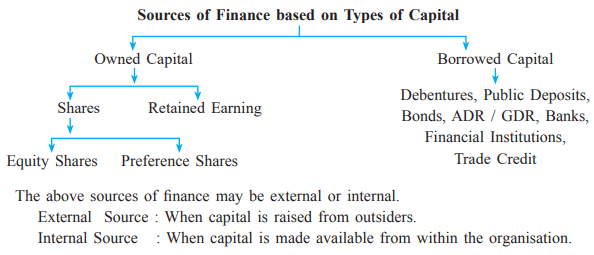

- A company can raise its capital from different sources is Owned capital or borrowed capital or both.

- The owned capital includes equity share + preference capital + reserve

- The borrowed capital includes loans + debentures + public deposits etc.

Components/parts of capital structures

There are four basic components of capital structure are follows:

- Equity share capital: It is the basic source of financing activities of business it represents the permanents capital of the company. The equity shareholder bears the ultimate risk. The equity shareholders get fluctuating dividends depending upon the profits. It enjoys normal rights.

- Preference share capital: The preference shareholder get preference for payment of dividend over the equity shareholders. Preference shares are those share which enjoys preference over equity share capital on the dividend. It does not enjoy normal voting rights.

- Retained earnings: It is an internal source of financing. It is nothing but ploughing back of profit. The company reserves part of the profit for self-financing.

- Borrowed funds:

- Debentures: A debenture capital is a part of borrowed capital raised by the company. It provides long-term finance. The company has to pay interest at an agreed rate.

- Term loan: The term loans are provided by banks and other financial institutions. The term loans carry a fixed rate of interest.

Reference: Maharashtra State Bureau of Textbook Production

Secretarial Practice

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

Secretarial Practice 12th Standard HSC Maharashtra State Board chapter 2 – Sources of Corporate Finance

- No business activity can ever be operated without finance. Finance (money) is necessary throughout the activities of promotion, organising, and regular operations of the business. All functions of business are ultimately reliant on finance.

- The Finance required by the business organisation is termed as ‘Capital’. Each business organisation requires certain capital for its activities.

- A joint-stock company, which is a modern form of business organisation and is a large company, requires large capital for business. This large capital collection or capital formation has unique significance in the management of joint-stock companies.

- A joint-stock company raises huge funds from different sources. These different sources of finance available to the business may be explained with the following chart :

Sources of Owned Capital

- The capital raised by the company with the help of owners (shareholders) is termed owned capital or ownership capital. The first form of owned capital is shareholders buy shares of the company and provide the necessary capital.

- The second form of owned capital is retained earnings which is also known as ploughing back of profit. It is the reinvestment of profit in the business by the company itself. It is an internal source of finance.

- Owned capital is considered permanent capital, as it is paid only at the time of winding up of the company. Owned capital in the form of share capital, provides an initial source of capital for a new company. It can be raised any time later to satisfy the further capital needs of a company.

- Promoters decide the share capital needed by a company. The amount of share capital is known as authorized capital. It is declared in the capital clause of the Memorandum of Association of the company.

What is share and state the features of share?

- The term share is defined by Section 2 (84) of the Companies Act 2013, ‘Share means a share in the share capital of a company and includes stock’.

- A share is a unit by which the share capital is divided. The total capital of the company is divided into small parts and each part is termed share and the value of each part/unit is known as face value.

- A share is a small unit of the capital of a company. It facilitates the public to subscribe to the capital in smaller amounts.

A person can buy any quantity of shares as he wants. A person who buys shares of a company is called a shareholder or a member of that company.

Features of Shares:

- Ownership: The owner of the share is known as a shareholder. It proves the ownership of a shareholder in the company.

- Distinctive Number/Unique Number: Unless dematerialised, each share has a different number for identification. It is mentioned in the Share Certificate.

- Evidence of title: A share certificate is issued by a company under its common seal. It is a document of title of ownership of shares. A share is not any visible thing. It is shown by share certificate or in the form of Demat share.

