TYBCOM Cost Accounting Semester 5 Paper Solution 2023 University of Mumbai

TYBCOM Cost Accounting Semester 5 Paper Solution 2023 University of Mumbai

ANSWER KEY TYB.COM SEM-5, COST ACCOUNTING (SUBJECT CODE: 23107)

Q1 A. Select the most appropriate option and rewrite the full sentence (1 mark for each answer, maximum 10 marks.

- a.Direct

- a.Direct

- d.Opportunity Cost

- a.EOQ

- b.Category B

- a.FIFO

- a.Piece work plan

- c.Rowan Syatem.

- a.Prime Cost

- b.Factory Cost.

- c.18000

- .d.12000

| Group A | Group B |

| Bank Charges | c.Administrative cost |

| Coding System | e.Facilitates entry collation |

| Ordering Cost | i.Goods inspection expenses |

| Economic Order Quantity | k.Size of purchase order |

| Idle Time | j.Power failure |

| Rowan Premium Plan | b.Individual bonus plan |

| Over Absorbed Overheads | h.Absorbed overheads less Actual overheads |

| Quality Control | d.Service Cost Centre. |

| Prime Cost | g.Chargeable expenses. |

| Loose tools written off | l.Factory Overheads. |

| Upkeep of delivery Vans | a.Selling Overheads |

| Loss by Fire | f.Excluded in cost books. |

Answer 1-c; 2-e; 3-i; 4-k; 5-j; 6-b; 7-h; 8-d; 9-g; 10-l; 11-a; 12-f

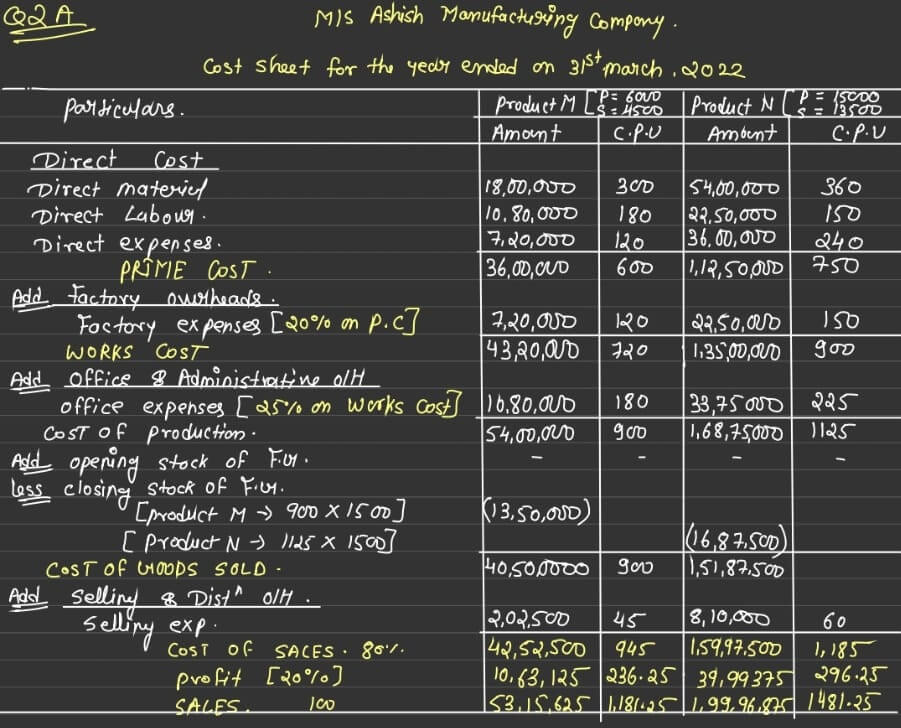

Q2A

M/s. Ashish Manufacturing Company manufactures two types of products viz. M and N. The information for the year ended on 31st March, 2022 is as under:

| Particulars | Products | |

| M (₹) | N (₹) | |

| Direct Material per Unit | 300 | 360 |

| Direct Labour per Unit | 180 | 150 |

| Direct expenses per unit | 120 | 240 |

Additional Information:

- Factory expenses are charged at 20% of prime cost.

- Office expenses are charged at 25% of works cost

- 6,000 units of product M were produced of which 4,500 units were sold and 15,000 units of product N were produced of which 13,500 units were sold.

- Selling expenses are Rs.45 per unit for product M and Rs.60 per unit for product N.

- Company charges a profit at 20% on sales for both the products

Prepare a cost sheet showing the cost and profit in total as well as in per unit

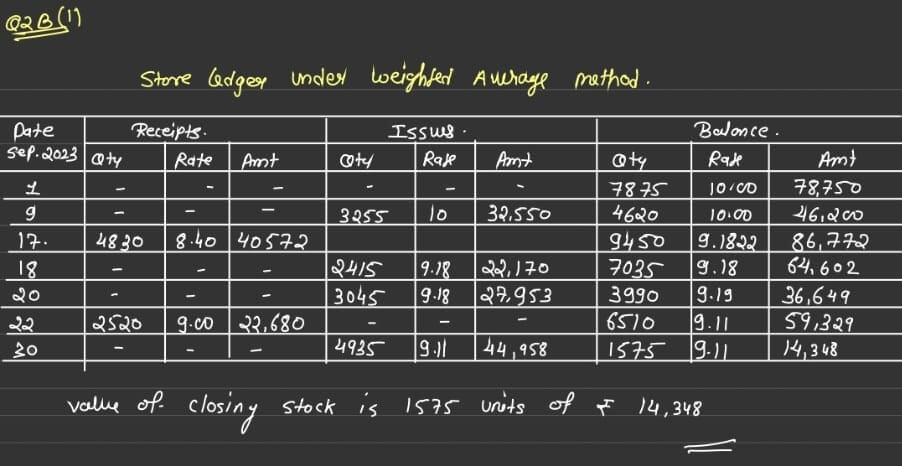

2B (i)

From the following information value closing stock as on 30-9-2023 applying Weighted

Average Method.

| Units | Rate Per Unit | |

| Opening stock | ||

| 01-09-2023 | 7875 | 10.00 |

| Purchase | ||

| 17-09-2023 | 4830 | 8.40 |

| 22-09-2023 | 2520 | 9.00 |

| Sales | ||

| 09-09-2023 | 3255 | 13.20 |

| 18-09-2023 | 2415 | 12.60 |

| 20-09-2023 | 3045 | 10.80 |

| 30-09-2023 | 4935 | 11.40 |

Ty bcom question paper with solution

Cost paper ko answer sheet