National Income Notes Class 12 Maharashtra Board

National Income

- The modern economy is a money economy. Hence, the national income of a country is expressed in terms of money. The total income of the nation is called national income.

- In simple words, national income is “The total money value of all the goods and services produced in an economy during a given period”.

- According to NIC “A national estimate measures the volume of commodities and services turned out during a given period counted without duplication.”

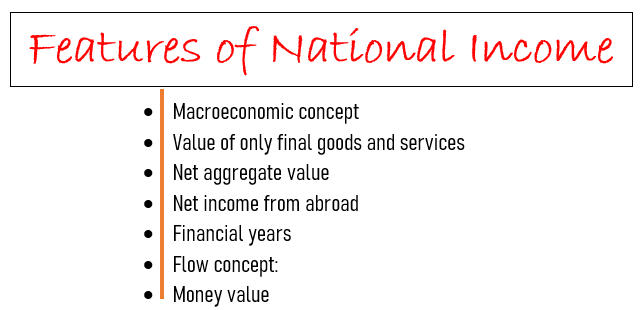

features of national income

- Macroeconomic concept: – Macroeconomics deals with aggregate or the economy as a whole. National Income data present the picture of the performance of the country’s economy as a whole in a given period.

- Value of only final goods and services: To avoid double-counting, while estimating national income, we include only the value of final goods and services.

- Net aggregate value: National income includes the net value of goods and services produced and does not include depreciation costs. (i.e. wear and tear of capital assets)

- Net income from abroad: – While estimating national income, net income received from international trade is the net export value (X-M) as well as net receipts (R-P).

- Financial years: – It is always expressed concerning the period, that is, generally a financial year, which in India is from 1st April to 31st March of every year.

- Flow concept: – National income is the ‘flow’ of goods and services produced in the country during a year. It includes only those goods and services which are produced.

- Money value: – National income is always expressed in monetary terms. It represents only those goods and services which are exchanged for money.

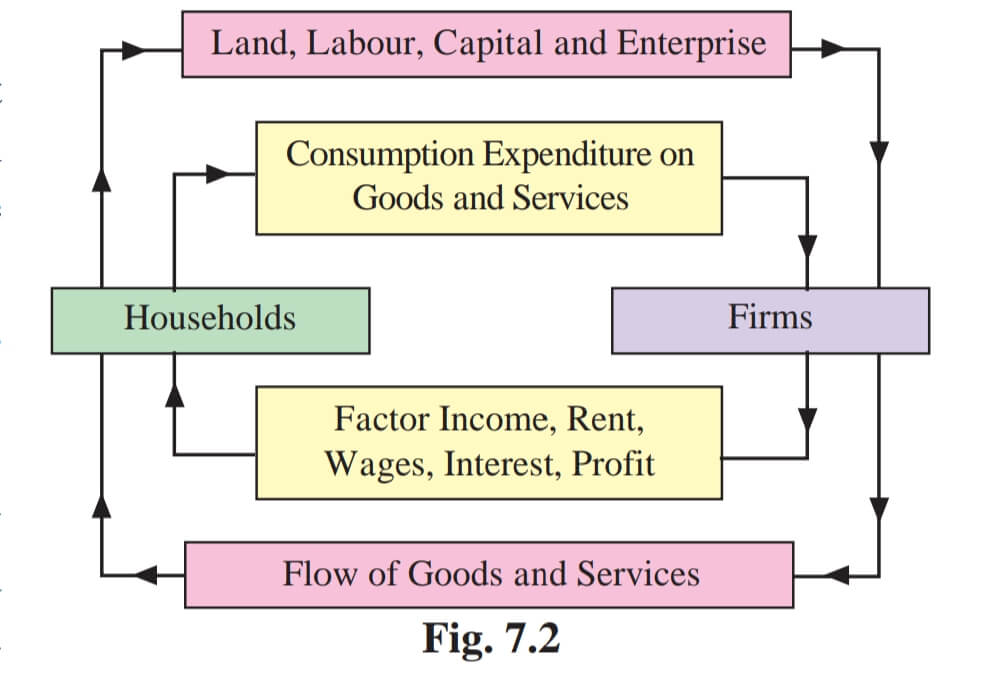

Circular flow of Income

The circular flow of income is the basic concept in macroeconomics. The circular flow of income refers to the process whereby an economy’s money receipts (revenue) and payments (Expenditure) flow circularly continuously through time.

