HSC Economics Notes: Important Question of Economics Class 12

HSC Board Exam 2021

Important Question

Sample Paper

1.A Choose the correct option: 5

- MU of the commodity becomes negative when TU of a commodity is ……… a) rising b) constant c) falling d) zero

- The relationship between demand for a good and price of its substitute is…….. a) direct b) inverse c) no effect d) can be direct and inverse

- Price elasticity of demand on a linear demand curve at the X axis is…………… a) zero b) one c) infinity d) less than one

- When supply curve is upward sloping, its slope is………….. a) positive b) negative c) first positive than negative d) zero

- The branch of economics that deals with the allocation of resources. a) Micro economics b) Macroeconomics c) Econometrics d) None of these

Options: 1) a, b and c 2) a and b 3) only a 4) None of these

Q.1 C. Give economic terms:

Q.1 C. Give economic terms:

- A situation where more quantity is demanded at a lower price ………

- Revenue per unit of output sold.

- Degree of responsiveness of quantity demanded to change in income

- The cost incurred on fixed factors.

- Degree of responsiveness of a change in quantity demanded of one commodity due to change in the price of another

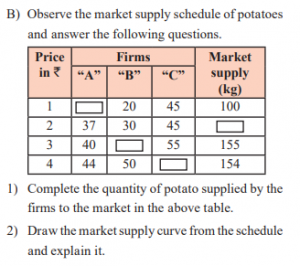

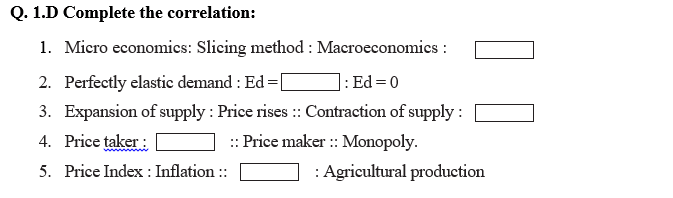

Q.1.D. Assertion and reasoning questions

Assertion (A) : Elasticity of demand explains that one variable is influenced by another variable.

Reasoning (R) : The concept of elasticity of demand indicates the effect of price and changes in other factors on demand.

Options :

- (A) is True, but (R) is False

- (A) is False, but (R) is True

- Both (A) and (R) are True and (R) is the correct explanation of (A)

- Both (A) and (R) are True and (R) is not the correct explanation of (A)

Assertion (A) : Money market economizes use of cash

Reasoning (R) : Money market deals with financial instruments that are close substitutes of money

Options : 1) (A) is True, but (R) is False

(A) is False, but (R) is True

Both (A) and (R) are True and (R) is the correct explanation of (A)

Both (A) and (R) are True and (R) is not the correct explanation of (A)

Assertion (A) : Degree of price elasticity is less than one in case of relatively inelastic

Reasoning (R) : Change in demand is less then the change in price.

Options : 1) (A) is True, but (R) is False

- (A) is False, but (R) is True

- Both (A) and (R) are True and (R) is the correct explanation of (A)

- Both (A) and (R) are True and (R) is not the correct explanation of (A)

Q.2 A. Identify and Explain the Concept (any 3) [6]

- Gauri collected the information about the income of a particular firm.

- Salma purchased sweater for her father in winter season.

- ABC bank provides d-mat facility, safe deposit lockers, internet banking facilities to its

- Japan sells smart phones to

- Number of firms producing identical

Q.2 B. Distinguish between (any 3) [6]

- Microeconomics and macroeconomics

- Total Utility and Marginal Utility

- Expansion of demand and Contraction of demand

- Perfectly elastic demand and Perfectly inelastic demand

- Stock and Supply.

- Internal trade and International

Q3. Answer the following questions (any3) [12]

- Explain the features of Micro economics.

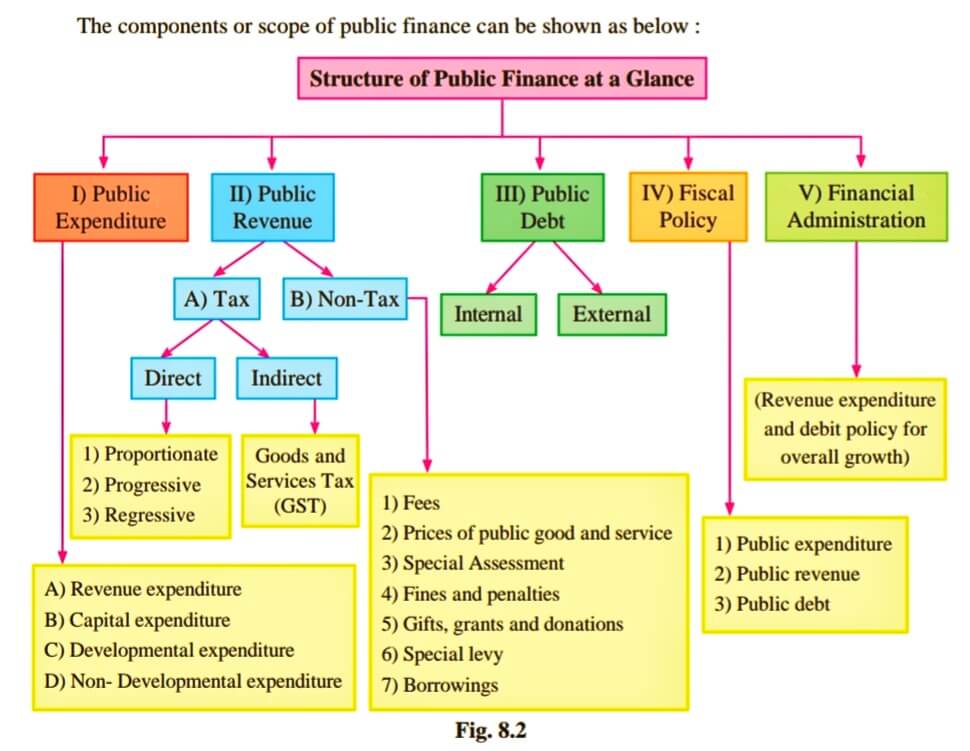

- Explain non-tax sources of revenue of the

- Explain the functions of commercial

- Features of monopoly

- Types of utility

Q4. State with reasons whether you agree or disagree with the following statements (any3) [12]

- The scope of microeconomics is unlimited.

- Price is the only determinant of demand.

- Fines and penalties are a major source of revenue for the Government.

- Foreign trade leads to division of labour and specialization at world

- The is no relationship between total utility and marginal utility

Q5. Study the following table, figure, passage and answer the questions given below it. (any2) [8]

| Unit of a commodity | TU units | MU units |

| 1 | 6 | 6 |

| 2 | 11 | 5 |

| 3 | 15 | 4 |

| 4 | 15 | 0 |

| 5 | 14 | –1 |

- Draw total utility curve and marginal utility curve.

- a) When total utility is maximum marginal utility is

- b) When total utility falls, marginal utility becomes

| Quantity demanded | ||||

| Price per kg. in ` | Consumer A | Consumer B | Consumer C | Market demand (in kgs) (A+B+C) |

| 25 | 16 | 15 | 12 | |

| 30 | 12 | 11 | 10 | |

| 35 | 10 | 09 | 08 | |

| 40 | 08 | 06 | 04 | |

- Complete the market demand

- Draw market demand carve based on above-market demand

6. Answer in detail (any2) [16]

- State and explain the law of diminishing marginal utility with exceptions.

- What is the Law of Demand? States the Exceptions to the law of demand

- What is the elasticity of demand? Explain the types of price elasticity of demand.

For Other Subjects Click Here

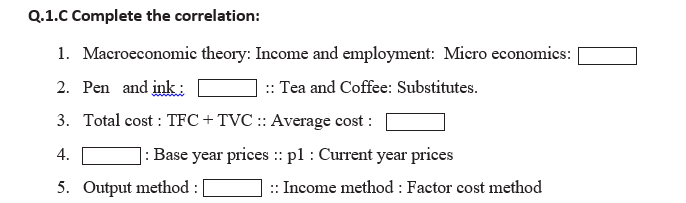

1. Choose the correct option:

- Point of Satiety means ………. a) TU is rising and MU is falling b) TU is falling and MU is negative c) TU is maximum and MU is zero d) MU is falling and TU is rising.

- When less units are demanded at high price it shows …………… a) increase in demand b) expansion of demand c) decrease in demand d) contraction in demand

- Price elasticity of demand on a linear demand curve at the Y-axis is equal to …………….. a) zero b) one c) infinity d) greater than one

- An upward movement along the same supply curve shows ……………. a) contraction of supply b) decrease in supply c) expansion of supply d) increase in supply

- Concepts studied under Micro economics. a)National income b) General price level c) Factor pricing d) Product pricing

Options :1) b and c 2) b, c and d 3) a, b and c 4) c and d

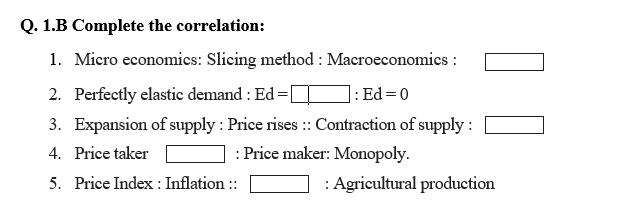

Q.1 B. Give economic terms:

- A situation where more quantity is demanded at a lower price ………

- Degree of responsiveness of quantity demanded to change in income

- The cost incurred on fixed factors.

- Net addition made to the total cost of production.

- Elasticity resulting from an infinite change in quantity

Q.2 A. Identify and Explain the Concept

- Nilesh purchased ornaments for his sister.