- Value of a Share: Each share has a value expressed in terms of money. There may be : (a) Face value which is written on the share certificate and mentioned in the Memorandum of Association. (b) Issue price at which company sells its shares. (c) Market Value of share is determined by demand and supply forces in the share market.

- Rights: A share gives certain rights to its holder such as the right to receive dividends, the right to attend shareholder’s meetings, and right to vote at such meetings, etc.

- Income: A shareholder is entitled to get a share in the net profit of the company which is called a dividend.

- Transferability: The shares of a public limited company are freely transferable in the manner provided in the Articles of Association.

- Property of Shareholder: Share is a movable property of a shareholder.

- Types of Shares: A company can issue two types of shares : (a) Equity shares. (b) Preference shares

What is Equity Shares? Explain its features

- Equity shares are also known as ordinary shares. Equity shares are the initial source of financing business activities. Companies Act defines equity shares as ‘those shares which are not preference shares’. the definition explains that: a) The equity shares do not enjoy a preference for dividends. b) The equity shares do not get priority for repayment of capital at the time of winding up of the company.

- Equity shareholders participate in their company’s management. shareholders invited to attend general meetings and allowed to vote on all matters discussed at the general meeting. Equity shareholders elect the representatives of a company to run the company. Thus Equity shareholders are real owners of the company.

- Equity shareholders do not get any fixed dividends, and dividends depend on the company’s performance. Dividends paid declared by the Board of Directors. If the company makes no profit, no dividends are payable. Thus, with less profit, a lesser dividend is going to be paid. The owners of equity shares are real risk bearers.

Features of Equity Shares :

- Permanent Capital: Equity shares are irredeemable shares. The amount received from equity shares is not refundable by the company during its lifetime. Equity shares become refundable only at the winding up of the company or the company decides to buy back shares. Thus equity share capital is long term and permanent capital of the company.

- Fluctuating Dividend: The equity shares holders get dividends at a fluctuating rate because dividend depends on companies profit. If the company makes more profit, a high rate of dividend gets paid. similarly, if Companies make lessor profit or loss, a lower rate of dividends or no dividend gets paid.

- Rights: Equity Shareholders enjoy certain rights such as the right to vote, the right to share in profit, the right to inspect books, the right to transfer shares.

- No preferential right: Equity shareholders do not enjoy preferential rights regards of payment of dividends. Equity shareholders are paid dividends only after the dividend is paid to preference shares holders. Similarly, at the time of winding up of the company, the equity shareholders are paid last and, if no surplus amount is available, equity shareholders will not get anything.

- Controlling power: The equity shareholders enjoy control over the company because they enjoy exclusive voting rights. The Act provides the right to cast vote in proportion to shareholding. They can participate in the management and affairs of the company. They elect representatives of the company to run the company’s business.

- Risk: The equity shareholders are the main risk-takers or bearers. If the income of the company declines, the rate of dividend also comes down. Due to this, the market value of equity shares comes down resulting in capital loss. Thus equity shareholders are the main risk-takers.

- Residual claimant: A residual claim means the last claim on the income of the company. Equity shareholders as owners are residual claimants to all earnings after expenses, taxes, etc. are paid. Although equity shareholders come last, they have the advantage of receiving the entire earnings that are remaining.

- No charge on assets: The equity shares do not create any charge over the assets of the company.

- Bonus Issue: Bonus shares are issued as a gift to equity shareholders. These shares are issued free of cost to existing equity shareholders. This benefit is available only to the equity shareholder.

- Right Issue: When a company required more funds for the expansion of the business and raises further capital by issue of shares, the existing equity shareholders may be given priority to get newly offered shares this is called ‘Right Issue’. The shares are offered to equity shareholders first, in proportion to their existing shareholding.

- Face Value: The face value of equity shares is low. It can be generally 10 per share or even 1 per share.

- Market Value: The market value of equity shares fluctuates according to the demand and supply of the company’s shares within the market. The demand and supply of equity shares depend on the company’s profits earned and dividends declared.

- Capital Appreciation: Share Capital appreciation takes place when the market value of shares increases in the share market. Profitability and prosperity of the company improve the reputation of the company in the share market and it facilitates appreciation of the market value of equity shares.

