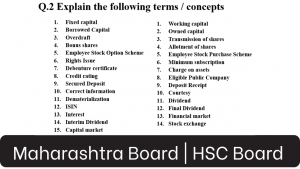

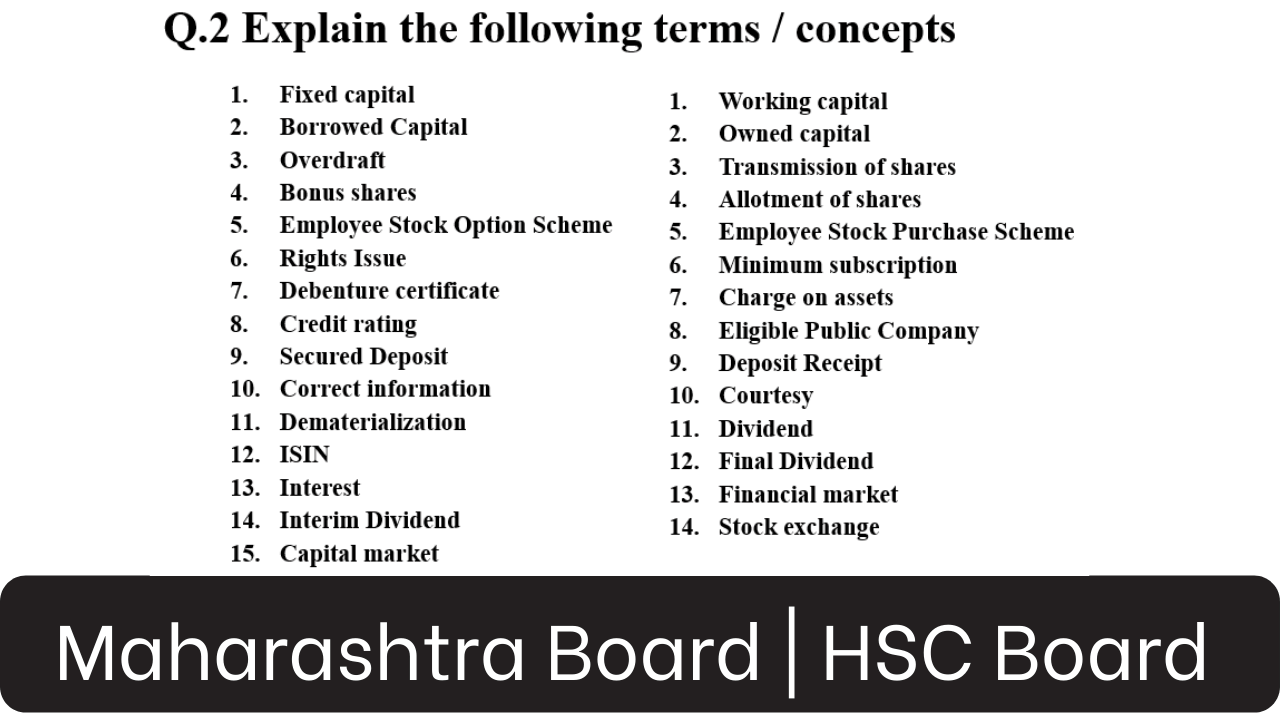

secretarial practice 12th commerce important questions: terms / concepts

secretarial practice 12th commerce important questions: terms / concepts

Owned Capital

- The capital raised by the company with the help of owners (shareholders) is termed owned capital or ownership capital. The first form of owned capital is shareholders buy shares of the company and provide the necessary capital.

- The second form of owned capital is retained earnings which are also known as ploughing back of profit. It is the reinvestment of profit in the business by the company itself. It is an internal source of finance.

- Owned capital is considered permanent capital, as it is paid only at the time of winding up of the company. Owned capital in the form of share capital, provides an initial source of capital for a new company. It can be raised any time later to satisfy the further capital needs of a company.

- Promoters decide the share capital needed by a company. The amount of share capital is known as authorized capital. It is declared in the capital clause of the Memorandum of Association of the company.

Retained Earnings :

- In simple words, a company saves the part of net profit/income as a reserve, which is not distributed to shareholders as a dividend is retained by the company within the sort of ‘Reserve Fund’.

- The company converts its reserves into ‘bonus share capital’ and capitalizes its profit. This capitalization of profit by the issue of bonus shares is known as ploughing back of profit or self-financing.

- It is an internal source of finance. Bonus shares are issued free of cost to the existing equity shareholders out of the retained earnings. The Management can convert retained earnings into permanent share capital by issuing bonus shares.

- It is an important source of raising long-term capital. It is the simple and cheapest method of raising finance. It is used by established companies.

- Business organizations are subject to fluctuation in earnings. It would be a smart decision to keep aside a part of earning during a period of high profit. A part of the profit is retained by the company in the form of a reserve fund. These reserves are the retained earnings of the company.

