Circular Flow of Income Four Sector Model | Business Economics | Macroeconomics | 2022

Circular flow of income

The topics covered in this post: Circular Flow of Income in a Two Sector Model, Circulation Flow Income with Saving and Investment, Circular Flow of Income in a Three Sector Economy Model, and circular flow of income four sector model.

Circular flow of Income two sector model:

- The circular flow of money refers to the process whereby money payments and receipts of the economy flow circularly continuously over a period of time. The various components of money payments and receipts are saving, investment, taxation, loans, government purchases, exports, imports, etc. the circular flow of income and expenditure explains the process that determines national income and national output simultaneously.

- circular flow of income refers to the cycle of generation of income in the production process, its distribution and finally its is circular from household to firm in the form of consumption expenditure on goods and services produced by the firm.

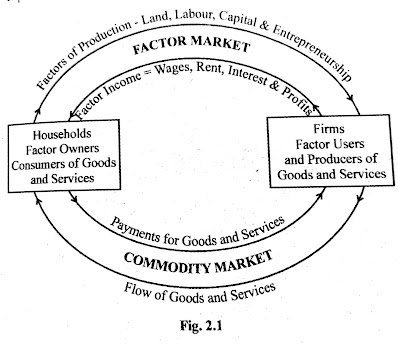

- The circulation flow of income is explained by considering a simple economy in two-sector that is household firms. The circular flow of income is explained with help of the following assumptions.

Assumptions

- The economy consists of two sectors (i) Households and (ii) Firms.

- Production takes place only in firms

- Household spend than entering income received in the form of wages, interest, rent, on goods services i.e. no savings.

- Firm supply goods and services as per the demand,

- There are no government operations,, i.e. no government expenditure and taxes in the economy.

- There are no international economic relations. There is no outflow and inflow of goods and services in a closed economy.

- The factoring service flows from the households to the firm and factors income from the firms to the household. The upper half shows this flow through the factor market. The lower half shows the flow of goods and services and payments for identical(same) through the commodity market.

- The factor of production and goods and services indicates real flow and the factor payment and payment of goods and services represents money flow.

- The real flow and money flow occur in the opposite direction. When we joined the flow factors and goods market we get the circular flow.

- Households supply factor services to the firms and get converted into goods and services and flow back to the households.

- Similarly, the money income received by the households in the form of rent, wages, interest, and profits are spent by them in purchasing goods and services, money returns to firms.

Circulation Flow Income with Saving and Investment:

The circular flow of money refers to the process whereby money payments and receipts of the economy flow in a circular manner continuously over a period of time. The various components of money payments and receipts are saving, investment, taxation, loans, government purchases, exports, imports, etc. the circular flow of income and expenditure explains the process that determines national income and national output simultaneously.

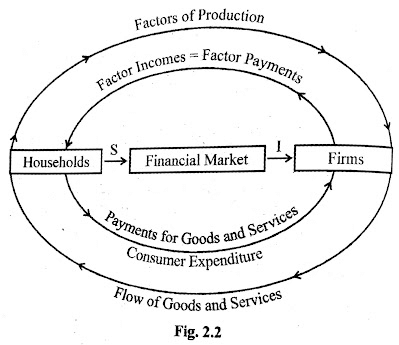

The saving and investment flow between households and firms through the financial market that consists of commercial banks, stock market, and non-banking financial institutions.

Circulation Flow of income with Saving and Investment

The circular flow in a two-sector economy with savings and investment through the financial market is explained in fig. 2.2.

Saving-Investment Identity:

In a simple economy, the value of output produced is equal to the value of output sold, i.e. equal to the total consumption expenditure and investment spending thus, we can write:

Y= C + I ………………(1)

Where,

Y (National income) C (consumption expenditure) I (Investment)

The income received by households is allocated to consumption and saving. The income received in the form of wages, rent, interest, and profits, Thus we can write

Y = C +S ……………….(2)

from identities (1) and (2) we get,

C +I =Y = C +S …………(3)

The above identity (3) shows that the output produced is equal to the output sold. The value of output produced is equal to income received, and income received successively is spent on goods or savings.

If we subtract consumption from identity (1) and identity (2) we have

I = Y – C = S ……………(4)

OR

I = S

Identity (4) shows that economy is in equilibrium when the investment is equal to saving.