What is Preference Shares? Explain the features Preference Shares

- Preference shares have certain preferential rights different from equity shares. The shares which carry the preferential rights are known as preference shares: a) A preferential right on payment of dividends during the lifetime of the company. b) A preferential right on the return of capital at the time of winding up of the company.

- The preference shareholder has a prior right to receive a fixed rate of dividend. The rate of dividend is fixed at the time of issue.

The preference shareholders are not the controllers but they are co-owners of the company. preference share purchase by investors who are interested in the safety of investment and who want fixed returns on investments. - Usually, preference shares do not carry any voting power. They have voting right only on matters of which affect their interest, like selling of undertaking or changing rights of preference shares, etc. or they get voting rights if the dividend remains unpaid.

Features of Preference Shares:

- Preference for dividend: Preference shareholders have the first preference in the company’s annual net profit distribution. The dividend is paid to preference shareholders before equity shareholders.

- Preference for repayment of capital: The Preference shareholders get the preference over equity shareholders at the time of winding up for repayment of the capital. This minimizes the risk of capital loss.

- Fixed Return: Preference shares offer fixed-rate dividends. The rate of dividend is decided at the time of issue. It may be in the form of a fixed sum or may be calculated at a fixed rate. The preference shareholders are entitled to dividends which can be paid only out of profits. If the directors, in a financial crisis, decide not to pay dividends, the preference shareholders have no claim for dividends.

- Nature of Capital: Preference shares do not provide permanent share capital. They are redeemed after a specific period of time. A company can not issue irredeemable preference shares. Preference capital is mostly raised at a later stage when the company gets established. These shares are issued to satisfy the requirement for additional capital of the company.

- Market Value: The market value of preference shares does not change because the rate of dividend paid to preference shareholders at a fixed rate. The capital appreciation is considered to be low as compared with equity shares.

- Voting rights: The preference shares do not have normal voting rights. They can vote only on matters affecting their interest. They do not enjoy the right of control over the affairs of the company.

- Risk: Preference shareholders have less risk as they get preference for payment of dividend and repayment of capital at the time of business closer.

- Face Value: The face value of preference shares is comparatively more than the equity shares. They are normally issued at a face value of Rs. 100/-.

- Rights or Bonus Issue: Preference shareholders are not entitled to Rights issues or Bonus issues.

- Nature of Investor: Preference shares attract an investor who is less risk-taker. Investors who interested in the safety of capital, and who want a fixed return on investment normally purchase preference shares.

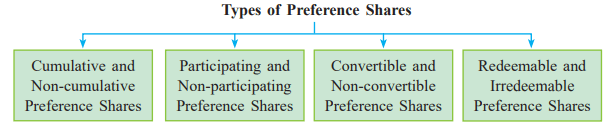

Types of Preference Shares

- Cumulative Preference Shares: It implies, if the dividend is not paid in one or more years due to inadequate profits or bad performance of a company, then the unpaid dividend gets accumulated and paid when the company makes a profit.

- Non-cumulative Preference Shares: It implies the dividend on shares can be paid only out of the profits of the current year. It is lost forever if the dividend is not paid in any year. The right to claim dividends will lapse if the company does not make a profit in that particular year.

- Participating Preference Shares: This means preference shareholders participate in the remaining profit after the dividend has been paid to equity shareholders. The preference shareholders are entitled to participate in surplus or excess profit other than the preferential dividend.

- Non-participating Preference Shares: The preference shares are considered to be non-participating if there is no clear provision in the Articles of Association. These shareholders are entitled to a fixed rate of dividend, prescribed at the time of issue.

- Convertible Preference Shares: The preference shareholders have a right to convert their preference shares into equity shares. The conversion takes place within a certain fixed period.

- Non-convertible Preference Shares: These shares cannot be converted into equity shares.

- Redeemable Preference Shares: Shares that can be redeemed after a specific fixed period of time are called redeemable preference shares.

- Irredeemable Preference Shares: Shares that are not redeemable that are payable only at the time of winding up of the company are known as irredeemable preference shares.