- The aggregation of retained earnings gets accumulated over the years. These accumulated profits are reinvested in the business rather than distributed as dividends.

- ”The process of accumulating corporate profits and their utilization in business is called retained earnings.”

Borrowed Capital

- Only owned capital is not sufficient to carry on all business activities of a joint-stock company or large organization. A company required borrowed capital to supplement its owned capital.

- Every trading company is entitled to borrow money. However, it is a standard practice to have an express provision in the Memorandum of Association, enabling a company to borrow money. The power to borrow money is normally exercised by the Board of Directors of the company.

- A private company may exercise its borrowing powers immediately after incorporation. However, the public company cannot exercise its borrowing power until it secures a certificate of commencement of business.

- The capital could be borrowed for short, medium, or long-term requirements. It is better to raise borrowed capital at a later stage for the expansion and diversification of the business.

- This additional capital can be raised by A) issue of debentures B) Accepting deposits C) bonds D) Loans from commercial banks and financial institutions, etc. Interest is paid on borrowed capital. Borrowed capital is repayable after a certain period of time.

Fixed Capital

- Fixed capital is the capital that is used for buying fixed assets that are used for a longer period of time in the business. It stays in the business for a long period almost permanently.

- Examples of fixed capital are – capital used for purchasing land and building, furniture, plant, and machinery, etc. Such capital is required usually at the time of the establishment of a new company. However, existing companies may also need such capital for their expansion and development, replacement of equipment, etc.

- An entrepreneur obtains funds for the purchase of fixed assets from the capital market (Stock market). Funding can come from the issue of shares, debentures, bonds, or obtaining even long-term loans.

Working Capital

- Working capital is the capital that is used to carry out day-to-day business activities. After estimating the fixed capital requirement of the business firm, it is necessary to estimate the amount of capital, that would be needed to ensure the smooth functioning of the business firm.

- A business firm requires funds to store adequate raw material in stock. A firm would need capital to maintain sufficient stock of finished goods.

Dividend:

- A dividend is a distribution of profits by a company to its shareholders. When a corporation earns a profit or surplus, it can pay a proportion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business.

- A dividend is the distribution of a company’s profits to eligible shareholders. The Dividend amounts and payments are determined by a company’s board of directors.

Interim Dividend:

- A dividend is a distribution of a portion of a company’s earnings The amount of dividend to be paid to the shareholders is decided by the board of directors by convening a board meeting at regular intervals.

Dividend declared by the Board of Directors between two Annual General Meetings is called Interim Dividend. - An interim dividend is paid in the middle of the accounting year i.e. before the finalization of annual accounts for the year. Opinion of the company’s Auditors should be taken before declaring Interim Dividend.

Final Dividend:

- The final Dividend is declared and paid after the close of the financial year.

- It is decided and recommended by the Board of Directors. It is declared by the shareholders in the AGM

- It is declared only after the accounts of the year are prepared and finalized.

Financial market

- A Financial Market is a market where Financial assets i.e. Financial instruments are exchanged or purchased and sold. The financial market helps in the mobilization of savings and converts them into investments. Thus financial market acts as an intermediary(agent/mediator) between investors and borrowers.

- Financial instruments are documents in the form of a legal agreement between two parties having a monetary value. It represents a financial asset to one party and a financial liability to another party e.g. securities like shares, bonds, debentures, derivatives, commercial papers, etc. are financial instruments

- The term Financial Market represents the market that raises finance for the long term via the Capital Market and short term via – the Money Market.

Capital Market

- The capital market is the market for borrowing and lending long-term capital required by business enterprises. The financial assets traded within the capital market have a long or indefinite maturity period. The capital market is the core of a country’s financial system as it helps in the mobilization of resources.

- As per SEBI, the capital market is a market for long-term debt and equity shares. In this market, the capital funds comprising of both equity and debt are issued and traded. This also includes private placement of debt and equity as well as organized markets like stock exchanges.

- One of the key functions of the capital market is to provide ease of transactions for both the investors and companies.

Rights Issue :

- When a company needs additional funds, they can first collect it from their existing investors by allowing them to buy the shares of the company at a discount price. Such issue of shares is called as Rights Issue as the existing shareholders are given the ”right” to buy new shares before it is offered to the public.

- When a company wants to raise further capital, it can issue shares to its existing Equity shareholders in proportion to their existing shareholding. Such an issue of shares is called as ‘Rights Issue’ of shares.

- Whenever a company makes the further issue of shares, the existing Equity shareholders have ‘pre-emptive rights (first option to buy) to subscribe to the new shares offered by the company

Bonus shares

- Bonus shares are fully paid shares issued free of cost to the existing equity shareholders in proportion to their shareholdings. Usually, financially sound companies issue Bonus Shares out of their accumulated distributable profits or reserves. Hence as the profits or reserves are capitalized, it is also called ‘Capitalisation of Profits or Reserves’.