The circular flow of income can be determined by the following :

- Two sector Economy (Households and Business Firms.) Y = C + I

- Three sector Economy (Households, Business Firms, and Government sector) Y = C + I + G

- Four Sector Economy(Households, Business Firms, Government and Foreign sector)

Y = C + I + G + (X-M) - The circular flow of goods and money in a two-sector model is explained below :

circular flow of income

- The factoring service flows from the households to the firm and factors income from the firms to the household. The upper half shows this flow through the factor market. The lower half shows the flow of goods and services and payments for the same through the commodity market.

- The factor of production and goods and services represent real flow whereas the factor payment and payment of goods and services represent money flow.

- The real flow and money flow occur in the opposition direction. When we combine the flow factors and goods market we get the circular flow.

- Factor services supplied by households to the firms get converted into goods and services and flow back to the households.

- Similarly, the money income received by the households in the form of rent, wages, interest, and profits are spent by them on purchasing goods and services, and money returns to firms.

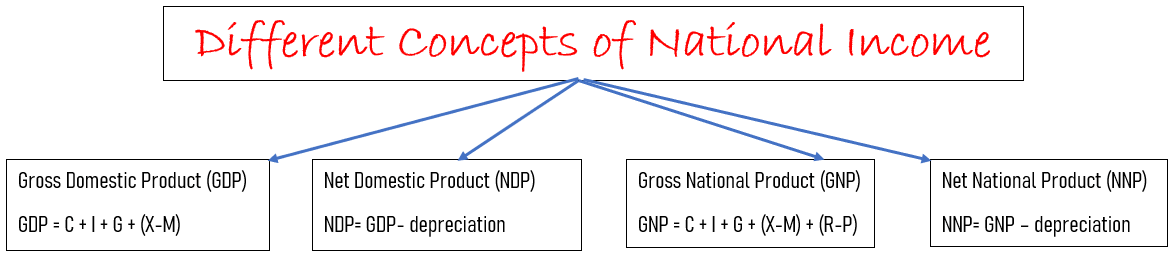

Gross Domestic Product (GDP):

GDP is defined as the aggregate market value of all goods and services produced in a country during a given period. It is the sum of the money value of goods and services produced within the country. GDP = C + I + G + (X-M)

Where, C = Private consumption expenditure

I = Domestic Private Investment

G = Government’s consumption and Investment Expenditures

X – M = Net export value (Value of Exports – Value of imports

Net Domestic Product (NDP):

NDP is defined as the net market value of all the goods and services produced during a given period. To get NDP we must have less depreciation from GDP. Hence, NDP= GDP- depreciation

Gross National Product (GNP):

- Gross National Product means the gross value of final goods and services produced annually in a country, which is estimated according to the price prevailing in the market.

- GNP = C + I + G + (X-M) + (R-P). (R = receipts from abroad and P = payments made abroad)

Net National Product (NNP):-

NNP defines as the net market value of all goods and services produced in a country during a given period as well as net factor income from abroad. Since NNP measures the market value of all goods and services less depreciation is called NNP. Hence, NNP= GNP – depreciation