Circular Flow of Income in a Three Sector Economy Model

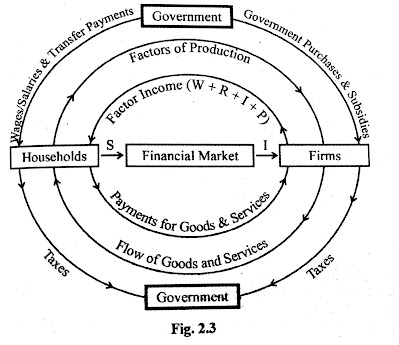

- The two-sector economy model consists of households and business organizations, but in a three-sector economy Government is an additional sector. The government affects the economy in many ways. Here we will focus on its taxing, spending, and borrowing roles. In the modern economy, the government plays various roles. The government performs totally different functions.

- For this, it requires a huge amount of income. The government receives income in the form of taxes from households and business organizations. Taxes are paid by the households and business Companies that not only reduce their income but also their expenditure and savings.

- Government spending includes expenditure on goods and services, pension payments, unemployment allowance, etc. Money spent by Government is an injection of income into the economy which is further received by households and business organizations.

- Another vital methodology of funding Government expenditure is borrowing from the financial market. This is represented by money flow from the financial market to the Government is known as Government borrowing.

In a three-sector economy, we have the following three economic agents.

- Households and business firms

- Financial sector

- Government

The circular flow of income in a three-sector economy is shown in the following fig. 2.3.Wages, Salaries & Payments Purchase of goods & services

- The above figure clearly shows that income received by the Government in the form of taxes from households and business firms is used for spending in the form of wages, salaries, allowances, pension, subsidies, and purchases of goods and services from them. Money spent by the Government is received by households and business firms.

- Thus, the leakages (withdrawal) in the form of savings and taxes arise in the circular flow of income. The savings and taxes are further get injected back into the circular flow of income in the form of investment and Government spending. Once these leakages (withdrawal) are equal to injections in the form of investment and Government spending the flow of money in the economy operates smoothly.

- The inclusion of the Government sector significantly affects the general economic scenario. Total expenditure flow in an economy is the sum of consumption expenditure (C), investment expenditure (I), and Government expenditure (G).

Thus, it’s symbolically expressed as,

Total expenditure (E) = C + I + G

Total income (Y) received is allotted to consumption (C), savings (S), and taxes (T).

Thus, symbolically expressed as,

Y = C + S + T

Since expenditure (E) made must be equal to the income received (Y) from the equation above we have

C + I + G = C + S + T

Since C occurs on both sides of the equation and will, therefore, be canceled out, we have

I + G = S + T

By rearranging we get

G – T = S – I

This equation is very important because it indicates what would be the implications of the Government budget isn’t balanced. If Government expenditure (G) is larger than the tax (T), the Government budget is a deficit. To finance the deficit budget, the Government can borrow from the financial market.

Circular flow of income four sector model

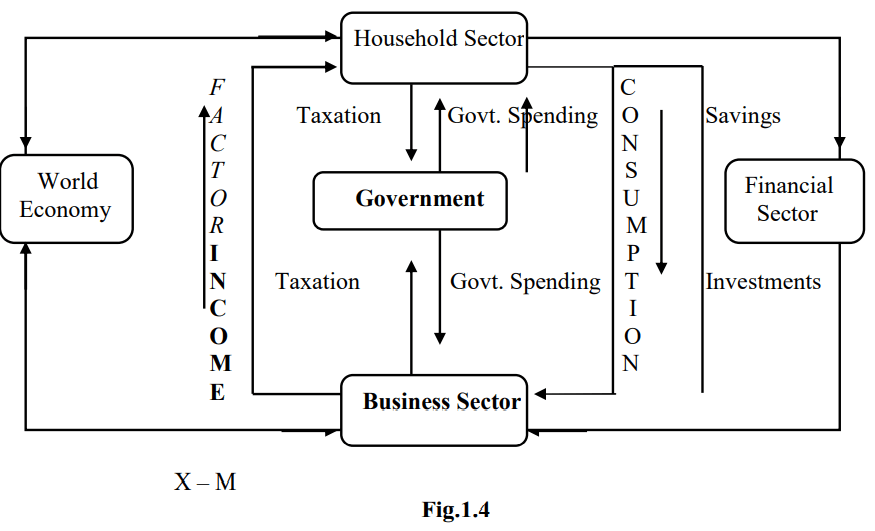

- The circular flow model in four sector economy provides a real sight of the circular flow in an economy. Four sector model analyzes the circular flow in an open economy i.e. interaction of the domestic economy with foreign countries. Four sector model of consists household sector, Firm (business sector), government sector, and foreign sector.