The Employee Stock Option Plan (ESOP)

- The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage or motivates employee ownership in the company.

- Thus, ESOP is a scheme where a company proposes to increase its subscribed share capital by issuing further shares to its employees at a predetermined rate.

- “employee stock option” means the option given to the whole-time Directors, Officers or employees of a company which gives such Directors, Officers or employees, the benefit or right to purchase or subscribe at a future date, the securities offered by the company at a predetermined price.

Employee Stock Purchase Scheme

- An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock at a discounted price.

- “employee stock purchase scheme (ESPS)” means a scheme under which the company offers shares to employees as part of a public issue or otherwise.

- An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

Interest

- Monetary return offered to creditors (i.e.) Debenture holders) is known as interest. Interest is paid at a fixed rate.

- Interest is always paid whether the company makes a profit or not. Interest is paid with the highest priority i.e. before paying the dividend.

International Securities Identification Number (ISIN)

- It is a code that uniquely identifies a specific securities issue.

- ISINs in any country is allotted by that country’s NNA (National Numbering Agency)

- ISIN is a standard numbering system that is accepted globally.

- The International Organisation of Standardization (ISO) currently defines ISIN’s structure.

- In India, issuing ISIN to securities is assigned by SEBI to NSDL (for demated shares) SEBI works as NNA in India.

- For Government securities, allotment of ISIN is done by the RBI.

- ISIN consists of a 12 (Twelve) digit alpha-numeric code which is divided into 3 (Three) parts.

- The company has to apply for ISIN for its securities with documents like prospectus

Dematerialization

- Dematerialization (Demat) is a process whereby a client can get physical certificates converted into electronic mode.

- The client has to surrender the certificates along with the Demat Request Form (DRF). The DP forwards these to the Depository who in turn forwards them to the Issuer. After confirmation from the Issuer, the Depository will credit the securities in the Demat A/c with DP

- Process of converting Physical certificates of securities into electronic form.

Charge on assets

- The company has to create a charge on the assets of the company or its subsidiary company or holding company.

- The value of the charge should be adequate to cover the entire value of debentures issued and the interest to be paid on it.

- If a Government company issues secured debentures which has Central or State Government’s guarantee, then it need not create any charge on its assets.

Transmission of shares

- Transmission of shares takes place due to operation of law i.e. the shares of a member are automatically transferred to another person on the death, insolvency, or phobia of a member.

- Thus the transmission of shares is an involuntary action. There is only one party i.e. Legal Heir who initiates the process of transmission. The legal heir or official receiver need not pay any consideration for the shares.

- Original liability of the member continues in case of transmission. There is no need to submit an Instrument of Transfer or pay stamp duty.

Allotment of Shares

- Allotment of Shares Means distributing shares to those applicants who have submitted the share application form along with the application money.

- When a company gives shares to an applicant based on the application submitted, it is known as the Allotment of Shares.

- Supreme court has defined allotment as ‘‘the appropriation out of the previously unappropriated capital of the company of a certain number of shares to a person.’

- Thus as per this definition, Allotment of shares means allocating (giving) a certain number of shares by the Board of Directors out of the previously unallocated capital of the company to persons who have applied for the shares.

Secured Deposit

- A company can accept secured or unsecured deposits which should be clearly mentioned in every circular form advertisement or in any document related to invitation or acceptance of deposits.

- If the company intends to issue secured deposits it shall create security in favor of the trustee within 30 days of acceptance of deposits.

- The trustee should ensure the security of depositors. if there is any default in repayment, the trustee should organize a meeting of depositors rule 6 to 8 of companies (acceptance of deposit) Rule 2014.

Credit Rating

- SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 states that companies should get credit ratings for issuing debentures.

- As per SEBI, Companies making a public issue or right issue of convertible debentures must obtain a credit rating from one or more credit rating agencies.

- The rating should be mentioned in the offer letter or letter of offer or prospectus.

- Credit Rating is given to the debt securities by a credit Rating Agency which indicates the credit risk level.

- Credit Rating Agencies like CRISIL, CARE, etc. which rates the creditworthiness of a company issuing debentures, deposits, and other debt securities.

Stock Exchange

- The stock exchange is a specific place where various types of securities are purchased and sold.

- The term securities include equity shares, preference shares, debentures, government securities, and bonds, etc. including units of Mutual Funds.

- Stock markets act as an intermediary between investors and borrowers. To provide safety and stability to the investors, Stock exchanges in India are regulated by SEBI.

For Answer Click Here

If you are looking for a sample paper as the new syllabus for Important Questions of Secretarial Practice for hsc board exam 2021 Click Here

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books

13 + 13 = 26