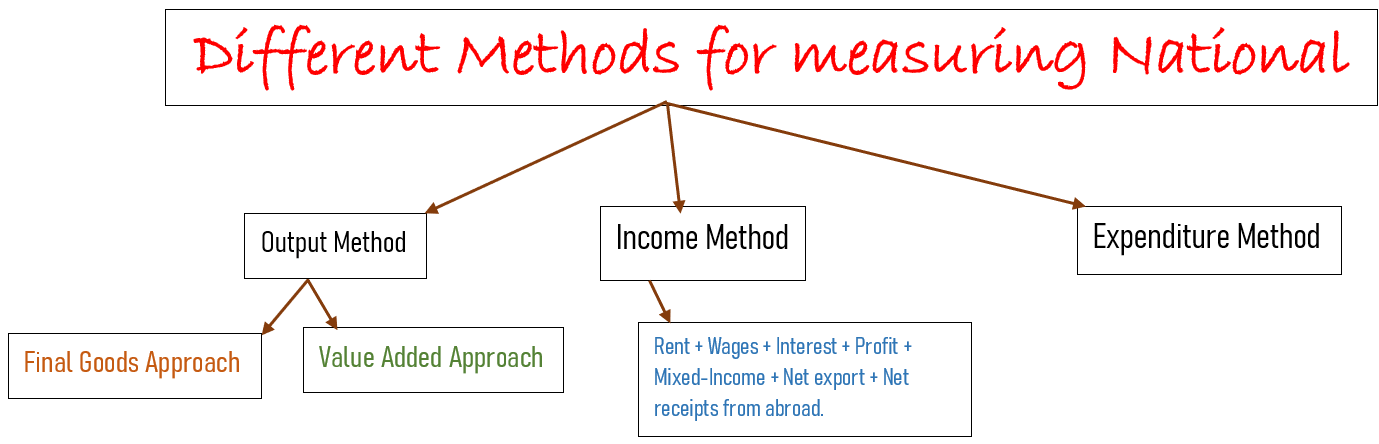

There are three methods for measuring national income.

- Value-added Method

- Income Method

- Expenditure Method

Output method: –

This method is known as the output and inventory method. Under this method, National Income is calculated as the “total of the money value of all goods and services produced in a country during a given period as well as net factor income from abroad.” In this method, the value of final goods and services is included to avoid double counting.

Final Goods Approach

Final goods are those goods that are ready for final consumption. According to this approach, the value of all final goods and services produced in primary, secondary, and tertiary sectors are included and the value of all intermediate transactions is ignored. Intermediate goods are involved in the process of producing final goods.

For example, the price of bread include, the cost of wheat, making of flour, etc., wheat and flour are both intermediate goods. Their values are paid up during the process of production. In the final product i.e. bread, the values of intermediate goods are already included

Thus, a separate accounting of the values of intermediate goods, along with the accounting of the value of the final product, would mean double counting. To avoid this, the value of only the final product or goods must be considered.

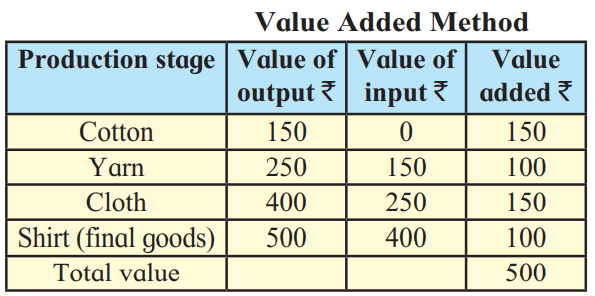

Value Added Approach

To avoid double counting value-added approach is used. According to this approach, the value added at each stage of the production process is included. The difference between the value of final outputs and inputs, at each stage of production, is called the value added.

Value added at each stage is calculated by deducting the value of inputs from the value of output produced. The total added at different stages makes GNP.

Value added at each stage is calculated by deducting the value of inputs from the value of output produced. The total added at different stages makes GNP.- In the above table, the value of the final good (Shirt) is ₹500. The sum total of value added at each stage of production is also ₹500. Thus the total value added is equal to the value of final goods. (150 + 100 + 150 + 100 = 500)

Precautions:

- To avoid double counting, only the value of final goods and services must be taken into account.

- Depreciation of capital assets should be deducted.

- Value of exports should be added and value of imports should be deducted.

- Sale and purchase of second-hand goods should be ignored as it is not a part of current production.

- Goods used for self-consumption by farmers should be estimated by guess work.

