Sources of Agricultural Finance: Institutional and Non-institutional Finance

Sources of Agricultural Finance

There are two significant sources of agriculture finance a) Non-institutional and b) Institutional. Agricultural credit is available to farmers and other people who are working in the agriculture sector in India from different sources which can be broadly classified into non-institutional and institutional.

Non-Institutional source of agriculture finance

Non-Institutional sources of agriculture finance include moneylenders, traders and commission agents, relatives, and landlords. In 1951, 92.7 percent of rural agriculture credit was provided by the non-institutional source money lenders providing 69.7 percent of the credit.

At the present contribution of non-institutional finance is reduced to about 20 percent. 40 percent of small and marginal farmers’ credit depends on non-institutional sources.

non-institutional credits have decreased due to the nationalization of major banks and the establishment of NABARD (National Bank of Agriculture and Rural Development).

The merit of Non-institutional Credit

- Easy to obtain a loan: It is easy to obtain a loan as the lenders and borrowers are known to each other.

- Simple Procedure: Simple procedures are followed for giving loans. Very often it is only one oral guarantee. however, a written guarantee is required when the loan amount is comparatively large.

- Easy access: It is easy to access and has no formal timing to approach the money lenders traders and landlords. Borrowers can obtain a loan at midnight during an emergency.

- No restriction is imposed on the use of the loan. It is granted for productive as well as non-productive purposes.

- Consumption loans are also available from money lenders and others. Money required for marriages and other social celebrations and even for death ceremonies is available without much delay.

The demerit of Non-institutional Credit

- An exorbitant rate of interest means an extremely high-interest rate is charged by the money lenders and others making the farmers can’t redeem their loans

- Indebtedness: Farmers are unable to repay the loans as interest is very high which creates a huge burden on borrowers.

- Loss of land and property: If farmers were unable to pay the loan and interest on the time it will be the loss of their land and property to them. And the landlords take the ownership.

- Malpractice is indulged in the form of obtaining a thumb impression or Signature on a blank Bond stamp paper and misusing them and thus depriving the farmer of their property and asset.

- the exploitation of the farmer become easier by making them obligate to render free services to money lenders and landlord. The trader forces them to sell the product at a lower price immediately after the harvest.

- Bonded labour is the result of the indebtedness of small and marginal farmers. In certain cases, it may even continue from generation to generation as they cannot redeem the debt due to the high interest and other malpractice resorted by the lenders.

Institutional source of agriculture finance

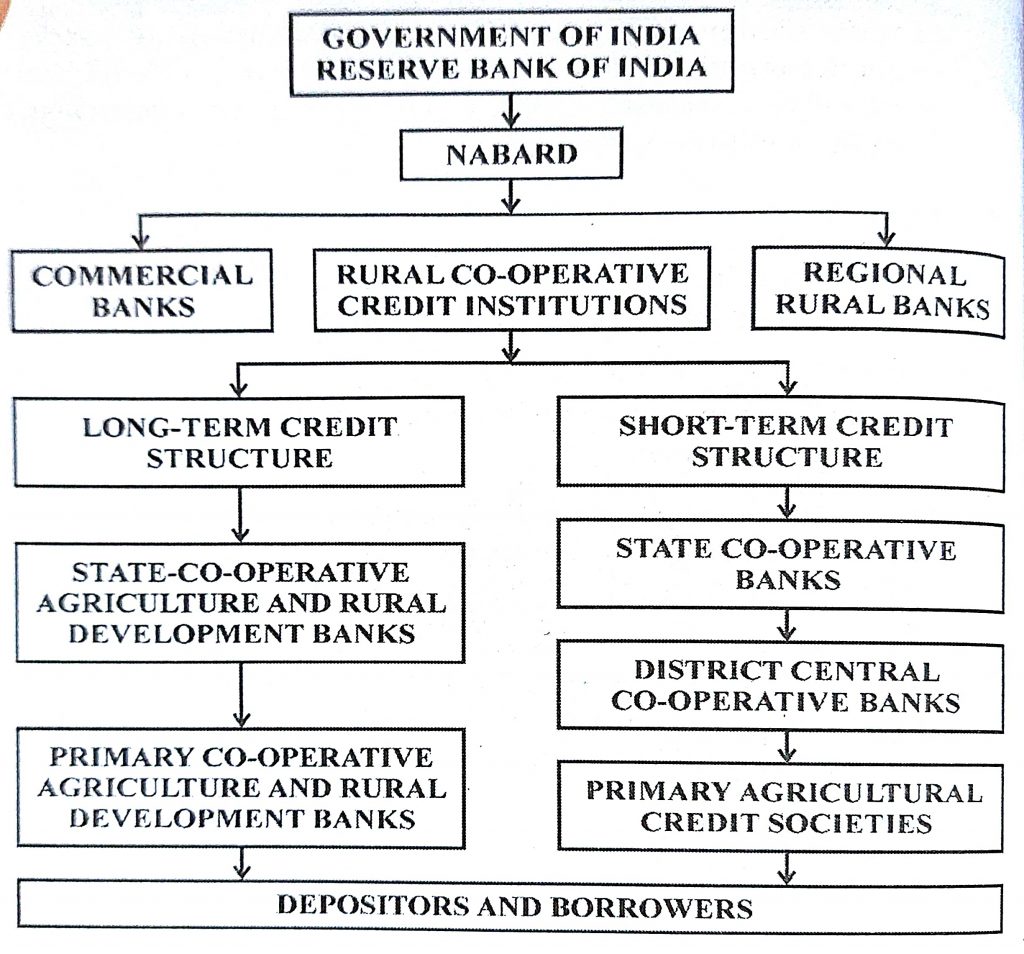

Institutional sources of agriculture finance include co-operatives, and commercial banks including the SBI Group, RBI, and NABARD. Recently share of Institutional credit has increased after the nationalization of commercial banks and the establishment of NABARD. Cooperative and commercial banks have been playing the important role in rural agriculture credit. let us discuss in the brief the major source of institutional credit.