- Vrinda receives monthly pension of Rs.5,000/- from the State Government.

- India purchased petroleum from

- Maharashtra purchased wheat from

2 B. Distinguish between (any 3) [6]

- Increase in demand and Decrease in demand

- Relatively elastic and Relatively inelastic demand.

- Expansion of Supply and Increase in Supply.

- Public finance and Private

- Money market and Capital

Q3. Answer the following questions (any3) [12]

- Explain the features of Macroeconomics.

- Explain various reasons for the growth of public expenditure.

- Explain the role of the capital market in

- Features of utility/characteristic of utility

- Features of perfect competition

Q4. State with reasons whether you agree or disagree with the following statements (any3) [12]

- Macroeconomics is different from microeconomics.

- When the price of Giffen goods falls, the demand for it increases.

- The goods and services tax (GST) has replaced almost all indirect taxes

- Homogeneous is the only assumption of the law of DMU

- There are many theoretical difficulties in the measurement of national

Q5. Study the following table, figure, passage, and answer the questions given below it. (any2) [8]

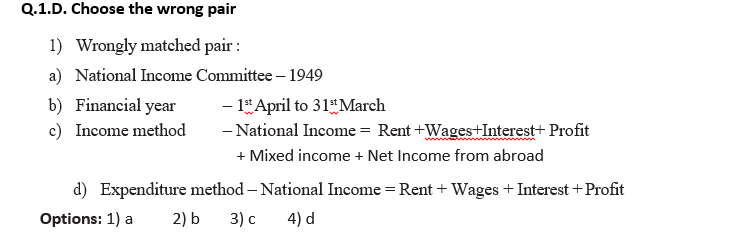

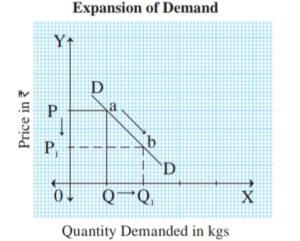

Observe the given diagram and answer the following questions :

- Rightward shift in demand curve …………

- Leftward shift in demand curve …………

- Price remains ……….

- Increase and decrease in demand comes under……….

Q6. Answer in detail (any2) [16]

- What is the law of diminishing marginal utility explain with assumption?

- Define the Law of Demand, explain it the assumption

- What is the national income? Explain difficulties in measuring national income

For Other Subjects Click Here

1.A Choose the correct option:

- When MU is falling, TU is………. a) rising b) falling c) not changing d) maximum

- The relationship between income and demand for inferior goods is……. a) direct b) inverse c) no effect d) can be direct and inverse

- Ed = 0 in case of……………. a) luxuries b) normal goods c) necessities d) comforts

- A rightward shift in supply curve shows……………. a) contraction of supply b) decrease in supply c) expansion of supply d)increase in supply

- Homogeneous product is a feature of this market. a) Monopoly b)Monopolistic competition c)Perfect competition d)Oligopoly

Options:1) c and d 2) a, b and c 3) a, c and d 4) only c

Q.1 B. Give economic terms :

- A situation where more quantity is demanded at a lower price ………

- Revenue per unit of output sold.

- Degree of responsiveness of quantity demanded to change in income

- The cost incurred on fixed factors.

- Degree of responsiveness of a change in quantity demanded of one commodity due to change in the price of another

Q.1.C. Find the odd word out

- The market structure on the basis of competition: Monopoly, Oligopoly, Very Short Period market, Perfect competition.

- Features of monopoly: Price maker, Entry barriers, Many sellers, Lack of substitutes.

- Types of Bank Accounts: Saving a/c, D-mat a/c, Recurring a/c, Current a/c

- Unregulated Financial intermediates: Mutual fund, Nidhi, Chit fund, Loan Companies

- Number of firms producing identical

Q.2 A. Identify and Explain the Concept

- Shabana paid wages to workers in her factory and interest on her bank loan.

- Lalita satisfied her want of writing on essay by using pen and notebook.

- Rajendra has a total stock of 500 gel pens in his shop which includes the 200 gel pens produced in the previous financial year.

- Tina deposited a lumpsum amount of ` 50,000 in the bank for a period of one

- India purchased petroleum from

Q.2 B. Distinguish between (any 3) [6]

- Individual Demand and market demand

- Desire and Demand

- Contraction of Supply and Decrease in Supply.

- Average Revenue and Average Cost.

- Internal debt and External

- Demand deposit and Time

Q3. Answer the following questions (any3) [12]

- Scope of Micro economics.

- Explain the functions of RBI.

- Features of oligopoly

- Explain the features of national income

- Calculate Price Index number from the given data :

| Commodity | A | B | C | D |

| Price in 2005 (`) | 6 | 16 | 24 | 4 |

| Price in 2010 (`) | 8 | 18 | 28 | 6 |

Q4. State with reasons whether you agree or disagree with the following statements (any3) [12]

- Macroeconomics deals with the study of individual behaviour.

- The demand curve slopes downward from left to right.

- Democratic Governments do not lead to an increase in public

Q5. Study the following table, figure, passage, and answer the questions given below it. (any2) [8]

Q6. Answer in detail (any2) [16]

- Define Law of Supply explains its Assumption/ Exception.

- Explain the income method and expenditure method of measuring national income.

- Define elasticity of demand and explain the method of measuring elasticity of demand.

For Other Subjects Click Here

Support us: GooglePay/PhonePay/Paytm: 7208379315

HSC Economics Notes

Micro- Economics:

- The word Micro-Economic used first time in 1933 by Ragnar Frisch. The word Micro Economics is derived from the Greek word ‘mikros’ which means small.

- ii. It studies the economic behavior of individual units of the economy, such as households, firms, industries, and markets.

- Prof A. P. Lerner – “Microeconomics consists of looking at the economy through a microscope, as it were, to see how the millions of cells in the body of economy – the individuals or households as consumers and individuals or firms as producers play their part in the working of the whole economic organism.”

Scope of Micro Economic

Theory of Product Pricing:

- The Theory of Product Pricing Explain or determined the relative price of a particular product like cotton cloth, rice, car, and thousands of other commodities

- The price of the product/commodity depends upon the forces of demand and supply. The demand and supply position analyses to determine product prices.

- The Study of Demand helps to the analysis of consumer’s behavior and the study of Supply helps to the analysis of conditions of production, cost, and behavior of firm & Industry

- So, the theory of product pricing is subdivided into the theory of Demand and theory production and Cost.

Theory of Factor Pricing:

- Microeconomics studies help to determine the pricing of various factors of production: Wages of labour, Rent for land, Interest for capital

- Theory of factor pricing i.e. Theory of distribution Explains how wages (price for the use of labour), rent (payment for use of land), interest (Price for use of capital), and profit (the reward for the entrepreneur are determined).

Theory of Welfare:

- The theory of Welfare basically deals with efficiency in the allocation of resources. Efficiency in the allocation of resources is helping to maximization of satisfaction of people, Economic involves three efficiencies:

- Efficiency in Production: it means to maximize the level of output from a given amount of resources

- Efficiency in consumption: It means the distribution of produced goods & services among the people for consumption, in such a way to maximize total satisfaction of society

- Efficiency in direction of production i.e. overall economic efficiency it means the production of those goods which are most desired by the people

Features of Microeconomics

- Study of individual units: – Micro-economic is concerned with depth study of the economic behavior of individual units such as individual households, particular firms, individual industries, individual prices, etc.

- Price Theory: – Microeconomic studies help in determining the price of a particular product. The price of the products depends upon the forces of demand and supply. The demand and supply position is analyses to determine product prices.

- Slicing method: – Microeconomic uses the slicing method for in-depth study of economic units. It split (divide into part) the economy into smaller units, such as individual households, individual firms, etc. for the depth study.

- Partial equilibrium analyses: – Microeconomics based on the assumption, and in partial equilibrium, we assume that other things being equal. Based on the assumption, we try to establish the relationship between two variables. E.g. law of Demand’ the quantity of the commodity is inversely related to its price.

- Factor pricing:– Microeconomics studies help to determine the pricing of various factors of production: Wages of labour, Rent for land, Interest for capital.

- Analysis of Market Structure:– Microeconomics analyses different market structures such as Perfect Competition, Monopoly, Monopolistic Competition, Oligopoly, etc.

- Limited Scope:– The scope of microeconomics is limited to only individual units. It doesn’t deal with nationwide economic problems such as inflation, deflation, the balance of payments, poverty, unemployment, population, economic growth, etc.

- Use of Marginalism Principle:– The term ‘marginal’ means change brought in total by an additional unit. The marginal analysis helps to study a variable through the changes. Producers and consumers make economic decisions using this principle. The concept of Marginalism is the key tool of microeconomic analysis.

- Based on Certain Assumptions:– Microeconomics begins with the fundamental assumption, “Other things remaining constant” (Ceteris Paribus) such as perfect competition, laissez-faire policy, pure capitalism, full employment, etc. These assumptions make the analysis simple.

Importance of Micro Economic

- Price determination: Microeconomic studies help in determined the price of a particular product. The price of the products depends upon the forces of demand and supply. The demand and supply position is analyses to determine product prices.

- Free Market Economy: Microeconomics helps in understanding the working of a free market economy. Free market economy means there is no intervention by the Government or any other agency, where the economic decisions regarding the production of goods, such as ‘What to produce? How much to produce? How to produce? etc.’ are taken at individual levels.

- Foreign Trade: Microeconomics helps in explaining various aspects of foreign trade like the effects of a tariff (tax) on a particular commodity, determination of currency exchange rates of any two countries, gains from international trade to a particular country, etc.

- Economics Model Building: Microeconomic involves the construction of simple models to express the actual economic phenomenon. The economic models state the relationships between two variables. For e.g. the model of the law of demand, there is an inverse relationship between demand and price.

