Sources of Corporate Finance: Secretarial Practice 12th Standard HSC Maharashtra State Board 2022

Secretarial Practice 12th Standard HSC Maharashtra State Board chapter 2 – Sources of Corporate Finance

- No business activity can ever be operated without finance. Finance (money) is necessary throughout the activities of promotion, organizing, and regular operations of the business. All functions of business are ultimately reliant on finance.

- The Finance required by the business organization is termed as ‘Capital’. Each business organization requires certain capital for its activities.

- A joint-stock company, which is a modern form of business organization and is large, requires large capital for business. This large capital collection or capital formation has unique significance in the management of joint-stock companies.

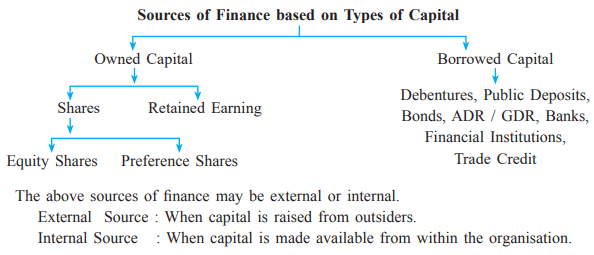

- A joint-stock company raises huge funds from different sources. These different sources of finance available to the business may be explained with the following chart :

Sources of Owned Capital

- The capital raised by the company with the help of owners (shareholders) is termed owned capital or ownership capital. The first form of owned capital is shareholders buy shares of the company and provide the necessary capital.

- The second form of owned capital is retained earnings which are also known as ploughing back of profit. It is the reinvestment of profit in the business by the company itself. It is an internal source of finance.

- Owned capital is considered permanent capital, as it is paid only at the time of winding up of the company. Owned capital in the form of share capital, provides an initial source of capital for a new company. It can be raised any time later to satisfy the further capital needs of a company.

- Promoters decide the share capital needed by a company. The amount of share capital is known as authorized capital. It is declared in the capital clause of the Memorandum of Association of the company.

What is share and state the features of share?

- The term share is defined by Section 2 (84) of the Companies Act 2013, ‘Share means a share in the share capital of a company and includes stock’.

- A share is a unit by which the share capital is divided. The total capital of the company is divided into small parts and each part has termed a share and the value of each part/unit is known as face value.

- A share is a small unit of the capital of a company. It facilitates the public to subscribe to the capital in smaller amounts.

A person can buy any quantity of shares he wants. A person who buys shares of a company is called a shareholder or a member of that company.

Features of Shares:

- Ownership: The owner of the share is known as a shareholder. It proves the ownership of a shareholder in the company.

- Distinctive Number/Unique Number: Unless dematerialized, each share has a different number for identification. It is mentioned in the Share Certificate.

- Evidence of title: A share certificate is issued by a company under its common seal. It is a document of title of ownership of shares. A share is not any visible thing. It is shown by a share certificate or in the form of a Demat share.

- Value of a Share: Each share has a value expressed in terms of money. There may be : (a) Face value which is written on the share certificate and mentioned in the Memorandum of Association. (b) Issue the price at which the company sells its shares. (c) Market Value of share is determined by demand and supply forces in the share market.

- Rights: A share gives certain rights to its holder such as the right to receive dividends, the right to attend shareholder’s meetings, and the right to vote at such meetings, etc.

- Income: A shareholder is entitled to get a share in the net profit of the company which is called a dividend.

- Transferability: The shares of a public limited company are freely transferable in the manner provided in the Articles of Association.

- Property of Shareholder: A share is a movable property of a shareholder.

- Types of Shares: A company can issue two types of shares : (a) Equity shares. (b) Preference shares

What is Equity Shares? Explain its features

- Equity shares are also known as ordinary shares. Equity shares are the initial source of financing for business activities. Companies Act defines equity shares as ‘those shares which are not preference shares. the definition explains that: a) The equity shares do not enjoy a preference for dividends. b) The equity shares do not get priority for repayment of capital at the time of winding up of the company.

- Equity shareholders participate in their company’s management. shareholders are invited to attend general meetings and allowed to vote on all matters discussed at the general meeting. Equity shareholders elect the representatives of a company to run the company. Thus Equity shareholders are real owners of the company.

- Equity shareholders do not get any fixed dividends, and dividends depend on the company’s performance. Dividends paid are declared by the Board of Directors. If the company makes no profit, no dividends are payable. Thus, with less profit, a lesser dividend is going to be paid. The owners of equity shares are real risk bearers.

