Public Finance in India class 12 chapter 8 economics | Maharashtra Board

Public Finance in India class 12 chapter 8 economics class 12 notes of Maharashtra board

- The concept of public finance is a combination of two words ‘public’ and ‘finance. ‘Public’ means all the people who live in a certain area ruled by a government. In economics, “public” means the government that works for all the people. Finance’ simply means income and expenditure.

- So, ‘public finance’ is basically studying how the government receives income and spends that money at different levels – like central, state, and local.

- There are two functions of the government 1) Obligatory functions: Protection from external attacks, maintaining internal law and order, etc. are obligatory functions of the government. 2) Optional functions: The government can choose to provide education, health services, social security (like pensions), and other support for people.

- Public finance includes public revenue, public expenditure, public debt, and financial administration Thus, Public Finance is the branch of economics that studies the taxing and spending activities of the government.

According to Prof. Findlay Shirras: “Public finance is the study of the principles underlying the spending and raising of funds by public authorities.”

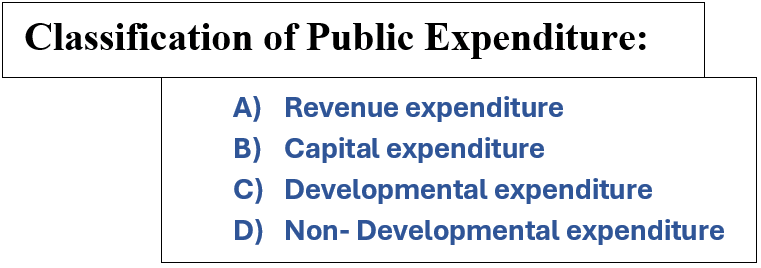

What is Public Expenditure? Write Classification of Public Expenditure:/ Types of Public Expenditure

- Public expenditure means the money spent by the government (Central, State, and Local) for the protection of citizens, for satisfying their common collective needs, and to make citizen’s life better in terms of money and their social well-being.

- Till the 20th century, most governments followed laissez-faire policy. Under this policy, the government was restricted to obligatory functions. But today, governments not only perform obligatory functions such as defence and civil administration but also perform optional functions for promoting the social and economic development of the country.

- Revenue Expenditure: The government spends for carrying out day-to-day functions of the government departments and various services are called revenue expenditure. For example, Salaries and Wages, Maintenance and Repairs, allowances and pensions of government employees, medical and public health services, etc.

- Capital Expenditure: When the government spends money to help the country’s growth and development is called capital expenditure. For example, Building Infrastructure, Education Facilities, Power Generation, huge investments in different development projects, and loans granted to the state governments and government companies for the improvement of the country.

- Developmental Expenditure: The money spent by the government on projects and investments that leads to the long-term development and growth of the country. The expenditure which results in the generation of employment, increase in production, price stability, etc. is known as developmental expenditure. For example, expenditure on health, education, industrial development, social welfare, Research and Development (R & D), etc.

- Non-Developmental Expenditure: Non-developmental expenditure is when the government spends money on things that do not really help the country’s growth or development. For example, war expenditure, Repayment of Public Debt, etc.

| Points of difference | Public finance | Private finance |

| 1) Objectives | To offer the maximum social advantage to society | To fulfill private interests |

| 2) Determination of expenditure | The government first determines the volume and different ways of its expenditure | An individual considers his income and then determines the volume of expenditure |

| 3) Credit status | The high degree of credibility in the market | The credit of a private individual is limited |

| 4) Right to print currency | The Government can print notes through the Reserve Bank of India | The private individual does not enjoy such right |

| 5) Elasticity of finance | Public finance is more elastic | There is not much scope for changes in private finance |

| 6) Effect on the economy | Tremendous impact on the economy of the country | Marginal effect on the national economy |

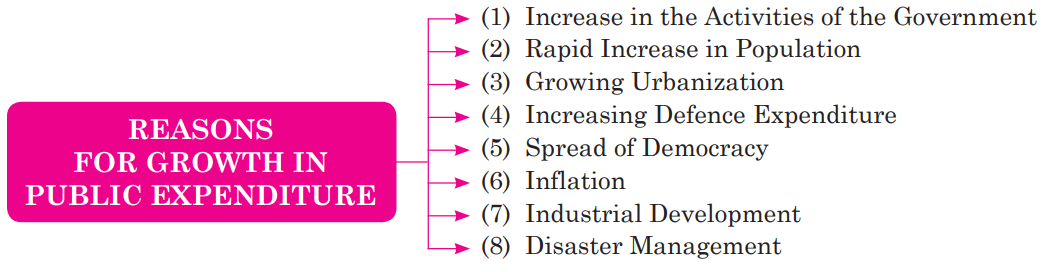

What are Reasons for Growth in Public Expenditure :

It is observed that there is a continuous growth in public expenditure in developing countries like India.