- Business Decisions: Microeconomic theories are helpful to businessmen for taking crucial business decisions. These decisions are related to the determination of cost of production, determination of prices of goods, maximization of output and profit, etc.

- Useful to Government: It is useful to the government in framing economic policies; Microeconomic analysis is useful in determining tax policy, public expenditure policy, price policy, efficient allocation of resources, etc.

- Basis of Welfare Economics: Microeconomics explains how best results can be obtained by optimum utilization of available resources and proper allocation of resources. It also studies how taxes affect social welfare.

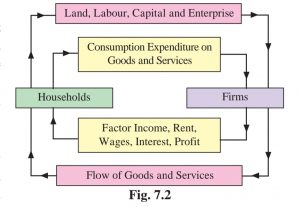

Macro Economics

The term macro-economic is derived from the Greek word ‘MAKROS’ which means large, so macro-economic refers to the study of the economic behavior of total employment, total consumption, total investment, etc. Macroeconomic is the study of aggregate. It is the study of the economic system as a whole. Therefore, it also called aggregate economic.

Definitions of Macro Economics :

J. L. Hansen – “Macroeconomics is that branch of economics which considers the relationship between large aggregates such as the volume of employment, total amount of savings, investment, national income, etc.”

Scope of Macro Economics

Theory of Income and Employment:

- Macroeconomic is known as Theory of Income and Employment because it explains or determines the level of national incomes and employment in an economy and analyses the causes of fluctuation in the level of income, output, and employment

- This theory also examines the inter-relation between income and employment and suggests policies to solve the problems related to these variables

Theory of General price level and Inflation:

- The macro-Economic analysis shows how the general level of price is determined and it also explains what causes fluctuations in it.

- The study if the general level of prices is significant in the account of the problems created by inflation and depression.

- The problem of inflation and depression are serious problems in the worlds these days

- The theory of price level studies the causes and effects of inflation and depression and suggests economic policies to tackle these problems.

Theory of Growth and Development:

- Another important subject matter of Macroeconomics is the theory of economic growth and development.

- It analysis the causes of underdevelopment and poverty in poor countries and suggests the best policies for growth and development.

- It also deals with the problems of the full utilization of resources to increase production capacity.

- It explains how the higher rate of growth with stability, can be achieved in countries.

Theory of Distribution:

- It explains what determines the relative shares from the total national income of the various classes.

- It deals with the relative shares of rent, wages, interest and profits in the total national income.

Features of Macro Economics

- Study of Aggregates: Macro-economic is the study of aggregates. It is related to concepts such as aggregate demand and supply, national income, and total output.

- Income theory: Income theory is a major aspect of macroeconomic theory. A major task of macroeconomic is the determination of national income. Macroeconomics studies the factors determining national income.

- General equilibrium Analysis: Macro-economic is related to the behavior of aggregate and their interdependence. It is a general equilibrium analysis in which everything depends on everything else. E.g. change in the level of income may result in a change in saving, which in turn may influences investment. The investment turn may affect production output.

- Interdependence: Macro analysis takes into account interdependence between aggregate economic variables, such as income, output, employment, investments, price level, etc. For example, changes in the level of investment will finally result in changes in the levels of income, levels of output, employment, and eventually the level of economic growth.

- Lumping method: Macro-economic study deals with the lumping methods i.e. study of the whole, like national income and the general price of products not the price of individual products.

- Growth Models: Macroeconomics studies various factors that contribute to economic growth and development. It is useful in developing growth models. These growth models are used for studying economic development. For example, the Mahalanobis growth model emphasized basic heavy industries.

- General Price Level: General Price level is the average of all prices of goods and services currently being produced in the economy. Determination and changes in the general price levels are studied in macroeconomics.

- Policy-Oriented: The study of macroeconomics is highly useful for the formulation and implementation of the economic policy of the government. The government is concerned with the regulation of aggregate of economic systems such as the general price level, the general level of production, the level of employment, and so on.

Importance of Macroeconomics :

- Functioning of an Economy: Macroeconomic analysis gives us an idea of the functioning of an economic system. It helps us to understand the behavior pattern of aggregative variables in a large and complex economic system.

- Economic Fluctuations: Macroeconomics helps to analyze the causes of fluctuations in income, output, and employment and makes an attempt to control them or reduce their severity.

- National Income: Macroeconomics analysis helps to measure national income and social accounts. Without a study of national income, it is not possible to formulate correct economic policies.

- Economic Development: Study of macroeconomics help to understand the problems of developing countries such as poverty, inequalities of income and wealth, differences in the standards of living of the people, etc. It suggests important steps to achieve economic development.

- Performance of an Economy: Macroeconomics helps us to analyse the performance of an economy. National Income (NI) estimates are used to measure the performance of an economy over time by comparing the production of goods and services in one period with that of the other period.

- Study of Macroeconomic Variables: Study of macroeconomic variables are important to understand the working of the economy, Main economic problems are related to the economic variables such as behaviour of total income, output, employment, and general price level in the economy.

- Level of Employment: Macroeconomics helps to analyse the general level of employment and output in an economy.

For Other Subjects Click Here For SP Click Here

Reference: MHSB books

Utility

- “Utility is the power or capacity of a commodity to satisfy human wants.”

- When a consumer consumes or buys a commodity, he expects to get some benefit in the form of satisfaction of a certain want.

- This benefit or satisfaction experienced by the consumer is referred to by economists as a utility.

The features/characteristic of utility are as follows:

- Relative concept: – Utility is related to time and place. It differs from time to time and place to place. E.g. umbrellas have utility only in the rainy season. Similarly, woolen clothes have more utility in Kashmir than in Mumbai.

- Subjective concept: – Utility of a commodity cannot be the same for all individuals. It differs from person to person, because of the differences in tastes, preferences, etc. of the peoples. E.g. Meat has a utility to non-vegetarians, but not to pure vegetarians.

- Ethically neutral concept: The concept of utility has no ethical consideration. The commodity should satisfy any want of a person without consideration of what is good or bad, desirable, or undesirable. For example, a knife has a utility to cut fruits and vegetables as well as it can be used to harm someone. Both wants are different in nature but are satisfied by the same commodity. Thus, the utility is ethically neutral.

- The utility is different from usefulness: – Utility is the power or capacity of a commodity to satisfy human wants while usefulness is the benefit that a consumer gets. A commodity may have utility but not be useful. E.g. A cigarette has utility for a smoker, but it does not have used as it is injurious to health.

- The utility is different from pleasure: – Some goods have utility but consuming them is not enjoyable. E.g. No one enjoys taking bitter medicine or an injection.

- The utility is different from satisfaction: – Utility and satisfaction are related but not the same. The utility is the power or capacity of a commodity to satisfy human wants. Satisfaction is the end result of utility.

- Measurement of utility is hypothetical: – It is difficult to measure utility in objective terms. It cannot be measured in numerical terms or cardinal numbers such as 1, 2, 3, and so on. The utility can only be experienced and found either positive, zero, or negative.

- Utility is multi-purpose:– If a commodity can be put to a number of uses, then its utility will differ in each use. E.g. Electricity can be used for lighting, ironing, cooking, and washing, etc.

- Utility depends on the intensity of wants: – The utility of commodity depends upon the intensity of the want. The more urgent or intense the want more will be the utility. E.g. the Utility of food is higher for the hungry people and utility decline with the satisfaction of hunger.

- Utility is intangible: – Utility is intangible in nature. It has no physical existence. One cannot touch it or see it. It can be felt only by the use of the commodity.

Types Utility

- Form Utility: – When utility increase due to the changing in the shape or structure of existing material, it called form utility. E.g. wood converted into a chair or furniture.

- Place Utility: – When the utility of commodity increases due to the change in the place of utilization. E.g. Goods produced in Mumbai can be transported to Goa for consumption. Thus, transport services can create place utility.

- Time Utility: – When the Utility of a commodity increases with a change in the time of utilization it is called time utility. E.g. Umbrellas have greater utility during the rainy season.

- Services Utility: – Services Utility is created by providing services to people. E.g. teachers can provide services utility to students, and doctors to patients, etc.

- Knowledge Utility: – It’s created by filling the knowledge gap. E.g. advertisements can create knowledge utility by providing information about the latest product in the market.

- Possession Utility: It is created by transferring ownership of a commodity from one person to another person. For example when we purchase a Flat after paying the full amount we get Possession utility.

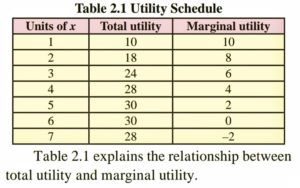

Concept of utility

Total Utility:-

- It refers to the sum of the total utility derived from all units of the commodity consumed at a given period of time.

- Total utility is the sum of all utilities derived by a consumer from all units of a commodity consumed by him.

- Symbolically TU = ∑mu

TU= Total Utility

∑MU = sum total of marginal utilities

Marginal Utility:-

- Marginal Utility is the utility derived from the consumption of an additional or extra unit of a commodity.

- Symbolically MUn = TUn – TUn-1

- It starts diminishing at a beginning level and It is positive zero, and negative.

Relationship between Total Utility and Marginal Utility:

Total Utility:- Total utility is the sum of all utilities derived by a consumer from all units of a commodity consumed by him.

Symbolically TU = ∑mu

TU= Total Utility

∑MU = sum total of marginal utilities

Marginal Utility:- Marginal Utility is the utility derived from the consumption of an additional or extra unit of a commodity.