Features of Equity Shares :

- Permanent Capital: Equity shares are irredeemable shares. The amount received from equity shares is not refundable by the company during its lifetime. Equity shares become refundable only at the winding up of the company or the company decides to buy back shares. Thus equity share capital is long term and permanent capital of the company.

- Fluctuating Dividend: The equity shares holders get dividends at a fluctuating rate because dividend depends on companies profit. If the company makes more profit, a high rate of dividend gets paid. similarly, if Companies make lesser profit or loss, a lower rate of dividends or no dividend gets paid.

- Rights: Equity Shareholders enjoy certain rights such as the right to vote, the right to share in profit, the right to inspect books, and the right to transfer shares.

- No preferential right: Equity shareholders do not enjoy preferential rights regards of payment of dividends. Equity shareholders are paid dividends only after the dividend is paid to preference shares holders. Similarly, at the time of winding up of the company, the equity shareholders are paid last and, if no surplus amount is available, equity shareholders will not get anything.

- Controlling power: The equity shareholders enjoy control over the company because they enjoy exclusive voting rights. The Act provides the right to cast vote in proportion to shareholding. They can participate in the management and affairs of the company. They elect representatives of the company to run the company’s business.

- Risk: The equity shareholders are the main risk-takers or bearers. If the income of the company declines, the rate of dividends also comes down. Due to this, the market value of equity shares comes down resulting in capital loss. Thus equity shareholders are the main risk-takers.

- Residual claimant: A residual claim means the last claim on the income of the company. Equity shareholders as owners are residual claimants to all earnings after expenses, taxes, etc. are paid. Although equity shareholders come last, they have the advantage of receiving the entire earnings that are remaining.

- No charge on assets: The equity shares do not create any charge over the assets of the company.

- Bonus Issue: Bonus shares are issued as a gift to equity shareholders. These shares are issued free of cost to existing equity shareholders. This benefit is available only to the equity shareholder.

- Right Issue: When a company required more funds for the expansion of the business and raises further capital by issue of shares, the existing equity shareholders may be given priority to get newly offered shares this is called the ‘Right Issue’. The shares are offered to equity shareholders first, in proportion to their existing shareholding.

- Face Value: The face value of equity shares is low. It can be generally 10 per share or even 1 per share.

- Market Value: The market value of equity shares fluctuates according to the demand and supply of the company’s shares within the market. The demand and supply of equity shares depend on the company’s profits earned and dividends declared.

- Capital Appreciation: Share Capital appreciation takes place when the market value of shares increases in the share market. Profitability and prosperity of the company improve the reputation of the company in the share market and it facilitates appreciation of the market value of equity shares.

What is Preference Shares? Explain the features of Preference Shares

- Preference shares have certain preferential rights different from equity shares. The shares which carry the preferential rights are known as preference shares: a) A preferential right on payment of dividends during the lifetime of the company. b) A preferential right on the return of capital at the time of winding up of the company.

- The preference shareholder has a prior right to receive a fixed rate of dividend. The rate of dividend is fixed at the time of issue.

The preference shareholders are not the controllers but they are co-owners of the company. preference share purchase by investors who are interested in the safety of investment and who want fixed returns on investments. - Usually, preference shares do not carry any voting power. They have voting right only on matters which affect their interest, like selling of undertaking or changing rights of preference shares, etc. or they get voting rights if the dividend remains unpaid.

Features of Preference Shares:

- dividend preference: Preference shareholders have the first preference in the company’s annual net profit distribution. The dividend is paid to preference shareholders before equity shareholders.

- Preference for repayment of capital: The Preference shareholders get the preference over equity shareholders at the time of winding up for repayment of the capital. This minimizes the risk of capital loss.

- Fixed Return: Preference shares offer fixed-rate dividends. The rate of dividend is decided at the time of issue. It may be in the form of a fixed sum or may be calculated at a fixed rate. The preference shareholders are entitled to dividends which can be paid only out of profits. If the directors, in a financial crisis, decide not to pay dividends, the preference shareholders have no claim for dividends.

- Nature of Capital: Preference shares do not provide permanent share capital. They are redeemed after a specific period. A company can not issue irredeemable preference shares. Preference capital is mostly raised at a later stage when the company gets established. These shares are issued to satisfy the requirement for additional capital for the company.

- Market Value: The market value of preference shares does not change because the rate of dividend is paid to preference shareholders at a fixed rate. The capital appreciation is considered to be low as compared with equity shares.

- Voting rights: The preference shares do not have normal voting rights. They can vote only on matters affecting their interest. They do not enjoy the right of control over the affairs of the company.