Retained Earnings :

- In simple words, a company saves the part of net profit/income as a reserve, which is not distributed to shareholders as a dividend is retained by the company within the sort of ‘Reserve Fund’.

- The company converts its reserves into ‘bonus share capital’ and capitalizes its profit. This capitalization of profit by the issue of bonus shares is known as ploughing back of profit or self-financing.

- It is an internal source of finance. Bonus shares are issued free of cost to the existing equity shareholders out of the retained earnings. The Management can convert retained earnings into permanent share capital by issuing bonus shares.

- It is an important source of raising long-term capital. It is the simple and cheapest method of raising finance. It is used by established companies.

- Business organizations are subject to fluctuation in earnings. It would be a smart decision to keep aside a part of earning during a period of high profit. A part of the profit is retained by the company in the form of a reserve fund. These reserves are the retained earnings of the company.

- The aggregation of retained earnings gets accumulated over the years. These accumulated profits are reinvested in the business rather than distributed as dividends.

- ”The process of accumulating corporate profits and their utilization in business is called retained earnings.”

Sources of Borrowed Capital

- Only owned capital is not sufficient to carry on all business activities of a joint-stock company or large organisation. A company required borrowed capital to supplement its owned capital.

- Every trading company is entitled to borrow money. However, it is a standard practice to have an express provision in the Memorandum of Association, enabling a company to borrow money. The power to borrow money is normally exercised by the Board of Directors of the company.

- A private company may exercise its borrowing powers immediately after incorporation. However, the public company cannot exercise its borrowing power until it secures a certificate of commencement of business.

- The capital could be borrowed for short, medium, or long-term requirements. It is better to raise borrowed capital at a later stage for the expansion and diversification of the business.

- This additional capital can be raised by A) issue of debentures B) Accepting deposits C) bonds D) Loans from commercial banks and financial institutions, etc. Interest is paid on borrowed capital. Borrowed capital is repayable after a certain period of time.

What is Debentures? state the features of debenture

- The term debenture has come from the Latin word ‘debere’ which means to ‘owe’. Debenture means a document that either creates or acknowledges debt.

- Topham defines: “A debenture is a document given by a company as evidence of debt to the holder, usually arising out of loan, and most commonly secured by charge.”

- Debentures are one of the main sources of raising borrowed capital to meet long and medium-term financial needs. Over the years debentures have occupied an important position in the financial structure of the companies.

- A debenture is an instrument issued in the form of a debenture certificate, under the common seal of the company.

Features of Debenture

- Promise: Debenture is a promise by the company that it owes (obligation to pay) a specified amount of money to the debenture holder.

- Face Value: The face value of debenture normally carries a high denomination(value). It is for Rs. 100 or in multiples of Rs. 100.

- Time of Repayment: Debentures are issued with the due date mentioned in the debenture certificate. The principal amount of debenture is repaid on the maturity date.

- The priority of Repayment: Debentureholders have a priority in repayment of debenture capital over the other claimants of the company.

- Assurance of Repayment: Debenture is long-term debt. They carry an assurance of repayment on the due date.

- Interest: A fixed rate of interest is paid periodically in case of debentures. Payment of interest is a fixed liability of the company. It must be paid by the company no matter whether the company makes a profit or not.

- Parties to Debentures: i)Company is the entity that borrows money. ii) Trustees: A company has to appoint a Debenture Trustee if it is offering Debentures to more than 500 people. The company makes an agreement with trustees, it is called Trust Deed. It contains the obligations of the company, rights of debenture holders, powers of Trustee, etc. iii) Debenture holders: These are the parties who provide loan and receive, ‘Debenture Certificate’ as evidence.

- Authority to issue debentures: According to the Companies Act 2013, Section 179 (3), the Board of Directors has the power to issue debentures.

- Status of Debentureholder: Debentureholder is a creditor of the company. Since debenture is a loan taken by a company, fixed-rate interest is paid at fixed intervals until the debenture is redeemed.

- No Voting Right: According to Section 71 (2) of the Companies Act 2013, no company shall issue any debentures carrying any voting right. Debenture holders have no right to vote at a general meeting of the company.