Symbolically MUn = TUn – TUn-1

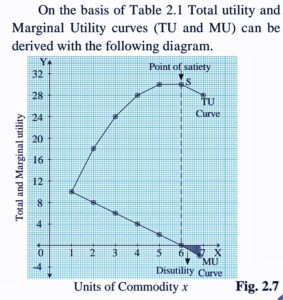

TU Curve = Total Utility Curve

MU Curve = Marginal Utility Curve

The X-axis measures the units of the commodity consumed while the Y-axis indicates the figures of total and marginal utility.

Fig. 2.7 shows that the total utility curve slopes upwards whereas the marginal utility curve slopes downwards. The marginal utility curve shows zero and negative levels of marginal utility whereas the total utility curve show maximum and constant total utility level.

- The total utility and the marginal utility of the very first unit of x consumed, are the same.

- As the consumer consumes further units of x, the total utility increases at a diminishing rate, and marginal utility goes on diminishing.

- At a particular stage, total utility reaches its maximum and remains constant whereas marginal utility becomes zero. This is called the point of satiety. (TU highest, MU = 0)

- After this point, any additional unit consumed further results in a decline in the total utility, while marginal utility becomes negative.

- After reaching the point of satiety, a rational consumer should stop his consumption since the maximum limit of satisfaction is reached and there is no addition to the total utility by any further increase in the stock of a commodity.

- Consumption beyond the point of satiety transforms satisfaction into dissatisfaction. In other words, a consumer starts experiencing ill effects of consumption.

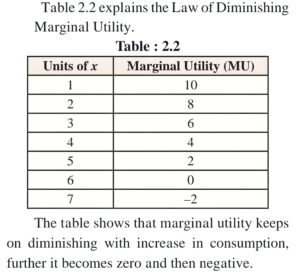

Law of Diminishing Marginal Utility :

Introduction :

- This law was first proposed by Prof. Gossen but was discussed in detail by Prof. Alfred Marshall in his book ‘Principles of Economics’ published in 1890.

- The law of diminishing marginal utility is based on the common consumer behaviour that utility derived diminishes with the reduction in the intensity of a want.

Statement of the Law: According to Prof. Alfred Marshall, “Other things remaining constant, the additional benefit which a person derives from a given increase in his stock of a thing, diminishes with every increase in the stock that he already has.”

The law explains the economic behaviour of a rational consumer. It states that as a consumer consumes more and more, his Marginal Utility (MU) will decrease. Means after consuming more and more unit of a commodity decrease the satisfaction level of the consumer.

Explanation of the Diagram :

- In the above diagram, units of commodity x are measured on X-axis and marginal utility is measured on Y-axis. Various points of MU are plotted on the graph as per the given schedule. When the locus of all the points is joined, the MU curve is derived.

- MU curve slopes downwards from left to right which shows that MU goes on diminishing with every successive increase in the consumption of a commodity.

- When MU becomes zero, the MU curve intercepts the X-axis. Further consumption of a commodity brings disutility (negative utility) which is shown by the shaded portion in the diagram.

Assumption of the law of DMU:

- Rationality: – It assumes that consumer beahviour is rational or normal. And his aim should be to get maximum satisfaction.

- Cardinal Measurement: – Dr. Marshall assumes that a consumer can measure utility in terms of numbers i.e. 1, 2, 3, etc.

- Homogeneity: – The law is applicable only if all units of goods consumed must be uniform i.e. all the units must be the same in respect of size, colour, taste, quality, etc.

- Continuity: – The law applies only if the consumption process is continuous. There should be no time gap during the process of consumption. MU will not diminish if there is a time interval.

- Reasonability: – The units of the commodity consumed, should be of a standard or normal size. There should neither be too big nor too small. E.g. a cup of tea, a glass of water, etc.

- Constancy: – The law assumes that there should be no change in taste, habits, preference, and income of the consumers during the process of consumption.

- Divisibility: The law assumes that the commodity consumed by the consumer is divisible so that it can be acquired in small quantities.

- Single wants: – The law of DMU assumes that a commodity is used to satisfy only a single want. The commodity has got single use.

The exception of law of DMU:

- Hobbies: – In the case of hobby like painting as you paint more pictures every additional panting gives you more and more satisfying because it is better than the previous panting. Hence marginal utility increases instead of falling.

- Misers: – In the case of the miser, every additional rupee gives him more and more satisfaction, because he is not a normal person. So his MU tends to increase with an increase in the stock of money.

- Addictions: – This law is not applicable to drunkards because they like to consume more with every additional unit offered to them.

- Music and poetry: – Those who are like music and poetry, whenever they hear them, get more and more satisfaction, even if they hear the second time.

- Reading: – Reading gives more knowledge, a scholar may receive more and more satisfaction, when he reads various books again, and again he gets more satisfaction And MU increase.

- Money: – It is assumed that an individual gets more satisfaction with more money and he wants to have more of it.

Criticisms of the Law :

- Unrealistic assumptions: The law of diminishing marginal utility is based upon various assumptions like homogeneity, continuity, constancy, rationality, etc. but in reality, it is difficult to fulfill all these conditions at a point of time.

- Cardinal measurement: In reality, the cardinal measurement of utility is not possible because the utility is a subjective concept.

- Indivisible goods: this law is not applicable in the case of indivisible commodities like T.V set, car, fridge, etc.

- Constant marginal utility of money: The law assumes that the marginal utility of money remains constant that is prices remain constant but this is not true as price level charge.

- A single want: The law is restricted to the satisfaction of a single want at a point in time. However, in reality, a man has to satisfy many wants at a point in time.

Significance of the Law :

- Usefulness to the consumers: This law creates awareness among the consumers. To obtain maximum utility from the limited resources, it is necessary to ‘diversify’ the consumption.

- Useful to the government: The law is useful to the government in framing various policies such as progressive tax policy, trade policy, pricing policy, etc.

- Basis of paradox of values: The law of diminishing marginal utility helps us to understand the paradox of values. It includes goods that have more value-in-use and zero or less value-in-exchange such as air, water, sunshine, etc. as well as goods that have more value-in-exchange and less value-in-use such as gold, diamonds, etc.

- Basis of the law of demand: The law of demand is based on the law of diminishing marginal utility. According to the law of demand, the quantity demanded of a good rise with a fall in price and falls with an increase in price. When a consumer purchases more and more units of a good, its marginal utility steadily declines. Hence, he would buy additional units of a commodity only at a lower price.

For Other Subjects Click Here

Reference: MHSB books

Demand:

- Goods are demanded because they have utility

- Demand is the quantity of a commodity that a person is ready to buy at a particular price during a given period of time.

- In economics, the term ‘Demand’ refers to a desire for a commodity-backed by the ability to pay and willingness to pay for it.

- Demand = desire + ability to pay + willingness to pay

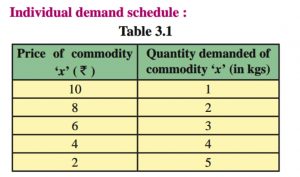

Individual Demand:-

Individual demand is demanded by an individual. Individual demand indicates the different quantity of commodities demanded by a consumer at different prices during a given period time.

Explanation of schedule:-

Explanation of schedule:-

- The above table shows that a lower quantity of commodities demanded at higher prices and a higher quantity of commodities demanded at lower prices.

- For e.g. when the price of a commodity is higher Rs. 10, 1Kg commodity demanded by the individual.

- It shows an inverse relationship between price and quantity demanded.

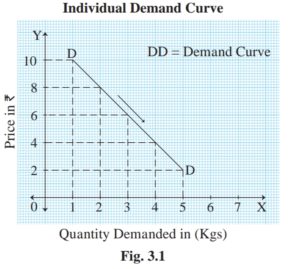

- In figure 3.1, X-axis represents the quantity demanded and Y-axis represents the price of the commodity.

- The demand curve DD slopes downward from left to right, indicating an inverse relationship between price and quantity demanded.

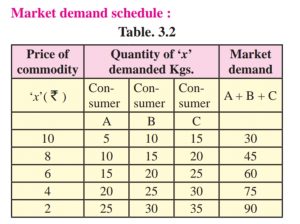

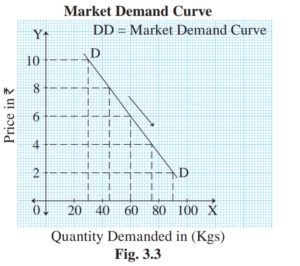

Market Demand:

- Market demand indicates the total quantity of commodities demanded by all consumers in the market during a given period of time.

- The market demand schedule is a tabular representation showing different quantities of a commodity which all consumers are prepared to buy at various prices over a given period of time.

- Table 3.2 shows different quantities of commodity x purchased by different consumers (A, B, C) at various prices.

- Market demand indicates the total quantity of commodities demanded by all consumers in the market during a given period of time. Thus, there is an inverse relationship between price and quantity demanded.

- The X-axis shows the quantity of a commodity demanded and Y-axis shows the price of a commodity. It slopes downwards from left to right.

- The market demand curve shows the inverse relationship between price and total quantity demanded in the market.

Types of demand

- Direct demand: – When goods and services are demanded to satisfy human wants directly, it is called direct demand. E.g. demand for food, clothes, computer, mobile, etc.

- Indirect demand / Derived demand: – When demand for one commodity gives rise to the demand for another commodity, it’s called indirect demand. E.g. raw material, labour, machines, etc. are not demanded to serve directly but they are needed for the production of goods having direct demand.

- Joint demand / Complementary demand: – When two or more commodities are demanded at the same time to satisfy a single want, it is called joint demand. For e.g. car and petrol, pen and paper, toothbrush and toothpaste, etc.

- Composite demand: – When one commodity is demanded number of uses, it is called composite demand. For e.g. electricity is demanded lighting, cooking, etc. or Milk is used for making tea, coffee, ice-creams, etc.