- Risk: Preference shareholders have less risk as they get preference for payment of dividends and repayment of capital at the time of business closer.

- Face Value: The face value of preference shares is comparatively more than equity shares. They are normally issued at a face value of Rs. 100/-.

- Rights or Bonus Issue: Preference shareholders are not entitled to Rights issues or Bonus issues.

- Nature of Investor: Preference shares attract an investor who is less risk-taker. Investors who are interested in the safety of capital, and who want a fixed return on investment normally purchase preference shares.

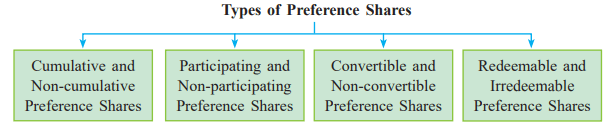

Types of Preference Shares

- Cumulative Preference Shares: It implies, that if the dividend is not paid in one or more years due to inadequate profits or bad performance of a company, then the unpaid dividend gets accumulated and paid when the company makes a profit.

- Non-cumulative Preference Shares: It implies the dividend on shares can be paid only out of the profits of the current year. It is lost forever if the dividend is not paid in any year. The right to claim dividends will lapse if the company does not make a profit in that particular year.

- Participating Preference Shares: This means preference shareholders participate in the remaining profit after the dividend has been paid to equity shareholders. The preference shareholders are entitled to participate in surplus or excess profit other than the preferential dividend.

- Non-participating Preference Shares: The preference shares are considered to be non-participating if there is no clear provision in the Articles of Association. These shareholders are entitled to a fixed rate of dividend, prescribed at the time of issue.

- Convertible Preference Shares: The preference shareholders have a right to convert their preference shares into equity shares. The conversion takes place within a certain fixed period.

- Non-convertible Preference Shares: These shares cannot be converted into equity shares.

- Redeemable Preference Shares: Shares that can be redeemed after a specific fixed period are called redeemable preference shares.

- Irredeemable Preference Shares: Shares that are not redeemable that are payable only at the time of winding up of the company are known as irredeemable preference shares.

Retained Earnings :

- In simple words, a company saves part of net profit/income as a reserve, which is not distributed to shareholders as a dividend and is retained by the company within the sort of ‘Reserve Fund’.

- The company converts its reserves into ‘bonus share capital’ and capitalizes its profit. This capitalization of profit by the issue of bonus shares is known as ploughing back of profit or self-financing.

- It is an internal source of finance. Bonus shares are issued free of cost to the existing equity shareholders out of the retained earnings. The Management can convert retained earnings into permanent share capital by issuing bonus shares.

- It is an important source of raising long-term capital. It is the simple and cheapest method of raising finance. It is used by established companies.

- Business organizations are subject to fluctuation in earnings. It would be a smart decision to keep aside a part of earnings during a period of high profit. A part of the profit is retained by the company in the form of a reserve fund. These reserves are the retained earnings of the company.

- The aggregation of retained earnings gets accumulated over the years. These accumulated profits are reinvested in the business rather than distributed as dividends.

- ”The process of accumulating corporate profits and their utilization in business is called retained earnings.”

Sources of Borrowed Capital

- Only owned capital is not sufficient to carry on all business activities of a joint-stock company or large organization. A company required borrowed capital to supplement its owned capital.

- Every trading company is entitled to borrow money. However, it is a standard practice to have an express provision in the Memorandum of Association, enabling a company to borrow money. The power to borrow money is normally exercised by the Board of Directors of the company.

- A private company may exercise its borrowing powers immediately after incorporation. However, the public company cannot exercise its borrowing power until it secures a certificate of commencement of business.

- The capital could be borrowed for short, medium, or long-term requirements. It is better to raise borrowed capital at a later stage for the expansion and diversification of the business.

- This additional capital can be raised by A) issue of debentures B) Accepting deposits C) bonds D) Loans from commercial banks and financial institutions, etc. Interest is paid on borrowed capital. Borrowed capital is repayable after a certain period.

What is Debentures? state the features of debenture

- The term debenture has come from the Latin word ‘debere’ which means to ‘owe’. Debenture means a document that either creates or acknowledges debt.

- Topham defines: “A debenture is a document given by a company as evidence of debt to the holder, usually arising out of the loan, and most commonly secured by the charge.”

- Debentures are one of the main sources of raising borrowed capital to meet long and medium-term financial needs. Over the years debentures have occupied an important position in the financial structure of companies.