- Security: Debentures are generally secured by a fixed or fluctuating charge on the assets of the company. If a company is not in a position to make payment of interest or repayment of capital, the debenture holder can sell off the charged property of the company and recover their money.

- Issuers: Debentures can be issued by both private companies and public limited companies.

- Listing: Debentures must be listed with at least one recognized stock exchange.

- Transferability: Debentures can be easily transferred, through the instrument of transfer.

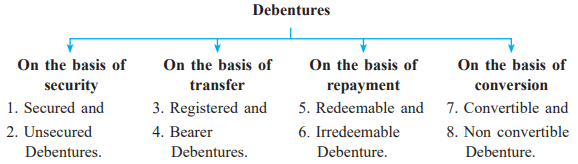

Types of debentures

- Secured debentures: The debentures can be secured. The property of the company may be charged as security for the loan. The security may be for some particular asset (fixed charge) or it may be the asset in general (floating charge). The debentures are secured through ‘Trust Deed’.

- Unsecured debentures: These are the debentures that have no security. The issue of unsecured debentures is permitted by the Companies Act, 2013.

- Registered Debentures: Registered debentures are those debentures on which the name of holders are recorded. A company maintains a ‘Register of Debentureholders’ in which the name, address, and particulars of holdings of debenture holders are entered. The transfer of registered debentures requires the execution of a regular transfer deed.

- Bearer Debentures: The name of holders are not recorded on the bearer debentures. Their names do not appear on the ‘Register of Debentureholders’. Such debentures are transferable by mere delivery. Payment of interest is made by means of coupons attached to the debenture certificate.

- Redeemable Debentures: Debentures are mostly redeemable i.e. Payable at the end of some fixed period, as mentioned on the debenture certificate. Repayment can be made at a fixed date at the end of a specific period or by installment during the lifetime of the company. The provision of repayment is normally made in ‘Trust Deed’.

- Irredeemable Debentures: These kind of debentures are not repayable during the lifetime of the company. They are repayable only after the liquidation of the company, or when there is a breach of any condition, or when some contingency arises.

- Convertible Debentures: Convertible debentures give the right to holders to convert them into equity shares after a specific period of time. Such right is mentioned in the debenture certificate. The issue of convertible debenture must be approved by special resolutions in general meetings before they are issued to the public.

- Non-convertible Debentures: Non-convertible debentures are not convertible into equity shares on maturity. These debentures are redeemed on the maturity date.

If you are looking for a sample paper as the new syllabus for Important Questions of Secretarial Practice for hsc board exam 2021 Click Here

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books, Click Here

Sources of Corporate Finance, Secretarial Practice 12th Standard HSC Maharashtra State Board chapter 2 – Sources of Corporate Finance, sources of corporate finance 12th class, HSC Board Exam 2022

Q.2. Distinguish between the following: (Any three) [15]

- Share and Debenture

- Equity share and preference share

- Transfer of share and transmission of share

- Share certificate and share warrant

- Interim dividend and final Dividend

- Primary Market and Secondary Market

- Fixed Capital and Working capital

Q.3. Write short notes on Any THREE of the following: [15]

- Renewal of Deposits

- Redemption of Debenture

- Share warrant

- Importance of financial planning

- Initial Public Offer (IPO)

- Global depository receipt

- Provisions regarding unpaid/ unclaimed dividend

- Acceptance of deposits.

- Retained profits.

- Employee Stock Option Scheme (E.S.O.S).

- Importance of Depository system.

- Bombay Stock Exchange.

- Capital structure and its components.

- Functions of stock exchange.

- Features of shares.

- Procedure for redemption of debentures.

- Statutory conditions of allotment of shares.

- Procedure for conversion of debentures.

- Methods of Redemption of Debentures.

Q.4 State with reasons, whether the following statements are True or False: (Any three) [15]

- The financial market contributes towards the nation’s economic growth and development.

- The bond holders are owners of the company.

- Depositor’s approval is must for renewal of deposit.

- A share certificate is a bearer document.

- Debentures are never redeemed by the company.

- Preference shareholders do not enjoy normal voting rights.