Let us study some of the important reasons :

- Increase in the Activities of the Government: The modern government performs many functions for the social and economic development of the country. These functions include the spread of education, public health, public works, public recreation, social welfare schemes, etc. This leads to an increase in public expenditure.

- Rapid Increase in Population: India has one of the world’s largest and fastest-growing populations. The increasing number of citizens places higher demands on public services such as education, healthcare, infrastructure, and social welfare programs.

- Growing Urbanization: Urbanization leads to an increase in government expenditure on water supply, roads, energy, schools and colleges, public transport, sanitation, etc.

- Increasing Defence Expenditure: In modern times, defence expenditure of the government is increasing even in the peacetime due to unstable and hostile international relationships. Defense spending is important for maintaining national security and modernizing the armed forces.

- Spread of Democracy: Most countries around the world use democratic systems of government. A democratic form of government is expensive due to regular elections and other such activities. This results in the increase in total expenditure of the government.

- Inflation: When prices of goods and services in the market go up is called inflation, it makes goods and services more expensive. The government needs to buy goods and services from the market to help the economy and society growth. Due to this, the government cost increased.

- Industrial Development: Industrial development leads to an increase in production, employment, and overall growth in the economy. Hence, the government makes huge efforts for implementing various schemes and programmes for industrial development. This results in an increase in government expenditure.

- Disaster Management: Many natural and man-made calamities like earthquakes, floods, cyclones, social unrest, etc. are occurring more frequently. Government spending increases during times of emergencies to provide relief and rehabilitation.

What is Public Revenue? Explain different sources of Public Revenue

- Public revenue is the money that a government collects from different sources to run its activities, to provide public services, and handle its financial responsibilities. Public revenue deals with the methods of raising income from tax and non-tax sources.

- It’s the income that the government receives to cover its expenses and carry out its functions for the benefit of its citizens.

- The main sources of public revenue is A) Taxes B) Non-tax Revenue

A) Taxes :

According to Prof. Seligman, “A tax is a compulsory contribution from the person to the government without reference to special benefits conferred.”

A tax possesses the following essential characteristics :

- It is a compulsory contribution to the government and every citizen of the country is legally bound to pay the tax imposed upon him. It is a major source of revenue for the government. If any person does not pay a tax, he can be punished by the government.

- Tax is paid by a taxpayer to enable the government to incur expenses in the common interests of the society.

- The payment of a tax by a person does not entitle him to receive any direct and proportionate benefits or services from the government in return for the tax.

- Tax is imposed on income, property, or commodities and services.

Types of Taxes :

- Direct Tax: It is paid by the taxpayer on his income and property. The burden of tax is borne by the person on whom it is levied. As he cannot transfer the burden of the tax to others, the impact and incidence of the direct tax fall on the same person. For example- personal income tax, wealth tax, etc.

- Indirect Tax: It is levied on goods or services. It is paid at the time of production or sale and purchase of a commodity or a service. The burden of an indirect tax can be shifted by the taxpayer (producers) to another person/s. Hence, the impact and incidence of tax are on different heads. For example, newly implemented Goods and Services Tax [GST] in India has replaced almost all indirect taxes, customs duty.