- It includes only those goods and services which are exchanged for money.

Income Method:

- This method is also known as the factor cost method. National Income is obtained by adding income such as rent, interest, wages, etc. of all the persons and enterprises in the country during a given period.

- According to this method, the income payments received by all citizens of a country, in a particular year, are added up, that is, incomes but income received in the form of transfer payments are ignored.

- The data about income are obtained from different sources, for example, from income tax returns, reports, books of accounts, as well as estimates for a small income.

- GNP can be treated as the sum of factor incomes, earned as a result of undertaking the economic activity, on the part of the resource owners and reflected in the production of the total output of goods and services during any given period.

- Thus, GNP, according to the income method, is calculated as follows:

NI = Rent + Wages + Interest + Profit + Mixed Income + Net export + Net receipts from abroad.

NI = R + W + I + P + MI + (X–M) + (R–P)

Precautions:

- Transfer payments like pensions, gifts, donations, gains from gambling and lotteries, etc. are to be excluded.

- All unpaid services of house-wife, and the help of friends should be excluded.

- Any income from the sale of second-hand goods like a car, house, etc., should be ignored.

- Net income from abroad should be included.

- Undistributed profit of the company, government income, and profit of government should be included.

Expenditure Method:

- This method of measuring national income is also known as the Outlay Method. Under this method, national income is measured by adding all the expenses made on the purchase of goods and services.

- Income can be spent either on consumer goods or capital goods (including buildings, machinery, equipment, vehicles, and tools).

- Thus, we can get national income by summing up all consumption expenditure and investment expenditure made by all individuals, firms, and the government of a country during a year.

- Thus, gross national product is found by adding up NI = C + I + G + (X–M) + (R–P)

We include the expenditure of the following category.

- Consumption (C):- Private Final Consumption Expenditure (C) by households is the market value of all consumer goods like food, transport services, medical services, gold, house, etc.

- Investment (I):- It refers to expenditure made by private businesses on replacement, renewals, and new investment (I), like machinery, tools, factories, buildings, etc.

- Government Expenditure (G):- expenditure incurred by the government on various administrative services like law and order,

defence, education, health, etc., and expenditure incurred by the government, on creating infrastructural facilities like the construction of roads, railways, bridges, dams, and canals, which are used by the business sector for the production of goods and services in any economy (G). - Net Income from abroad (x-m):- It refers to the net difference between export and import.

- Net Receipts (R-P): The difference between the expenditure incurred by foreigners on domestic goods and services (R) and expenditure incurred abroad by residents on foreign goods and services (P).

Precautions:

- Expenditure on all intermediate goods and services should be ignored, to avoid double counting.

- Expenditure on the repurchase of second-hand goods should be ignored, as it is not incurred on currently produced goods.

- Indirect taxes should be deducted.

- Expenditure on final goods and services should be included.

- Subsidies should be included.