- Share certificate is a bearer document.

- Dividend can be paid on advance amount of calls received.

- Share transfer in depository mode is fast and economical.

- There are no legal provisions regarding payment of dividend.

- It is not possible to go ahead without a financial plan.

- A company can accept deposits repayable on demand.

- Share certificate is a bearer document.

- Handling demat shares is very time consuming.

- Convertible debentures can be converted into equity shares.

- Financial management is essential for all types of organizations.

- The bond holders are owners of the company.

- Transfer of shares is initiated by the company.

- Debenture holders are creditors of the company.

- Depositor’s approval is must for renewal of deposit.

Q.5. Attempt the following: (Any two) [10]

- State the position of debenture holders in a company.

- Draft a letter of thanks to the depositor of a company.

- What are the factors affecting requirement of fixed capital?

- Draft a letter to a debenture holder informing him about redemption of debentures.

- Write a letter regarding payment of interest on debentures.

- Write the external factors influencing capital structure.

- Draft a letter to a depositor regarding repayment of his deposit.

- Write a letter to a debentureholder informing him about conversion of debentures into equity shares.

- Draft a letter to depositor for renewal of deposit.

- Draft a letter regarding payment of interest on debentures to the debenture holder.

- What are the points to be borne in mind by the secretary while writing letters to the members?

- What are the legal provisions regarding declaration of dividend?

- Write a letter regarding payment of interest on debentures.

- Draft a letter of thanks to the depositor of a company.

- What are the points to be borne in mind while writing letters to the members?

- State the preliminary steps in the issue of shares.

Q.6. [10]

- Write a letter to a shareholder regarding issue of bonus shares.

- Define “debenture” and explain the types of debentures.

- Define a preference share. Explain the different types of preference shares.

- Draft a letter of allotment of shares to the shareholder

- Define Equity Shares and explain its features.

- Define ‘preference shares’. Explain various types of preference shares.

Secretarial Practice

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

- Preference shareholders do not enjoy normal voting rights.

This statement is TRUE

- Holders of preference share do not have normal voting rights like equity shares.

- They can vote on any such matter which directly affects there interest as an investor.

- Preference shareholders are preferred before equity shareholders to have their capital returned at the times of the liquidation of the business.

- Taking a higher risk of losing capital, only equity shareholders are given voting rights.

- The preference shareholders have voting rights in their class meetings only.

2. Bondholders are the owner of the company.

This statement is FALSE

- A bond is an interest-bearing certificate issued by a government, semi-government, or business firm to raise capital.

- The Bondholders are entitled to get a fixed rate of interest on the amount invested in Bonds.

- It is paid compulsorily by the company even if profit is not earned.

- The holders of such debt security become the creditors of the company and they have no rights to attend the general meeting and participate in management through voting rights.

- Since bondholders are non – owners, they are not entitled to get dividend which is paid only to the owners of the company i.e., shareholders.

- Hence, bondholders are not the owners of the company.

3. Public deposit is a good source for long-term finance.

This statement is FALSE

- A public deposit is an important source of financing the short-term requirements of the company.

- Companies generally receive a public deposit for the period ranging from 6 months to 36 months.

- Under this method, the general public is invited to deposit their Savings with the company for varied periods.

- Interest is paid by companies on such a deposit.

- The rates of interest are higher than those allowed by commercial banks.

- For the long term, the ownership capital company uses equity share capital.

4. A shares certificate is a bearer document.

This statement is FALSE

- A share certificate is a written document prepared by the company under its common seals and send to the members, containing the number of shares held by him/her and the amount paid thereon.

- The documents work as evidence for the owner of the shares of the shareholders.

- It is not the same exact same as a share warrant.

- It evidences the holding of so many shares by the person mention therein i.e., the shareholders

- This renders is the non – negotiable but transferable document.

5. Transfer of shares is initiated by the company.

This statement is FALSE

- When a member sells or given his shares to another person voluntarily, it is known as the transfer is shared.

- The transfer of shares is a voluntary act on the parts of the shareholders.

- The shares cannot be transferred by mere delivery.