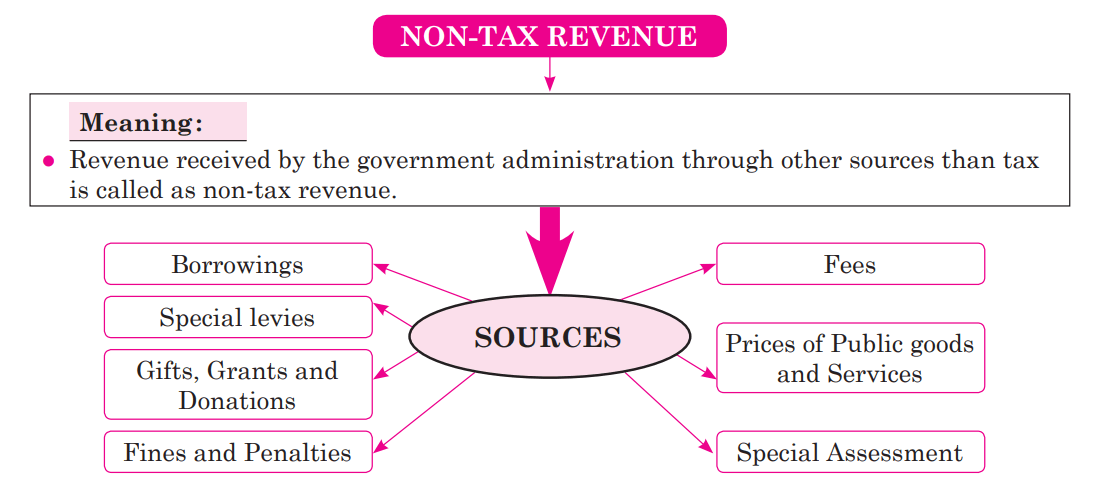

Non-Tax sources of revenue

B) Non-Tax Revenue Sources :

Public revenue received by the government administration, public enterprises, gifts, and grants, etc. are called as non-tax revenue. These sources are different than taxes. Brief information about these sources are as follows :

- Fees: Governments charge fees for services like issuing licenses, permits, and passports, or for using public facilities like parks, museums, and transportation.

- Prices of public goods and services: Modern governments sell various types of commodities and services to the citizens. A price is a payment made by the citizens to the government for the goods and services sold to them. For example- railway fares, postal charges, etc.

- Special Assessment: When people in a specific area get extra services from the government, they have to pay a special fee for those services. For example- local bodies can impose a special tax on the residents of a particular area where extra/ special facilities of roads, energy, water supply, etc. are provided.

- Fines and Penalties: Revenue is collected from fines and penalties imposed on individuals or organizations for breaking laws or regulations. The objective of the imposition of fines and penalties is not to earn income, but to discourage the citizens from violating the laws framed by the Government. For example, fines for violating traffic rules. However, the income from this source is small.

- Gifts, Grants, and Donations: Governments receive help from other countries, international groups, and donors in the form of gifts and grants, and donations. This source of revenue is uncertain in nature.

- Special levies: This is levied on those commodities, the consumption of which is harmful to the health and well-being of the citizens. Like fines and penalties, the objective is not to earn income, but to discourage the consumption of harmful commodities by the citizens. For example- duties levied on wine, opium, and other intoxicants.

- Borrowings: The government can borrow from the people in the form of deposits, bonds, etc. It also gets loans from foreign governments and organizations such as IMF, World Bank, etc. Loans are becoming a more and more popular source of revenue for governments in modern times.

III) Public Debt :

Like a private individual, the government also needs to raise loans. In fact, raising debt is the most common activity of any government, because government expenditure generally exceeds government revenue. The public debt policy of the government plays an important role in public finance.

There are mainly two types of public debt.

They are 1) Internal Debt and 2) External Debt

- Internal Debt: When a government borrows from its citizens, banks, the central bank, financial institutions, business houses, etc. within the country, it is known as internal debt.

- External Debt: When a government borrows from foreign governments, foreign banks or institutions, international organizations like the International Monetary Fund, World Bank, etc., it is known as external debt.

IV) Fiscal Policy :

Fiscal policy is the part of government policy that deals with raising revenue through taxation and deciding the level and pattern of public expenditure. Fiscal policy is composed of tax policy, expenditure policy, investment or disinvestment strategies, and public debt management.

Budgetary policy refers to government strategies to implement and manage a budget.

V) Financial Administration :

A smooth and efficient implementation of revenue, expenditure, and debt policy of the Government, is referred to as financial administration. This includes the preparation and implementation of the Government budgets along with the overall growth of the country.

Government Budget :

The budget is an important instrument of financial administration through which all the financial affairs of the state are regulated. The budget is a financial statement showing the expected receipts and proposed expenditures of the government in the coming financial year.

In India, a financial year is from 1st April to 31st March. Article 112 of the Constitution of India has a provision for annual financial statements. In every budget, a set of seven budget documents describe the details of Government finance in India.