- Take the inflows and outflows of the household, business, and government sectors in relation to the foreign sector. The household sector buys goods imported from abroad and makes payments for them which is a leakage from the circular flow of money.

The householders may receive transfer payments from the foreign sector for the services rendered by them in foreign countries.On the other hand, the business sector exports goods to foreign countries, and its receipts are an injection in the circular flow of money. similarly, there are many services rendered by the business firms to foreign countries such as shipping, insurance, banking, etc. for which they receive payments from abroad. They also receive royalties, interest, dividends, profits, etc. for the investment made in foreign countries.

On the other hand, the business sector makes payments to the foreign sector for imports of capital goods, machinery, raw materials, consumer goods, and services from abroad. These are the leakages from the circular flow of money - four sector model Foreign countries interact with the domestic firms and households via exports and imports of goods and services also borrowing and lending processes by the financial market.

- The foreign sector has a key role in the economy. When domestic business firms export goods and services from overseas markets, injections (funds are added to an economy) are made into the circular flow model. On the other hand, when the domestic households, firms or the government imports something from the foreign sector, leakage occurs (withdrawal of money from the economy) in the circular flow model.

1) Household Sector:

Households provide factor services (land, labour, capital, and entrepreneur) to firms, government, and foreign sectors. In return, the household receives factor payments (rent, wages, interest, and profits). Households also receive transfer payments from the government and the foreign sector.

Households spend their income on Payments for goods and services purchased from firms, Tax payments to the government, Payments for imports.

2) Firms:

Firms receive revenue from households, the government, and the foreign sector for the sale of their goods and services. Firms also receive subsidies from the government.

The firm makes payments to Factor services to households, Taxes to the government, Imports to the foreign sector.

3) Government:

Government receives income from firms, households, and the foreign sector for the sale of goods and services in the form of taxes, fees, etc. Government makes factor payments to households and also spends money on transfer payments and subsidies.

4) Foreign Sector:

The foreign sector receives income from firms, households, and the government for the export of goods and services. It makes payments for the import of goods and services from firms and the government. It also makes the payment for the factor services to the households.

The savings of households, firms, and the government sector get accumulated in the financial market. The financial market invests money by lending out money to households, firms, and the government. The inflows of money in the financial market are equal to outflows of money. It makes the circular flow of income complete and continuous.

- Like the business sector, modern governments also export and import goods and services, and lend to and borrow from foreign countries. For all exports of goods, the government receives payments from abroad.

Similarly, the government receives payments from foreigners when they visit the country as tourists and for receiving education, etc., and also when the government provides shipping, insurance, and banking services to foreigners through state-owned agencies. - It also receives royalties, interests, dividends, etc. for investments made abroad. These are injections into the circular flow of money. On the other hand, the leakages are payments made to foreigners for the purchase of goods and services.

- Figure 1.4 shows the circular flow of money in four sector model open economy with saving at the right hand and taxes and imports at the left hand shown as leakages from the circular flow on the upper side of the figure, and investment, and government purchase (spending) on the right-hand side and exports as injections into the circular flow, on the lower level left-hand side of the figure.

- Further, imports, exports, and transfer payments have been shown to arise from the three domestic sectors- the household, the business, and the government.

These outflows and inflows pass through the foreign sector which is also called the ‘Balance of Payments Sector.’ - Thus Figure 1.4 shows the circular flow of money where there are inflows and outflows of money, receipts, and payments among the business sector, the household sector, the government sector, and the foreign sector in currents and cross-currents.

circular flow income two sector model, circular flow of income three sector model, circular flow income four sector model

Economics Notes Click Here

Reference infoendless, Mumbai University books (IDOL)

From where I download this notes