- The transfer has to be placed in the manner specified in this respect.

- This transfer is effected by registering an instrument called ‘instrument of transfer’ with the company.

6.Debenture holders are the owner of the company

This statement is FALSE

- A debenture is a loan taken by the company for medium to long periods.

- Debenture holders, therefore, are the creditors of the company.

- Debenture capital is returnable and therefore has no permanency.

- Debenture holders earned interest has returned.

- Hence Debenture holders are not the owners of the company.

7. A company cannot accept deposits payable on demand.

This statement is FALSE

- A deposit is a short to medium-term long taken by a company for a certain period.

- Pre-decided by the company and accept by the deposit.

- It is always a term deposit with a maximum period of 36 months and a minimum of 6 months.

- It is repayable after the fixed period.

- So the public deposit of the company is not a demand deposit like current or savings bank account.

8. Depositor approval is a must for renewable deposits.

This statement is TRUE

- On maturity of the deposit, of depositor may apply for renewable of the deposits the old deposit receipt is canceled and in that place, a new deposit receipt is issued without repaying deposit amount.

- Usually, depositors expect safety and regular income in the form of interest on their investment.

- If they are satisfied with the above condition, they get their deposits renewed for a further period.

- This, if the depositors are willing and interested, the company can also renewal of deposit.

- Hence, for depositors, approval is a must for the renewal of the deposit.

9. Handling demand shares is very time-consuming.

This statement is FALSE

- Shares certificate, when converted from a physical form into an electronic form called Demat shares.

- The depositor system eliminates the handling of huge paperwork involved in the transfer of securities.

- Under this system, the securities are transferred by means of the entire ledger of the depository system without the physical movement of the security certificate.

- Under the depository system, the process of Transfer of security is very simple and easy.

- The transfer of securities from one investor to another under this system is virtually automatic, speedily and all hurdles of the transfer of securities are removed.

10. The rate of interim dividend is greater than the final dividend.

This statement is FALSE

- The interim Dividend is the dividend that is declared between two annual general meetings of the company.

- The final dividend is a dividend that is declared at the annual general meeting of the company.

- The interim dividend is declared by the board by passing resolution if they are authorized by articles.

- The final dividend is recommended by the board and declared by shareholders by passing an ordinary resolution at the annual general meeting.

- Therefore the rate of interim dividend is less than the final dividend.

Secretarial Practice

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

Method of redemption of debenture

As the debenture is capital is borrowed capital it has to be paid back. The repayment of debenture amount to debenture holders is called the redemption of the debenture.

- BOARD MEETING: A board meeting is held, to finalize the procedure for redemption of the debenture. A resolution is approved of the meeting to redeem the debenture.

- INTIMATION ABOUT REDEMPTION TO DEBENTURE HOLDERS: Secretary has to send letters to debenture holders giving detail of redemption. He informs them to surrender the debenture certificate.

- REFUND: A secretary has to inform bankers to carry out the necessary steps to repay to debenture holders.

- CHANGE IN REGISTER TO DEBENTURE HOLDERS: After completion of the redemption procedure, the secretary notes down the details of redemption in the register in debenture holders.

- CHANGE IN REGISTER OF CHARGE: The charge created on assets in favour of the debenture holders is canceled and the register of charges is suitably modified.

Procedure of conversion of debentures

Joint-stock companies can be issued either non-conversion or convertible debenture. SEBI guidelines 2000 has given necessary provisions relating to convertible and non-convertible debenture.

- BOARD RESOLUTION: A resolution for the conversion is approved in the board meeting. The shares holders as well as the debenture holders’ approval for the taken for conversion. A special resolution is passed to that effect. A copy of the special resolution is filled with the registrar of companies within 30 days of its passing.

- LETTER OF OPTION: A letter of options is to be sent to debenture holders and one copy of the same is filed with SEBI. The secretary then verifies the contents send by debenture holders for conversion.

- ALLOTMENT OF SHARES: Debenture is convertible into equity shares. Notice of conversion is sent and Debenture holders are asked to return the debenture certificates. Secretary carries out the allotment of shares to debenture holders in due course.