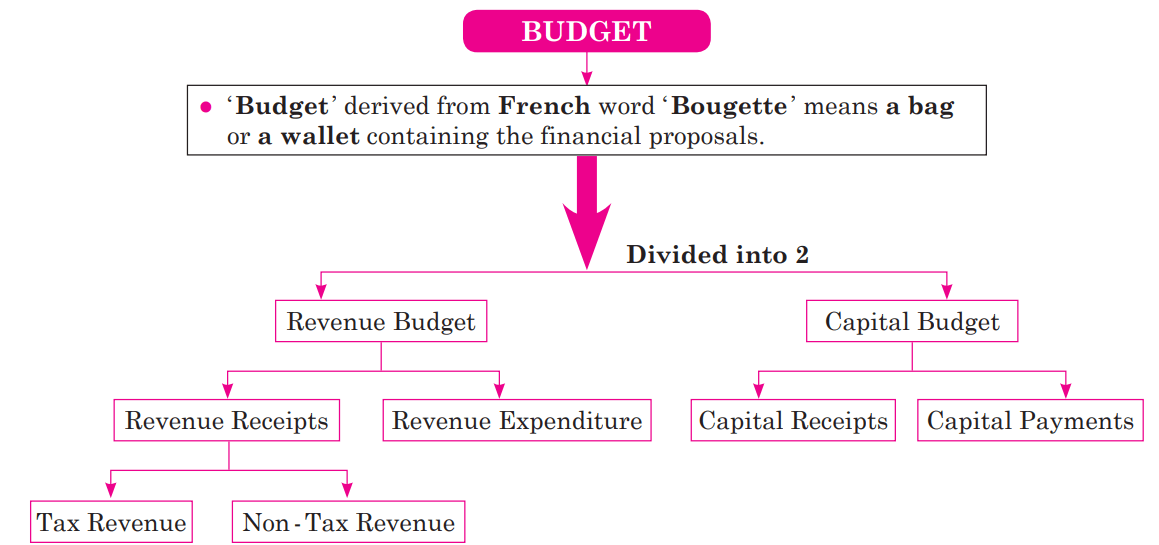

The word ‘Budget’ is derived from the French word ‘Bougette’, which means a bag or a wallet containing the financial proposals. These financial proposals are in the form of Government expenditure and revenue.

Revenue and Capital Budgets :

Central Budget provisions are divided into-

1) Revenue Budget and

2) Capital Budget

- Revenue Budget: It consists of revenue receipts and revenue expenditure of the government. Revenue receipts are divided into tax and non-tax revenue. Revenue expenditure comprises of interest paid on Government borrowings, subsidies, and grants given to the state governments.

- Capital Budget: The capital budget consists of capital receipts and capital payments. Capital receipts are Government loans raised from the public and the Reserve Bank of India, divestment of equity holding in the public sector enterprises, loans received from the foreign Governments and other foreign bodies, State deposit funds, special deposits, etc. Capital payments refer to the capital expenditures on various development projects, investments by the Government, loans given to the state Governments, and Government companies, corporations, and other parties. Besides, it includes expenditure on social and community development, defence, and general services.

Types of Budget :

Balance Budgets:

- When government revenue is equal to government expenditure is called as Balance budget

- A government budget is said to be balanced when its estimated revenue and its anticipated expenditure are equal. That is, Government receipts = Government Expenditure

- It implies that the government raised funds in the form of taxes and other means.

- The government must Exercise financial discipline and should keep its expenditure within the available income.

Surplus Budget:

- When Government revenue is greater than Government Expenditure it is called a surplus budget that is Estimated Government Revenue receipts > anticipated Government expenditure

- When estimated government receipts are more than the estimated government expenditure it is termed as Surplus budget

- A surplus budget is used either to reduce government public debts ( its liabilities) or increase its savings

- The Surplus budget can be used during inflation.

Deficit Budget:

- When Government revenue is less than government expenditure it is called a deficit budget

- When estimated government receipts are less than the estimated government expenditure than the budget is termed as Deficit Budget

- In modern economics, most of the budgets are of this nature. That is, estimated Government Receipts < anticipation government Expenditure

- A deficit budget increases the liability of the government or decreases its reserves

- A deficit budget may be useful during the period of depression.

Importance of Budget :

- The Union Budget is important because it affects people and the economy in general in a number of ways. Taxes are the most interesting part of any budget. Taxes determine the fate of businesses and individuals. The level of disposable income of the taxpayers depends on the tax rates presented in the budget.

- Government expenditure on various heads such as defence, administration, infrastructure, education, and health care, etc. affects the lives of the citizens and the overall economy.

- Also, the budget is important because Governments use it as a medium for implementing economic policies in the country.

- Budgetary actions of the Government affect production, size, and distribution of income and utilization of human and material resources of the country.

Thus, the scope and importance of public finance in a modern economy have undergone an immense change for the last 100 years.

demand-analysis-class-12 For Other Subjects Click Here

Reference: MHSB books