- A debenture is an instrument issued in the form of a debenture certificate, under the common seal of the company.

Features of Debenture

- Promise: Debenture is a promise by the company that it owes (obligation to pay) a specified amount of money to the debenture holder.

- Face Value: The face value of debenture normally carries a high denomination(value). It is for Rs. 100 or in multiples of Rs. 100.

- Time of Repayment: Debentures are issued with the due date mentioned in the debenture certificate. The principal amount of the debenture is repaid on the maturity date.

- The priority of Repayment: Debentureholders have a priority in repayment of debenture capital over the other claimants of the company.

- Assurance of Repayment: Debenture is long-term debt. They carry an assurance of repayment on the due date.

- Interest: A fixed rate of interest is paid periodically in case of debentures. Payment of interest is a fixed liability of the company. It must be paid by the company no matter whether the company makes a profit or not.

- Parties to Debentures: i)Company is the entity that borrows money. ii) Trustees: A company has to appoint a Debenture Trustee if it is offering Debentures to more than 500 people. The company agrees with trustees, it is called Trust Deed. It contains the obligations of the company, rights of debenture holders, powers of Trustee, etc. iii) Debenture holders: These are the parties who provide loans and receive, a ‘Debenture Certificate’ as evidence.

- Authority to issue debentures: According to the Companies Act 2013, Section 179 (3), the Board of Directors has the power to issue debentures.

- Status of Debentureholder: Debentureholder is a creditor of the company. Since debenture is a loan taken by a company, fixed-rate interest is paid at fixed intervals until the debenture is redeemed.

- No Voting Right: According to Section 71 (2) of the Companies Act 2013, no company shall issue any debentures carrying any voting right. Debenture holders have no right to vote at a general meeting of the company.

- Security: Debentures are generally secured by a fixed or fluctuating charge on the assets of the company. If a company is not in a position to make payment of interest or repayment of capital, the debenture holder can sell off the charged property of the company and recover their money.

- Issuers: Debentures can be issued by both private companies and public limited companies.

- Listing: Debentures must be listed with at least one recognized stock exchange.

- Transferability: Debentures can be easily transferred, through the instrument of transfer.

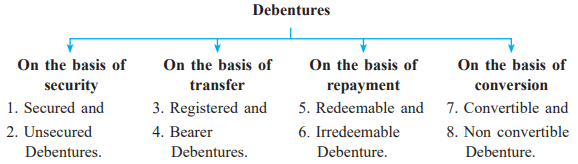

Types of debentures

- Secured debentures: The debentures can be secured. The property of the company may be charged as security for the loan. The security may be for some particular asset (fixed charge) or it may be the asset in general (floating charge). The debentures are secured through a ‘Trust Deed’.

- Unsecured debentures: These are the debentures that have no security. The issue of unsecured debentures is permitted by the Companies Act, 2013.

- Registered Debentures: Registered debentures are those debentures on which the name of holders are recorded. A company maintains a ‘Register of Debentureholders’ in which the name, address, and particulars of holdings of debenture holders are entered. The transfer of registered debentures requires the execution of a regular transfer deed.

- Bearer Debentures: The name of holders are not recorded on the bearer debentures. Their names do not appear on the ‘Register of Debentureholders’. Such debentures are transferable by mere delivery. Payment of interest is made using coupons attached to the debenture certificate.

- Redeemable Debentures: Debentures are mostly redeemable i.e. Payable at the end of some fixed period, as mentioned on the debenture certificate. Repayment can be made at a fixed date at the end of a specific period or by installment during the lifetime of the company. The provision of repayment is normally made in ‘Trust Deed’.

- Irredeemable Debentures: These kinds of debentures are not repayable during the lifetime of the company. They are repayable only after the liquidation of the company, when there is a breach of any condition, or when some contingency arises.

- Convertible Debentures: Convertible debentures give the right to holders to convert them into equity shares after a specific period. Such right is mentioned in the debenture certificate. The issue of convertible debentures must be approved by special resolutions in general meetings before they are issued to the public.

- Non-convertible Debentures: Non-convertible debentures are not convertible into equity shares on maturity. These debentures are redeemed on the maturity date.

If you are looking for a sample paper as the new syllabus for Important Questions of Secretarial Practice for hsc board exam 2021 Click Here

For Other Subjects Click Here For SP Click Here

Reference: MHSB Books, Click Here

Sources of Corporate Finance, Secretarial Practice 12th Standard HSC Maharashtra State Board chapter 2 – Sources of Corporate Finance, sources of corporate finance 12th class, HSC Board Exam 2022