- ENTRY IN REGISTER OF MEMBERS: Shares certificate is issued to holders and their names are entered in the registrar of members.

- FILLING OF RETURN OF ALLOTMENT: A return of allotment is filed with the register of the company within 30 days of allotment.

What is the legal provision regarding the declaration of dividends?

- Regulations 85 of Table A provides that the company may declare dividends it’s the general meeting.

- The rate of dividend shall not exceed the rate recommended by the board of directors.

- When the company fails to redeem redeemable preference shares within the specified period, the company shall not declare any dividend on its equity shares, so long as such failure continued.

- The company cannot declare dividends for last year in respect of which accounts are closed at the previous annual general meeting.

- The company cannot declare further dividends after the declaration of dividends at the annual general meetings.

- The dividend once declared cannot be canceled.

Feature of Shares

Meaning: Total share capital of a company is divided into many units of small denomination. each such unit is called shares.

Definition: According to sec 2(46) of the companies act 1956. Share is a share in the share capital of the company and includes stock except when is the distinction between stock and shares is expressed and implied.

- FACE VALUE: Each share has a definite face value say, RS 10, RS 25, RS 100 and so…The shares have a market value that may be more or less than the face value.

- ISSUE VALUE: A share may be issued at par (exact face value), at a premium (more than the face value), or at discount(less than the face value).

- PAID UP VALUE: shares may be fully paid – up or partly paid – up. A company can forfeit partly paid-up shares if calls on shares not paid in times.

- DISTINCTIVE NUMBER: Each share has a distinctive number. The shares are allotted in lots say, 10 shares, 50 shares, 100 shares, and so…

- OWNERSHIP: The owners of the shares are called shareholders or members of the company. The shareholders are the owner of the company.

Secretarial Practice

Nice teaching

Sir 2021 me bhi important questions banao na plzz

Very nice sir

Sir please upload Notes on second chapter of SP Sources of corporate finance as soon as possible and Thank you so much for making very simple and very easy Notes

Nice

Great..

No Worlds sir

Very nice video thanks sir ap hame guide krtte ho

Sir an number video banataoo aap

Great sir….

Great sir

Great mark in board exam.

Thanks for you 😊🤞

sir there are some spelling mistakes, it will be appriciated if they can be fixed

Nice Sir aap bahot aacha shikhate ho

Sir app PDF format me upload Karo na sir Question papers

Sir reduce ko bhi diye ho – capital structure

Sir aap ke purane videos kam ke hai Kya or agar vo Kam ke nhi hai to please sir vo video delete kr de vo confusion hota hai

Sir vo letters vale chapters ke letters hi ayenge kya exam me….. Answer in brief ya objective nahi ayenge kya

please reply me 🙏

Sir remaining chapters kab daa logai

Sir the model paper sets of org of com,s.p,eco,book keeping set a.b.c 2021 is if from new hsc syllabus. Pls guide

Sir can u make pdf of imp que likely to be asked for org of commerce,sect practise, book keeping accounts,economics & send on my mail id given above.

Thanks sir

Great evening sir,

Sir aap eco k imp questions Bta skte h kya please because mujhe eco ka kuch nhi smjh me aata aap please usk imp questions bta do taki thoda pdhne me easy ho 😅please sir

check other post already published

Assalamalekum sir 8 marks k quetion k ley kitne points kafi honge

w/s please watch youtube videos

Sir remaning chapter tho daalo

Sir very helpful notes thanks for giving this notes it becoming very easy to learn again thank you much sir 🙏🙏🙏🙏🙏👍👌🔥🔥🔥🔥💯💯💯💯💯

Thank you sir

Very helpful sir

I suddenly reach on ur account and i find some very good information u are very motivational teacher , u are the best yt teacher ever , u provided lots of info to us, thank u so much sir

I suddenly reach on ur account and i find some very good information u are very motivational teacher , u are the best yt teacher ever , u provided lots of info to us, thank u so much sir i love ur videos

U are doing Brilliant thing

Great teaching

Please shorts note in all subjects 12th commerce in PDF send me in email id ☺️

sure we will update soon