- Competitive demand: – When two goods are close substitutes of each other or when the demand for a commodity competes with its substitutes, it’s called competitive demand. E.g. tea or coffee, Pepsi or cola, etc.

Determinants of Demand /Factor Affecting Demand

- Price: – Price is one of the most important factors that affect demand. When the price rises demand falls and when the price falls demand rises.

- Income: – Income is directly related to demand. If consumer income rises demand also rises and if consumer incomes fall demand also falls.

- Prices of Substitute Goods: If a substitute good is available at a lower price then people will demand cheaper substitute goods than costly goods. For example, if the price of sugar rises then demand jaggery will rise.

- Price of complementary: – if goods are jointly demanded like cars and petrol when the price of the car rises, the demand for cars and petrol both will fall.

- Nature of product: If a commodity is a necessity and its use is unavoidable, then its demand will continue to be the same irrespective of the corresponding price. For example, medicine to control blood pressure.

- Size of the population: – An increase in size population leads to an increase in market demand for goods and services.

- Expectation about future prices: – If consumers expect a fall in the price of a commodity in the near future, they will demand less at the present price and vice versa. It shows that expectations about future prices affect demand.

- Advertisement: – Powerful advertisements create demand for products. E.g. consumers buy new products like shampoos, soap due to attractive advertisements.

- Taste, habits, and preference: – A change in taste also changes the demand for a commodity. E.g. demand for fast food has increased in recent years.

- Level of Taxation: High rates of taxes on goods or services would increase the price of the goods or services. This, in turn, would result in a decrease in demand for goods or services and vice-versa.

- Weather condition: – Weather also affects demand. E.g. raincoats have demand only in the rainy season or more ice-creams in summer.

- Taxation policy: – Government’s taxation policy affects demand. For e.g., a change in income tax will change consumer’s disposable income and therefore demand.

- Other factors: – Change in technology, social customs, and festivals, it affects the demand for certain goods. E.g. because of new technology LCD T.V. demand increase, and during Diwali sweets, cloths demand increase.

Law of Demand

Introduction :

The law of demand was introduced by Prof. Alfred Marshall in his book, ‘Principles of Economics’, which was published in 1890. The law explains the functional relationship between price and quantity demanded.

Statement of law:-

Dr. Alfred Marshall defines the law of demand as follows “other thing being equal, the larger quantity will be demanded at a lower price and less quantity at a higher price”

In other words, other factors remaining constant, if the price of a commodity rises, demand for it falls, and when the price of a commodity falls demand for the commodity rises. Thus, there is an inverse relationship between price and quantity demanded.

Symbolically, the functional relationship between demand and price is expressed as Dx = f (Px)

Where D = Demand for a commodity

x = Commodity

f = Function

Px = Price of a commodity

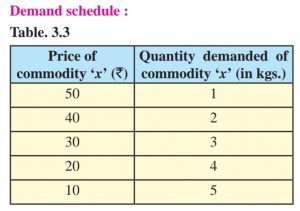

The law of demand is explained with the help of the following demand schedule and diagram.

- As shown in Table 3.3 when the price of commodity ‘x’ is 50, the quantity demanded is 1 kg. When the price falls from 50 to 40, the quantity demanded rises from 1 kg to 2 kgs.

- Similarly, at price 30, the quantity demanded is 3 kgs and when the price falls from 20 to 10, the quantity demanded rises from 4 kg to 5 kgs.

- Thus, as the price of a commodity falls, the quantity demanded rises and when the price of a commodity rises, the quantity demanded falls. This shows an inverse relationship between price and quantity demanded.

In fig. 3.5, X-axis represents the demand for the commodity, and the Y axis represents the price of commodity x. DD is the demand curve that slopes downward from left to right due to an inverse relationship between price and quantity demanded.

Assumptions of the Law of Demand

The law assumed certain factors to remain constant, otherwise, the inverse relationship between price and quantity demanded will not hold true. They are:

- Constant level of income: – It assumes that there is no change in consumer income because if income increases consumers will demand more quantity even at a higher price.

- No change in the size of the population: – There should not be any change in the size of the population. Because a change in population will bring about a change in demand and vice versa.

- Prices of substitute goods remain constant: – The price of substitute and complementary goods should remain the same. For e.g. if the price of tea rises, its demand will decrease but demand for coffee will increase.

- Prices of complementary goods remain constant: It is assumed that the prices of complementary goods remain unchanged because a change in the price of one goodwill affects the demand for the other.

- No expectations about future changes in prices: – There not be any change in the expectations about the prices of goods in the future. If consumers expect that price will rise or fall in the future, they will change their present demand through price is constant.

- No change in tastes, habits, preferences, fashions, etc: – It should remain unchanged, because if consumers tastes, habits, preference change, the demand also change vice and versa.

- No change in taxation policy: – No change in direct and indirect taxes compose by government. A change in income tax may cause changes in demand and vice-versa.

- No change in weather conditions: – Changes in weather conditions would affect the demand for certain goods, raincoats, woolen clothes, etc. So it assumed that weather conditions remain unchanged.

- No change in technology: – It is assumed that there is no change in technology because any changes in technology would affect the cost of production and also the prices of the products.

The exception of the Law of demand:

- Giffen’s paradox: – Inferior goods like bread, potatoes, etc. are those goods whose demand does not rise even if their price falls. Sir Robert in the 19th Century in England observed that when the price of inferior goods like bread fell, poor people purchased a small quantity of bread. This is because when their price fell, the real income of consumers increased and he brought more of some other commodities instead of demanding more of bread.

- Prestige goods: – Rich people buy costly things like a diamond, higher-priced motor car, and bungalows, etc. when their price is higher just to show off in the society and vice-versa.

- Speculation: – When people speculate rises in the price of goods in the future, they may buy more at the existing higher price. Likewise, when people speculate a fall in the price of goods in the future; they will not buy more at the existing lower prices. They will wait for the price to fall in the future.

- Price Illusion: – With a fall in price, sometimes consumers feel that the product of quality is low and they do not want to buy more.

- Ignorance: – If the price of a product falls and if people are not aware of that, they do not buy more.

- Habitual goods: – Due to habitual consumption certain goods like tobacco, cigarettes, etc. are purchased even if prices are rising. Thus it is an exception.

- Fashion: – if a commodity goes out of fashion, people do not buy more even if the price falls.

Variations in Demand :

When the demand for a commodity falls or rises due to a change in price alone and other factors remain constant, it is called variations in demand. It is of two types :

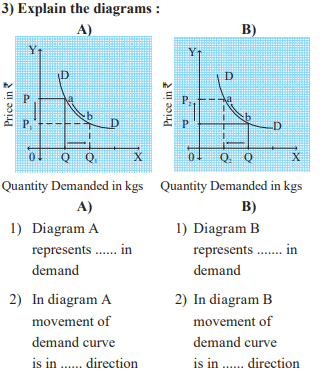

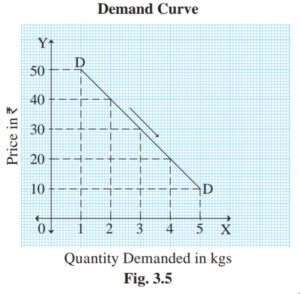

Expansion of demand:

Expansion of demand refers to rising in quantity demanded due to falling in price alone while other factors like tastes, the income of the consumer, size of the population, etc. remain unchanged.

Demand moves in a downward direction on the same demand curve.

This is explained with the help of the following fig. 3.7

As shown in fig. 3.7, DD is the demand curve. A downward movement on the same demand curve from point a to point b indicates an expansion of demand.

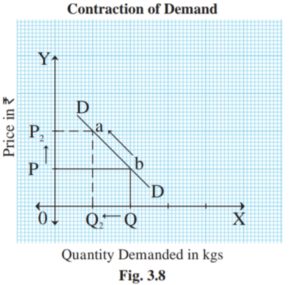

Contraction of Demand :

Contraction of demand refers to a fall in demand due to a rise in price alone. Other factors like tastes, the income of the consumer, the size of the population, etc. remain unchanged.

The demand curve moves in the upward direction on the same demand curve.

This can be explained with the help of following fig. 3.8

As shown in fig. 3.8, DD is a demand curve. An upward movement on the same demand curve from point b to point a shows contraction of demand.

Changes in Demand :

When demand for commodity increases or decreases due to changes in other factors and price remains constant, it is known as changes in demand. It is of two types :

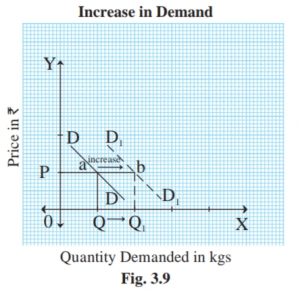

Increase in demand :

It refers to an increase in quantity demanded due to favourable changes in other factors like tastes, the income of the consumer, climatic conditions, etc. and the price remains constant.

Demand curve shifts to the right-hand side of the original demand curve. This can be explained with the help of fig. 3.9

As shown in fig. 3.9, DD is the original demand curve. The demand curve shifts outward to the right from DD to D1D1 which indicates an increase in demand.

As shown in fig. 3.9, DD is the original demand curve. The demand curve shifts outward to the right from DD to D1D1 which indicates an increase in demand.

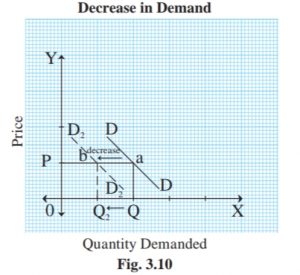

Decrease in demand:

It refers to a decrease in quantity demanded due to unfavourable changes in other factors like tastes, the income of the consumer, climatic conditions, etc. and the price remains constant.

