Structure of Indian Money Market | Mumbai University 2021-22

Structure of Indian money market

What is Money Market?

- The money market is a type of market where lending and borrowing funds for a short period. The Money market deals in short-term funds and financial instruments for the period of one day to one year or less. In the money market financial instruments are highly liquid and converted into cash within a short period.

- In the money market, various instruments are used for lending and borrowing such as call money, commercial bills, treasury bills, certificates of deposits, commercial papers, etc. It is a wholesale market for a short-term debt instrument.

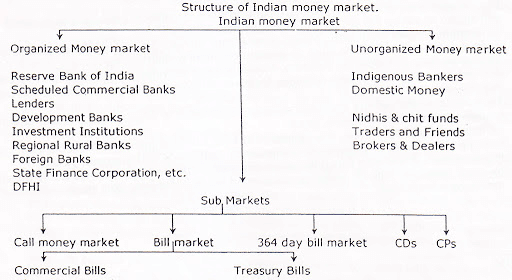

Structure of Indian Money Market

- Money Market is divided into the organized sector and the unorganized sector. organized money market governed by the Act. the organized market registered the government and follow the rules and regulations.

- The unorganized market is not governed by any Act. It is registered with the government; therefore no rules and regulations are followed by the unorganized sector.

Role of different players and participants in the organized sector:

- RBI: Reserve Bank of India Plays a very important role in the Money market. The objective of RBI operation in the money market is to ensure liquidity and short-term interest rate for achieving the objectives of monetary policy. RBI Plays the role of a middleman and regulator in the money market.

- Government: The government is an active player in the money market and, is the biggest borrower in the money market. The government needs to borrow funds in case of a deficit budget when expenditure is more than revenue. government raising funds by issue of securities in the money market.

- Banks: Banks are very important players in the money market because banks undertake short-term lending and borrowing of funds. The collective operation of banks on a day-to-day basis has a major impact on the structure of interest rate and liquidity position.

- Financial Institutions: The financial institution undertakes lending and borrowing of short-term funds. They carry out in large volumes and therefore have an important impact on the money market.

- Discount and Finance House of India(DFHI): The RBI set up DFHI jointly with public sector banks and all Indian financial institutions to provide liquidity in short term. The DFHI deals in treasury bills, commercial bills, CDs, CPs, short-term deposits, call money market, and government securities. The DFHI also participates in repos operations.

- Business Corporates: They deal in the money market mostly to raise short-term funds for satisfying their working capital requirement. they use both the organized and the unorganized sectors of the money market.

- Non-Banking Financial Intermediaries: NBFI consists of Mutual funds, Foreign Institutional Investors (FIIs), etc. they accept a deposit in different forms and lend or invest in different economic activities. Their level of participation depends on the regulations. For example, the level of participation of FIIs in the Indian money market is restricted to investment in government securities.

- Primary Dealers(PDs): RBI introduced PDs in 1995 to develop an active secondary market for government securities. They also act as underwriters to the government securities.

The main components of the Unorganized Sector of Indian Money Market

- Indigenous Bankers: They operate as banks, receive deposits, and give loans and deals in hundies. hundi is a short-term credit instrument. The rate of interest differs from one market to another market and from one bank to another. They are financial intermediaries who provide loans directly to trade and industry and agriculture by money lenders and traders.

- Money Lenders: Moneylenders’ primary business is money lending. They operate mainly in villages but they also operate in urban areas. A large amount of loans are given for unproductive purposes. The borrower is agriculture labourers, small farmers, factory workers, small traders, etc.

- Financial Brokers: Ficnaicla brokers are middlemen between lenders and borrowers. They are found in all major markets, especially in the cloth market, grain markets, and commodity markets.

- Unregulated non-bank Financial Intermediaries: the Unregulated non-bank Financial Intermediaries consist of Chit Funds, Nidhis, Loan Companies, and others.

a) Chit funds: It is a saving institution. The members make contributions of funds regularly. the collected funds are given to some members based on bids or draws.

b) Nidhis: The deposit from members are the main source of funds and makes loans to members at a reasonable interest rate for house construction or repairs.

c) Loan Companies: It is also knowns as Finance companies. The total capital of the loan companies is borrowings, deposits, and own funds. They offer a higher interest rate.

Difference between Money Market and Capital Market

|

Money Market |

Capital Market |

|

1. Meaning: |

It is a component of the financial market where long-term borrowings take place. |

|

2. Time period |

In the capital market, the instruments traded have a maturity period of more than one year. |

|

3. Instruments |

Stocks, Shares, Debentures, Bonds, and Securities of the government are the instrument of the capital market. |

|

4. Purpose of borrowing |

Long-term funds are required to establish a new business, expand or diversify the business, or purchase fixed assets. |

|

5. Institutions |

Stock exchanges, Commercial banks, Non-bank institutions, financial intermediaries, etc. are the participants in the market. |

|

6. Risk |

In The capital market, the risk is more as compared to in the money market. The reason behind this is the instruments have a long maturity period. |

|

7. Return on Investment |

Return on investment in the capital market is comparatively high as they are riskier. |

|

8. Role in Economy |

This market helps in the mobilization of savings in the economy. |

Structure of Indian Money Market, Business Economic Notes Click Here

Reference: Smart Notes, Manan Prakashan

Helpful