Structure of Capital Market in India: Capital Market Reform in India | Mumbai University 2021-22

What is Capital Market?

- The capital market is a financial market for long-term funds. The Capital market facilitates medium and long-term funds for borrowing lending for both equity and debt raised within and outside the country.

- The development of an efficient capital market is necessary for promoting more investments as well as achieving economic growth.

- The demand for long-term funds comes from agriculture, trade, and industry. Individual savers, corporate savings, banks, insurance companies, and specialized financial institutions are the suppliers of long-term funds.

Structure of Capital Market in India

In the capital market, there is a borrower who demands funds and a lender who supplies the funds.

The capital market consists of three different segments a) Government Securities Market which is regulated by the Reserve Bank of India (RBI). It is also known as the Gilt-edged market. b) Corporate debt Market c) Equity Market

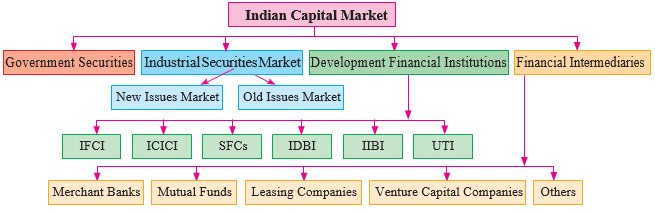

Indian capital market is widely composed of 1) A Gilt-edged market that is a government securities market, 2) an Industrial securities market, 3) Development financial institutions, and 4) Financial intermediaries.

- Government Securities Market: It is also called the gilt-edged market. It deals in government and semi-government securities. government securities are acknowledged as the Government’s debt obligation or certificates. Such securities carry a fixed rate of interest. The investors in government securities are mainly financial institutions such as commercial banks, LIC, GIC, provident funds, pensions, etc. RBI plays a very important role in the capital market.

- Industrial Securities Market: It deals with the shares and debentures issued by old and new companies. This market is further divided into Primary Market (New Issues) and Secondary Market (Old Issues). The primary market helps to raise fresh capital through the sale of shares and debentures. Secondary market deals with securities already issued by companies that are operated through stock exchanges.

- Development Financial Institutions (DFIs): These institutions were set up mainly to provide medium and long-term financial assistance to the private sector. They include the Industrial Finance Corporation of India (IFCI), Industrial Investment Bank of India (IIBI), EXIM Bank, etc.

- Financial Intermediaries: Financial intermediary is an organization that acts as a link between the investor and the borrower to meet the financial objectives of both parties. They consist of merchant banks, mutual funds, leasing companies, venture capital companies, etc.

What is the Primary Market?

- This market is for new issues and when companies sell their shares, Debentures, etc. for the first time to raise fresh capital it is known as the primary market. Therefore Primary market deals with the issue of new securities to investors for the first time. Hence this market is also known as New Issues Market or primary market.

- The main function of the primary market is to facilitate capital formation. The Primary market can be classified as the Equity market and Debt market. In the Equity market, securities like Equity shares, Preference Shares, Rights Issues, etc. are issued. In the Debt market, debentures, bonds, fixed deposits, etc. are issued.

Methods of Raising funds in the Primary market :

- IPO: Initial Public Offer means offering shares of a company to the public for the first time. Investors can directly buy the securities from the issuing company.

- FPO(Further/follow-on public offer): When a company issues shares to the public after an initial public offer (IPO) it is called a further/ follow-on public offer.

- Rights Issue: When a company needs extra additional funds, it can collect from its present investors by allowing them to buy the shares of the company. Such issues of shares are known as Rights Issue as the present or existing shareholders are given the ”right” to buy new shares before it is offered to the public.

- Private placement: Private placement means when a company offers its securities to a selective group of persons identified by the Board excluding qualified institutional buyers and employees that is financial institutions, Banks, Insurance companies, etc. not exceeding 200. This helps the company raise the funds efficiently, quickly, and economically.

What is the Secondary Market?

- The secondary market is more commonly known as the stock market or the stock exchange. It deals in existing or already issued securities or outstanding. In the secondary markets previously issued securities are bought and sold by the investors. After IPO, when the shares are listed on the Stock Exchange, they can be traded in the secondary market. In this market, the securities are traded between investors.

- The main difference between the primary and the secondary market is that in the primary market only new securities are issued, whereas in the secondary market the already existing securities are traded. There is no fresh issue in the secondary market.

Capital Market Reform / Capital Market Reform in India

- Discloser of Standards: Companies are required to disclose all material facts and specific risk factors related to their projects. SEBI has also introduced a code of advertisement for public issues for fair and truthful disclosure.

- Freedom to determine the par value of shares: SEBI has allowed the companies to determine the par value of shares issued by the company. SEBI has allowed issues of IPOs through the “book building” process.

- Underwriting Optional: It is subject to the condition that if an issue was not underwritten and was not able to collect 90 percent of the amount offered to the public, the entire amount collected would be refunded to the investor.

- FIIs Allowed to operate in the Indian market: Foreign institutional investors (FIIs like mutual funds and pension funds are allowed to invest in equity shares as well as in the debt market.

Access to Global Funds Market: Indian companies are permitted to access the global finance market through ADR, GDR, FCCBs, ECBs, etc., and benefit from the lower cost of funds. - Credit Rating Agencies: Different credit agencies like CRISIL, ICARE, CARE, etc. are set up to meet the emerging needs of the capital market. Credit rating agencies provide risk and quality investment of instruments by the business units. It helps a healthy discipline of the borrowers and guides investors.

- Investor Protection Measures: Discloser and Investors Protection (DIP) guidelines for new issues to proceed with the interest of investors and the development of the securities market. SEBI also introduced an automated complaints handling system to deal with investor complaints.

- PAN made Mandatory: PAN has been made mandatory with effect from 1st January 2007 to strengthen the KYC “know your customer.

- Electronic Transactions: Due to technological development in recent. The physical transaction or paperwork is reduced. Now investors make transactions online. It helps to save both money and time for investors. Thus it has made investing safer and hassle-free influencing more people to join the capital market.

- Securities Laws (Amendment) Act, 2014: This Act passed in August 2014 enhances powers conferred upon SEBI, including explicit power to disgorge ill-gotten gains, the power to conduct search and seizure, explicit powers for settlement, attachment and recovery, increase in penalties, and constitutions of special courts.

- Mutual Fund, Corporation Bonds, AIF: SEBI notified the Infrastructure Investment Trust Regulation in Sept 2014 that provides a framework for registration and regulation of investment in India. SEBI ( Research Analysts) Regulation, 2014 was notified on Sept 01, 2014.

- New Instruments: Several new financial instruments have been introduced after 1992. Instruments like convertible preference shares, secured premium notes, warrants, Zero Coupon Bonds, deep discount bonds, discount bonds, Flexible bonds, loyalty coupons, etc.

Difference between Primary Market and Secondary Market

Primary Market |

Secondary Market |

| The issue of new shares by the company is done in the primary market. |

The securities issued earlier are traded in the secondary market. |

| Direct investment in the securities. Securities are acquired directly from the company | Indirect investment as the securities are acquired from other stakeholders. |

| The parties dealing in this market are the company and investors. | The parties dealing in this market are only investors. |

| The underwriters are the intermediaries. | The security brokers are the intermediaries. |

| The price of security in the primary market is fixed as it is decided by the company. | The price of a security is fluctuating, depending on the demand and supply conditions in the market |

For more Business Economics Notes Click Here

Reference: ML Jhingan, Manan Prakashan