Demand curve shifts to the left-hand side of the original demand curve. This can be explained with the help of fig. 3.10

As shown in fig. 3.10, DD is the original demand curve. It shifts inward to the left from DD to D2D2 which indicates a decrease in demand.

For Other Subjects Click Here

Reference: MHSB Books

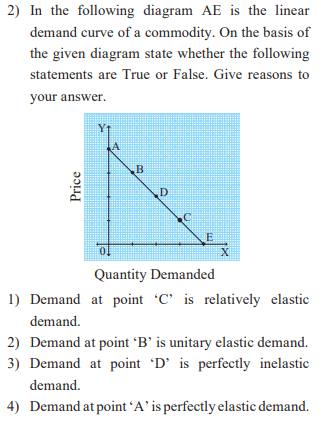

Concept of Elasticity of Demand :

- The elasticity of demand is a “measurement of the relative change in quantity demanded in response to the relative change in price”

- Because of the elasticity of demand, we are able to measure the percentage change in demand in response to the percentage change in price

- This elasticity of demand indicates a relationship between percentage change in demand and percentage change in price.

- According to Prof. Marshall, “Elasticity of demand is great or small according to the amount demanded which rises much or little for a given fall in price and quantity demanded falls much or little for a given rise in price.”

Types of elasticity of demand

- Income Elasticity of Demand.

- Cross Elasticity of Demand.

- Price Elasticity of Demand.

Income Elasticity: Income Elasticity of demand refers to a change in quantity demand for a commodity due to the change in the income of consumers, other factors remain constant. It can be expressed as follows:

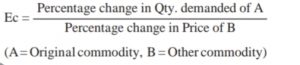

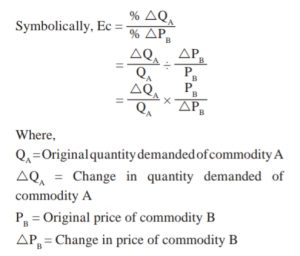

Cross Elasticity: Cross Elasticity of demand refers to a change in quantity demand for a commodity due to the change in the price of complementary goods. Eg. Car and Petrol.

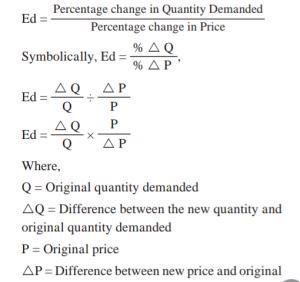

Price Elasticity: Price Elasticity of demand refers to change in quantity Demand for a commodity due to change in its price, other factors remain the same.

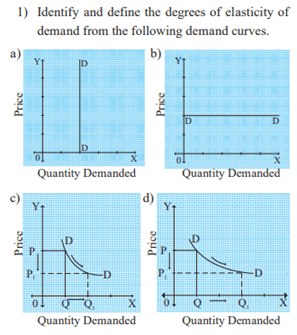

Types of Price Elasticity of Demand :

- Perfectly Elastic Demand: When there is a single change or no change in the price of commodity but demand for commodity change infinite. It is called perfectly elastic demand. E.g. if price change by 1% then demand change by more & more. watch my youtube videos for diagram

- Perfectly Inelastic Demand: When a change in the price of a commodity has no effect on the quantity demand of the commodity, it is called relatively inelastic demand. For Example, if demand changes by 1% then demand change by more & more.

Relatively elastic demand: When the percentage change in demand for a commodity is more than the percentage change in the price of the commodity, then it is known as relatively elastic demand. Example If demand change by 20% then the price change by 10% - Relatively inelastic Demand: When the percentage change in demand for a commodity is less than the percentage change in the price of the commodity, it is known as relatively inelastic demand. Example, If demand change by 20% then price change by 40%

- Unitary elastic demand: When the percentage change in demand for a commodity is equal to the percentage change in the price of the commodity, it is known as unitary elastic demand. For example, If demand change by 60% the price also changes by 60%.

Factors influencing the elasticity of demand :

- Nature of the commodity: The demand for necessaries is inelastic demand and demand for luxuries and comfort is elastic demand.

- Availability of substitutes: If the commodity has a number of substitutes it will have elastic demand. If the commodity has no substitute like railways services it will have inelastic demand.

- Number of uses: Single-use goods have a less elastic demand. Multi-use goods have more elastic demand, For example, coal, electricity, etc.

- Habits: Habits make a demand for certain goods inelastic. For example cigarettes, drugs, etc.

- Durability: The demand for durable goods is relatively elastic. For example, furniture, washing machine, etc. The demand for perishable goods is inelastic. For example, milk, vegetables, etc.

- Complementary commodities: A commodity having several uses has more elastic in demand. For example, electricity can be used for lighting, cooking, heating, etc.

- Income of the consumer: If the consumer income is more demand will be inelastic and when consumer income is less demand will elastic.

- Urgency: If wants are more urgent, demand becomes relatively inelastic. If wants can be postponed, demand becomes relatively elastic.

- Time period: Elasticity of demand is always related to a period of time. It varies with the length of the time period. Generally speaking, the longer the duration of the period greater will be the elasticity of demand and vice-versa.

Importance of Elasticity of Demand :

- Importance to the producer: – It is very useful for the producer in taking price decisions. It means deciding whether to charge a higher prices or lower prices. If the demand for the product is inelastic then the producer always charges a higher price. And if the demand elastic then the price has to low.

- Importance to the Government: – The knowledge of the concept of elasticity of demand helps the government in determining taxation policy etc. If the demand is inelastic the governments impose a higher tax and if the demand is elastic the governments impose less tax.

- Importance to factor pricing: – this concept is very useful for determining the factor reward. Factor, which has an elastic demand, are paid fewer wages. On the other hand, labour which has inelastic demand is paid a higher reward.

- Importance in Foreign Trade: – If export from a country has an inelastic demand then the exporter can fix higher prices to earn more foreign exchange.

- Public Utilities: In the case of public utilities like railways which have inelastic demand, Government can either subsidise or nationalise them to avoid consumer exploitation.

- Proportion of expenditure: When a consumer spends a very small portion of his income on a commodity demand will be inelastic and vice versa e.g. newspaper.

For Other Subjects Click Here

Reference: MHSB Books

Concept of Total Output, Stock, and Supply:

Total Output :

- Output produced through the process of production. Input – processing – output

- Output in economic is the “total quantity of goods or services produced in a given period of time by a firm, industry, or country”

- Therefore, Total output is the total amount of commodities produced during a period of time with help of all factors of production employed by the firms

Stock:

- Stock is the total quantity of commodities available for sale with a seller at a particular point in time. Stock refers to the quantity possessed by a seller.

- By increasing production, stock can be increased. Without stock, supply is not possible.

- Normally, Stock can exceed supply and it is fixed and inelastic.

In the case of perishable goods such as milk, fish, etc. stock may be equal to supply. On the other hand, durable goods such as furniture, garments, etc. stock can exceed the supply.

Supply:

- The term ‘supply’ refers to the quantity of a commodity which the seller is willing and able to sell in the market at a particular price, during a given period of time.

- According to Paul Samuelson, supply refers to “The relation between market prices and the number of goods that producers are willing to supply.”

- Supply is a relative term. It is always expressed in relation to price, time, and quantity.

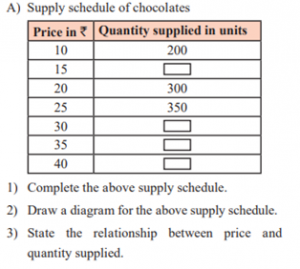

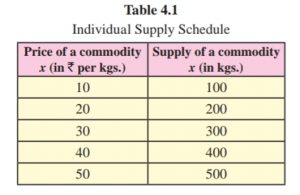

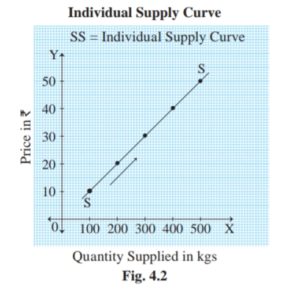

Individual Supply Schedule :

Individual supply refers to the various quantity of commodities, offered for sale by an individual seller/producer at different prices during a given period of time.

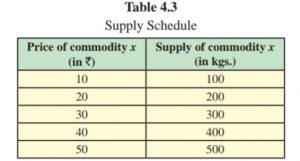

- Table 4.1 explains the functional relationship between price and quantity supplied of a commodity. Lower the price, lower the quantity of a commodity supplied, and vice versa.

- At the lowest price of ` 10, supply is also lowest at 100 kgs. At the highest price of ` 50, the quantity supplied is highest at 500 kgs.

In figure 4.2, the quantity supplied is shown on the X-axis and the price on the Y-axis. Supply curve SS slopes upwards from left to right, indicating a direct relationship between price and quantity supplied.

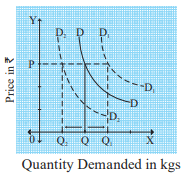

Market supply

Market supply refers to the various quantity of commodities, offered for sale by all the sellers/producers at different prices during a given period of time.

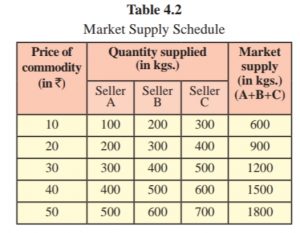

In Table 4.2, market supply is obtained by adding the supply of sellers A, B, and C at different prices. At the highest price of ` 50, market supply is the highest at 1800 kgs. At the lowest price of 10 market supply is the lowest at 600 kgs.