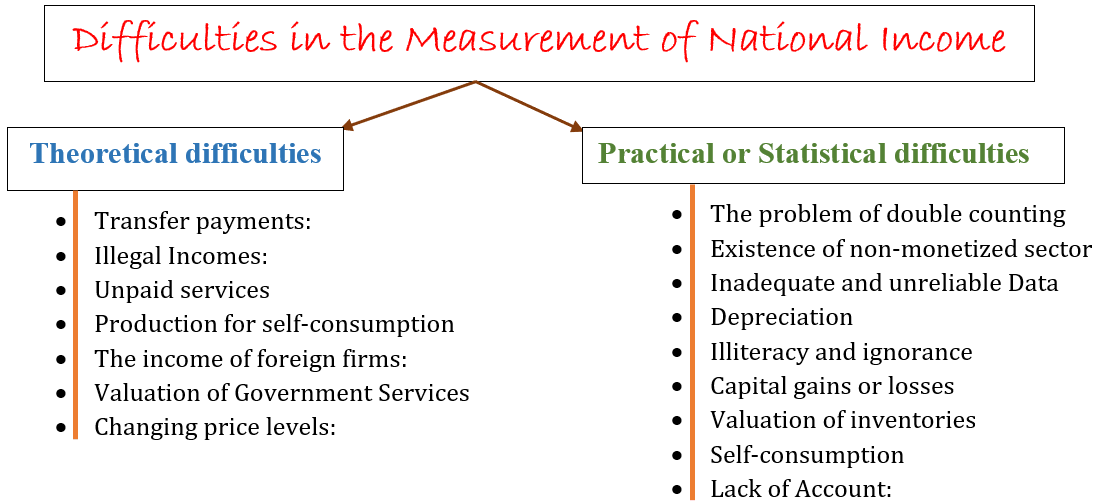

Theoretical difficulties :

- Transfer payments: Problem of transfer of payment National Income does not include transfer payments such as an old-age pension, scholarship, etc. therefore, the national income does not present a true picture of the real income of the country.

- Illegal Incomes: There are several illegal activities taking place in the country. For example, there are several smuggling activities or underworld activities. The income earned from such activities does not include in the national income.

- Unpaid services: National Income includes the money value of all the goods and services. There are many goods and services which cannot be measured in the terms of money. For example, the services of a housewife, the help of a friend, etc. these services are produced in a nation but not included in National Income.

- Production for self-consumption: Goods produced for self-consumption such as food grains, vegetables, and other farm products do not enter the market. But the value of such goods should be estimated at the rate of the market price that has been marketed and should be included in the national income.

- The income of foreign firms: According to the IMF viewpoint, the income of a foreign firm should be included in the national income of the country, where the firm undertakes production work. However, profits earned by foreign firms are credited to the parent concern.

- Valuation of Government Services: Government provides several public services like defense, public administration, law, and order, etc. Measuring the market value of such government services is difficult; as the real value of these services is not known, therefore it has become a convention to treat all such services as final consumption. Hence, it is included in the national income.

- Changing price levels: The difficulty of price changes arise in the national income estimate, when the price level in the country rises, the national income also shows an increase even though the production might have fallen, and when the price level falls., National Income may show a decrease even though production may have increased

Practical or Statistical difficulties

- The problem of double counting: Double counting is a major difficulty at the time of measuring national income. Double counting takes place when a commodity or raw material is included twice in the calculation of national income. In national income, we must include only final goods but in a big country like India, the danger of double counting cannot be avoided

- Existence of a non-monetized sector: In India, especially in rural areas, there exists a non-monetized sector. Agriculture, still being like subsistence(मात्र जीवन-निर्वाह) farming, a major part of production is partly exchanged for other goods and services. It is excluded while counting national income.

- Inadequate and unreliable Data: There is a problem in the estimation of national income as the data is inadequate and unreliable. In India, the production and cost data are not available. The data on unearned income such as old-age pensions, unemployment allowances, etc. are not available. Data related to expenditure on consumption and investment by rural and urban households is not obtainable

- Depreciation: National Income is calculated by deducting depreciation of capital assets. It is difficult to find out the net value of depreciation because there is no common and stander method for calculating depreciation, so it becomes difficult.

- Illiteracy and ignorance: Due to ignorance and illiteracy, small producers do not keep an account of their production. So they cannot give information about the quantity or value of their output.

- Capital gains or losses: Windfall gains such as lotteries and capital gains are unearned income and are not included in the estimation of the national income. However, these activities very much add to the national product.

- Valuation of inventories: Raw materials, intermediate goods, semi-finished and finished products in the stock of the producers are known as inventories. Any mistake in measuring the value of inventory will distort the value of the final production of the producer. Therefore, the valuation of inventories requires careful assessment.

- Self-consumption: At times, the producer or firm keeps a certain portion of the output for self-consumption. Such a portion of production that is retained for self-consumption should be included in the estimation of national income, but it is difficult to calculate such consumption and production.

- Lack of Account: In developing countries like India, most people are illiterate. They do not keep their account of income. So the figure for national income may be wrong.

Important Question Click HERE

PDF Books Bal Bharati