A) Commercial Banks

75 percent of the total institutional credit to agriculture lending is from commercial banks. Commercial bank lending can be classified as i) short term, ii) medium and long term, iii) direct finance and iv) indirect finance.

- Short-term finance is extended for purchasing fertilizers seeds pesticides etc. it provides the required working capital More than 50% of commercial banks’ agriculture finance comes in this category.

- Medium/long term: Commercial banks lend the medium term but do not encourage long-term finance. Money borrowed under this is usually used to purchase cattle, equipment, and the improvement of the land.

- Direct Finance is meant for expenditure on purchasing pump sets, tractors, and other Agricultural Machinery construction of Wells bore Wells and tube wells, etc. lending under direct finance has been around 10% of total lending.

- Indirect finance is granted to the Cooperative Society of various types to enable them to function more effectively. The commercial bank also subscribes to the debenture of central land development banks besides extending the loan to them. indirect finance is provided to the Food Corporation of India, the State Government, and other Agencies for procurement, shortage, and distribution of food grain.

B) Co-operatives

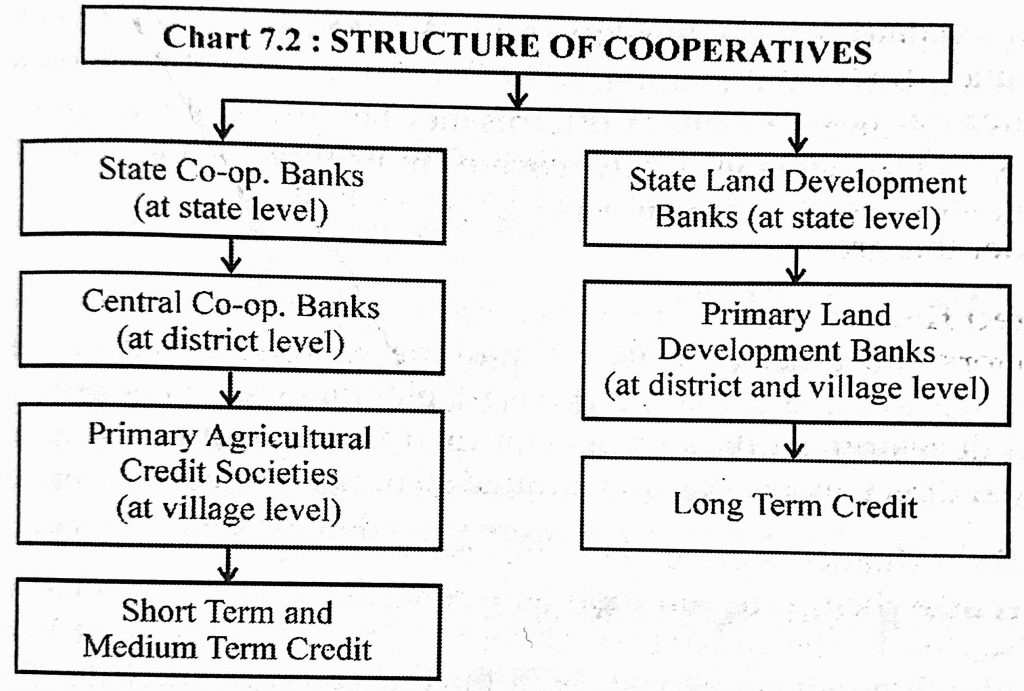

A cooperative credit society was established to provide rural credit at a lower cost. The Cooperative Banks provide short-term and long-term loans through the credit societies via Land Development Banks. They have well-established organizations as shown in the chart

Short-term and medium-term credit

- State cooperative banks are the apex of the cooperative credit structure. They link the central cooperative banks and NABARD (National bank for Agriculture and Rural Development).

- Central cooperative banks function at the district level and provide the link between primary societies and State Cooperative Banks. The primary Society for the money from the State Cooperative Through The Central Cooperatives.

- The primary credit society at the base level is at the village level. They provide short-term and medium-term credit to the farmers. Besides credit, they also help farmers by supplying seeds, fertilizers, Agricultural equipment, marketing, etc.

C) Regional Rural Credit

The regional rural bank was established in 1975 on the Recommendation of the M. Narsimha committee. The banks were originally based, rurally oriented, and generally sponsored by these scheduled commercial banks. Some private sector banks and State Cooperative Banks have supported the RRBs. At present these are 56 RRBs.

The objective of the rural regional banks is to develop the rural economy and to extend finance to the farmers especially small and marginal, village artisans, small entrepreneurs, and agricultural labourers.

For More Business Economic Notes Click Here

Reference: Smart Notes, Manan Prakashan

Very good