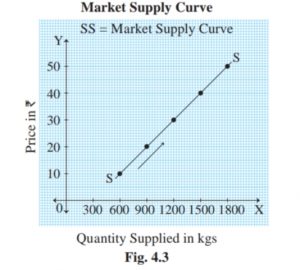

In figure 4.3, the quantity supplied is shown on the X-axis and the price on the Y-axis. Supply curve SS slopes upwards from left to right, indicating a direct relationship between price and market supply.

Determinants of supply factors determining supply

- Price of a Commodity:– The supply of commodities is directly related to its price. Generally, more quantity of a commodity is offered for sale at a higher price, and less quantity is offered for sale at a lower price.

- State of technology: – Technological improvements help not only improves the quality, but also the quantity of production. The quantity of production is increased due to the speed of the machines, and also there is a reduction in wastage. The increase in production facilities more supply in the market.

- Cost of production: – If the cost of production rises i.e. if sellers have to pay more factors like rent, wages, interest, etc. thus, supply will be reduced.

- Infrastructure facility: – Infrastructure in a form of transport, communication, etc. it influences the production process and also supplies. And the shortage of these facilities decreases the supply.

- Government policy: – Government’s policy affects the supply. For e.g., changes in taxation, industrial policies, sales tax, customs duties, etc. may encourage or discourage production and supply.

- Natural conditions: – Natural factors like weather conditions, drought, floods, earthquakes, etc. can cause fluctuations in supply, especially in agriculture goods.

- Future Expectation about price: – Expectations about the future price will affect the supply. If the price is expected to rise in the near future, the producer may hold on to the stock. This will reduce supply.

- Exports and imports: – Export reduces the number of goods supplied within the country. Imports increase the supply in the domestic market.

- Size of the market: – The size of the market greatly influences the supply. The larger the size of the market, there will more production and larger will be the supply.

- Nature of market: – Supply is influenced by the nature of the market. In a competitive market, the supply of goods would be more due to a large number of sellers. But in monopoly, i.e., single seller market, supply would be less.

- Number of producers: – If there is a large number of producers, there will be large-scale production of a commodity, which leads to higher supply in the market. However, if the number of producers is very low, the production may be low and supply also would be low.

Law of Supply

Introduction:-

The law of supply is introduced by Dr. Alfred Marshall in his book ‘Principles of Economic,’ which was published in 1890. The Law of Supply explains the functional relationship between the price of the commodity and quantity supplied in the market.

Statement of the Law:-

According to Dr. Alfred Marshall, “other thing being equal, higher the price of the commodity, greater is the quantity supplied and lowers the price of the commodity, smaller is the quantity supplied.”

More quantity of a commodity is offered for sale at a higher price and less quantity is offered for sale at lower prices. So the supply of a commodity is directly related to its price.

Sx = f (Px)

S = Supply, x = Commodity f = Function, P = Price of commodity

- Table 4.3 explains the direct relationship between the price and quantity of commodities supplied. When the price rises from ` 10 to 20, 30, 40, and 50, the supply also rises from 100 to 200, 300, 400, and 500 units respectively.

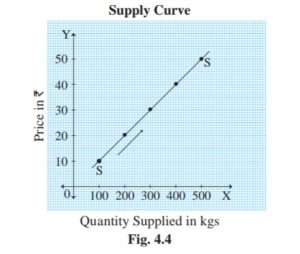

- It means, when price rises supply also rises and when the price falls supply also falls. Thus, there is a direct relationship between price and quantity supplied which is shown in following figure 4.4 :

- In figure 4.4, X-axis represents the quantity supplied and Y-axis represents the price of the commodity. Supply curve ‘SS’ slopes upwards from left to right which has a positive slope.

- It indicates a direct relationship between price and quantity supplied.

Assumptions of the law :

- Constant cost of production: It is assumed that there is no change in the cost of production. If there is a change in the cost of production, it may affect the price of the commodity and its supply.

- Constant technique of production: It is assumed that there is no change in the method or technique of production. Improvement in technology can increase the supply at the same price.

- No change in weather conditions: It is assumed that there is no change in weather conditions. There are no natural calamities like floods, earthquakes which may decrease supply.

- No change in Government policy: It is also assumed that government policies like taxation policy, trade policy, etc. remain unchanged.

- No change in transport cost: – It is assumed that the transport cost remains unchanged. If a change in transport cost it affect the price of the commodity and their supply.

- Price of other goods remains constant: – The prices of other goods are assumed to remain constant. If the price of other goods changes, then, the law of supply will not apply.

- No future expectations: The law also assumes that the sellers do not expect future changes in the price of the product.

Exceptions to the Law of Supply :

- Supply of labour: Labour supply is the total number of hours that workers work at a given wage rate. It is represented graphically by a supply curve. In the case of labour, as the wage rate rises the supply of labour (hours of work) would increase. So the supply curve slopes upward. Supply of labour (hours of work) falls with a further rise in wage rate and the supply curve of labour bends backward. This is because the worker would prefer leisure to work after receiving a higher amount of wages. Thus, after a certain point when the wage rate rises the supply of labour tends to fall.

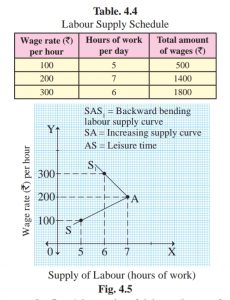

It can be explained with the help of a backward bending supply curve. Table no. 4.4 and fig. no 4.5 explains the backward bending supply curve of labour.

In fig. 4.5, the supply of labour (hours of work) is shown on X-axis, and the wage rate per hour is shown on the Y-axis. The curve SAS represents the backward bending supply curve of labour. Initially, when the wage rate is 100 per hour, the hours of work are 5. The total amount of wages received is 500. When the wage rate rises from 100 to 200, hours of work will also rise from 5 hours to 7 hours and the total amount of wages would also rise from 500 to 1400. At this point, labourer enjoys the highest amount

In fig. 4.5, the supply of labour (hours of work) is shown on X-axis, and the wage rate per hour is shown on the Y-axis. The curve SAS represents the backward bending supply curve of labour. Initially, when the wage rate is 100 per hour, the hours of work are 5. The total amount of wages received is 500. When the wage rate rises from 100 to 200, hours of work will also rise from 5 hours to 7 hours and the total amount of wages would also rise from 500 to 1400. At this point, labourer enjoys the highest amount

i.e. 1400 and works for 7 hours. If the wage rate rises further from 200 to 300, the total amount of wages may rise, but the labourer will prefer leisure time and denies working for extra hours. Thus, he is ready to work only for 6 hours. At point A, the supply curve bends backward, which becomes an exception to the law of supply. - Agricultural goods: The law of supply does not apply to agricultural goods as they are produced in a specific season and their production depends on weather conditions. Due to unfavourable changes in weather, if agricultural production is low, their supply cannot be increased even at a higher price.

- Urgent need for cash: – A businessman may face an urgent need for funds, and as such he may sell out more goods even at a lower price. This is an expectation of the law of supply.

- Perishable goods:- The seller has to dispose of perishable goods like meat, fish, fruits, flowers, etc., even if the price falls. They cannot wait for a longer time for the price to rise, in order to increase supply.

- Rare goods: The supply of rare goods cannot be increased or decreased according to their demand. Even if the price rises, supply remains unchanged. For example, rare paintings, old coins, antique goods, etc.

Variations in Supply :

When quantity supplied of a commodity varies due to change in its price, other factors remaining constant, it is known as variations in supply. There are two types of variations in supply :

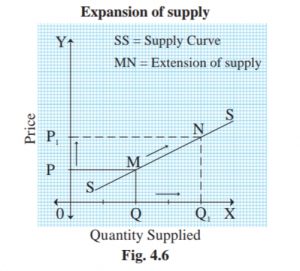

Expansion of supply :

Expansion of supply refers to a rise in the quantity supplied due to a rise in the price of a commodity, other factors remaining constant. Expansion in supply leads to an upward movement on the same supply curve due to a rise in price. It is shown in figure 4.6

In figure 4.6, the quantity supplied is shown on the X-axis and the price on the Y-axis. Quantity supplied rises from OQ to OQ1, with a rise in price from OP to OP1, resulting in an upward movement from M to N along the same supply curve SS. It is known as the Expansion of supply.

In figure 4.6, the quantity supplied is shown on the X-axis and the price on the Y-axis. Quantity supplied rises from OQ to OQ1, with a rise in price from OP to OP1, resulting in an upward movement from M to N along the same supply curve SS. It is known as the Expansion of supply.

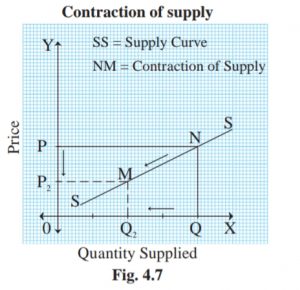

Contraction of supply :

Contraction of supply refers to a fall in the quantity supplied, due to a fall in the price of a commodity, other factors remaining constant. In the case of contraction of supply, there is a downward movement on the same supply curve. It is shown in figure 4.7

In figure 4.7, the quantity supplied is shown on the X-axis and the price on the Y-axis. Quantity supplied falls from OQ to OQ2 with a fall in price from OP to OP2, resulting in a downward movement from N to M on the same supply curve SS. It is known as Contraction of supply.

Changes in Supply :

When other factors change and price remains constant, it is known as changes in supply. There are two types of changes in supply :

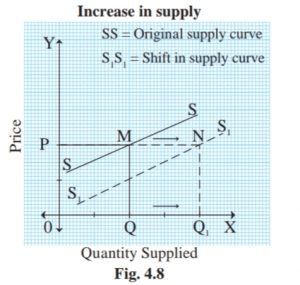

Increase in supply :

An increase in supply refers to a rise in the supply of a given commodity due to favourable changes in other factors such as fall in the price of inputs, fall in tax rates, technological up-gradation, etc., while price remains constant. The supply curve shifts to the right of the original supply curve. It is shown in figure 4.8

In figure 4.8, the quantity supplied is shown on the X-axis and the price on the Y-axis. Supply rises from OQ to OQ1 at the same price OP, resulting in an outward shift of the original supply curve to the right from SS to S1S1. It is known as an increase in supply.

In figure 4.8, the quantity supplied is shown on the X-axis and the price on the Y-axis. Supply rises from OQ to OQ1 at the same price OP, resulting in an outward shift of the original supply curve to the right from SS to S1S1. It is known as an increase in supply.

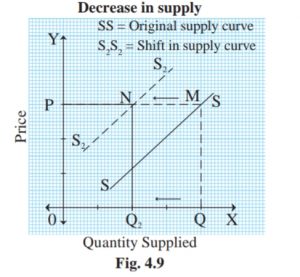

Decrease in supply :

A decrease in supply refers to a fall in the supply of a given commodity due to unfavourable changes in other factors such as an increase in the prices of inputs, an increase in the tax rate, outdated technology, strikes by workers, while price remains constant. The supply curve shifts to the left of the original supply curve. It is shown in figure 4.9

In figure 4.9, the quantity supplied is shown on the X-axis and the price on the Y-axis. Supply falls from OQ to OQ2 at the same price OP, resulting in an inward shift of the original supply curve to the left from SS to S2S2. It is known as a Decrease in supply.

Concepts of Cost and Revenue :

Total Cost (TC) :

Total cost is the total expenditure incurred by a firm on the factors of production required for the production of goods and services. Total cost is the sum of total fixed cost and total variable cost at various levels of

TC = TFC + TVC

TC = Total cost

TFC = Total Fixed Cost

TVC = Total Variable Cost

Total Fixed Cost (TFC): Total fixed costs are those expenses of production which are incurred on fixed factors such as land, machinery, etc.

Total Variable Cost (TVC): Total variable costs are those expenses of production which are incurred on variable factors such as labour, raw material, power, fuel, etc.

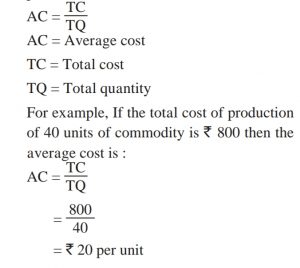

Average Cost (AC) :

The average cost refers to the cost of production per unit. It is calculated by dividing total cost by total quantity of production.

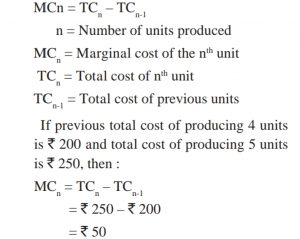

Marginal cost (MC):

Marginal cost is the net addition made to total cost by producing one more unit of output.

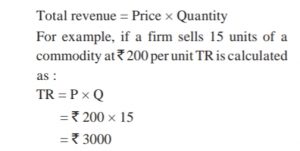

Total Revenue (TR):

Total revenue is the total sales proceeds of a firm by selling a commodity at a given price. It is the total income of a firm. Total revenue is calculated as follows :

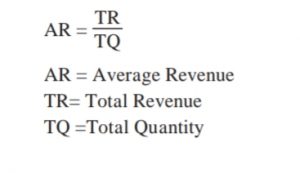

Average Revenue (AR):

Average revenue is the revenue per unit of output sold. It is obtained by dividing the total revenue by the number of units sold.

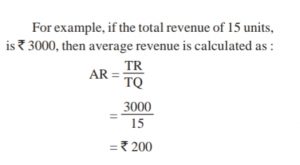

Marginal Revenue:

Marginal revenue is the net addition made to total revenue by selling an extra unit of the commodity.

For Other Subjects Click Here

Reference: MHSB books

Market

In the ordinary sense, the term market refers to a place where buyers and sellers meet for the purpose of exchange. However, the market need not be the place of exchange. The following are the features of the market.

- A market involves the exchange of goods and services between the buyers who are willing to buy and the seller who is willing to sell.

- ‘Demand’ from the buyer and ‘Supply’ from the seller are two market forces.

- There are free entry and exit of buyers and sellers in a competitive market.

- The sellers sell their goods in the market with a view to earning profit and buyers buy the goods to satisfy their wants.

- The market can be of any size, large or small, local or national, or international.

- Market need not necessarily refer to a place. Buyers and sellers may meet personally or they can contact each other through various means of communication.

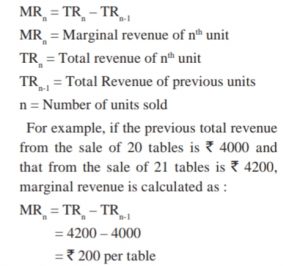

Classification of Market :

On the basis of place :

- Local market: Local market is a market in which sellers sell and customers buy a product in the region or area in which it is produced.

- National market: National market is a domestic market in a given country. Each national market is governed by the regulation of its own country.

- International market: The international market is a worldwide market in which buyers and sellers trade in goods and services across the national borders.

On the basis of time :

- Very short period: Very short period is a period in which supply is fixed and the price is determined by the demand. The time period is for a few days or weeks in which the supply of commodities cannot be increased.

- Short period: Short period is a period of less than one year. In this period, firms can only make adjustments in inputs like labour to increase the supply of goods and services.

- Long period: Long run is a period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all costs. It is for a few years, generally up to five years.

- Very long period: Very long period is a production time that is so long that all inputs are variable. It is for more than five years.

Perfect Competition :

Perfect competition is a market situation where there is a large number of buyers and sellers buying and selling homogeneous products at a single uniform price. It refers to market conditions which include the following features.

- Large number buyers and sellers: – In perfect competition, there is a large number of buyers and sellers. Their number is so large, so single buyers and sellers cannot affect the market demand and supply.

- Homogeneous product: – The product supplied by all the sellers is homogeneous or identical (same, similar) in all respect. That is size, colure, shape, quantity, etc.

- Free entry and exit: – In a perfect competition market, there is complete freedom for entry and exit of buyers and sellers. Any buyer or seller enters the market or exit from the market as and he wants.

- Single price: A single uniform price prevails under perfect competition which is determined by the interaction of demand and supply.

- Perfect knowledge about market: – Each and every buyer should have perfect knowledge about the market condition like price, quality, quantity, and feature of the product. If buyers have perfect knowledge about the market condition they cannot be charged more by the seller.

- Perfect mobility of factor of production: – labour, capital, etc. are known as features of the production. They are freely movable from one industry to another or one market area to another.

- Absence of transport cost: – In perfect competition, the transport cost remains the same or equal to another firm. If the transport cost is included in the cost, it makes a lot of difference in the price of the same commodity.

- No government intervention: – It assumed that the government does not interfere in respect of production, transportation, and exchange of goods. In other words, there are no government restrictions.

- Demand curve of the firm: – Under perfect competition demand curve is perfectly elastic i.e. a horizontal straight line parallel to X-axis because the seller can sell infinite quantity at market price.

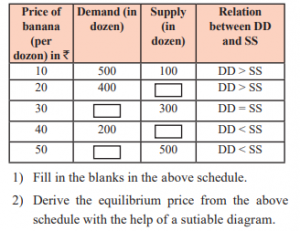

Price determination under Perfect Competition:

The interaction of demand and supply determines the price of the commodity in perfect competition. This is known as ‘equilibrium price.’ The equilibrium price is the price at which the quantity demanded is equal to the quantity supplied.

The price of the product under perfect competition is influenced by both buyers and sellers and the equilibrium price is determined by the interaction of demand and supply forces.

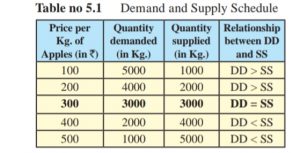

This is explained with the help of the following schedule and diagram.

- When the price rises from 100 to 200 quantity demanded falls from 5000 kgs. to 4000 kgs. whereas supply increases from 1000 kgs. to 2000 kgs. This is because demand falls with rising in price and supply rises with a rise in price. This is the stage where demand is greater than supply (DD >SS).

- When the price rises to 300, the quantity demanded and quantity supplied become equal that is 3000 kg. This is the stage of equilibrium where demand and supply become equal (DD = SS). Hence, 300 becomes the equilibrium price.

- When price further rises from 400 to 500, demand falls from 2000 kgs. to 1000 and supply rises from 4000 kgs. to 5000 kgs. Thus, supply is greater than demand. (SS > DD).

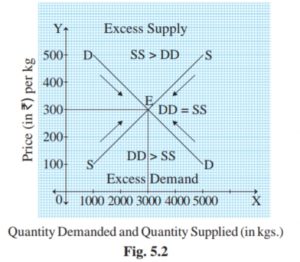

The process of price determination is explained in the following figure 5.2.

- In the above diagram, X-axis represents the quantity demanded and quantity supplied, whereas Y-axis represents the price.

- DD is the downward sloping demand curve which shows the inverse relationship between price and quantity demanded.

- SS is the upward-sloping supply curve which shows a direct relationship between price and quantity supplied.

- E is the equilibrium point where DD and SS curves intersect each other.

- Accordingly, 300 is the equilibrium price and 3000 kgs. is the equilibrium quantity demanded and supplied. This equilibrium price is determined by market demand and market supply.

Monopoly :

The terms ‘monopoly’ is derived from two Greek words ‘mono’ which means ‘one’ and ‘poly’ which means ‘seller’. A monopoly is a market situation where there is only one seller who commands complete control over the supply of commodities. There is no competition in the market, and therefore, the seller is a price maker and not a price taker. The following are the features of a monopoly: