Business Economics TYBCOM Semester 5 full Notes

Business Economics

If you are searching for TYBCOM Business Economics notes you are on the right page. We are going to share simple and easy notes on business economics with a diagram so that you can study well.

TYBCOM Business Economics Semester-5 Notes

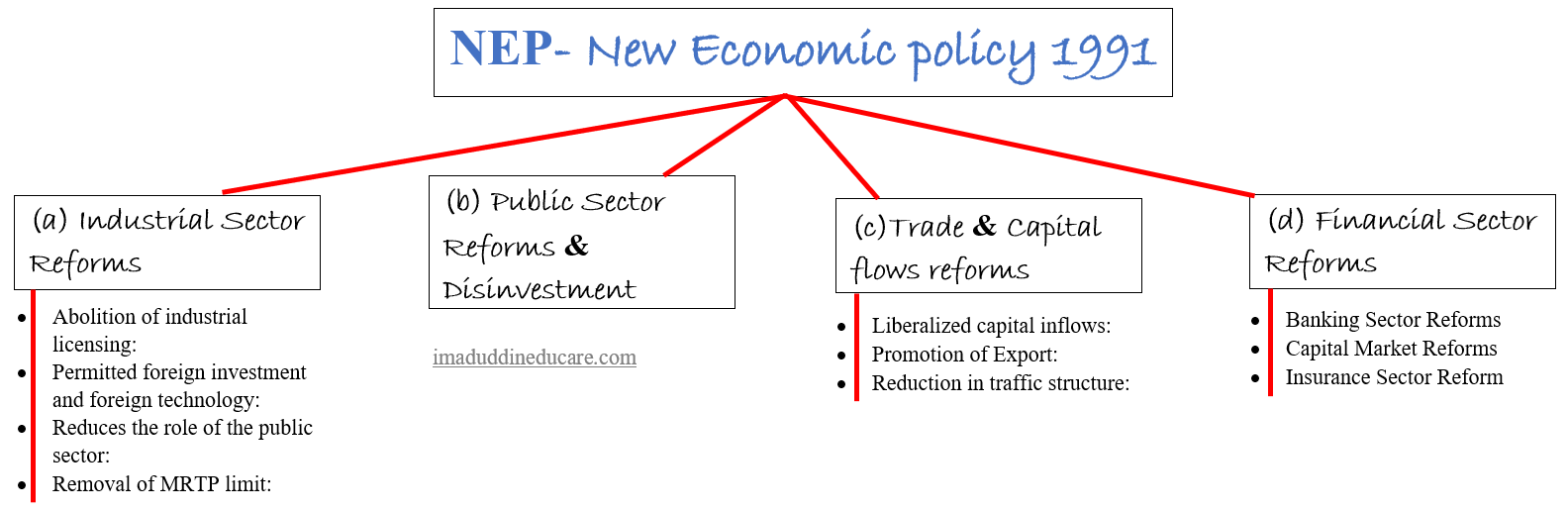

(A) Industrial sector reforms:

The country’s industrial development was due to the industrial policy resolution of 1948 and 1956. The government started to liberalize industrial policy measures in 1985. The momentum of industrial sector reforms increased with the announcement of the New Industrial Policy in 1991 (NIP). The important industrial sector reforms introduced in July 1991 were the following:

- Abolition of industrial licensing: The new policy abolished industrial licensing for all Industries except 18 Industries. At present, there are only five Industries under compulsory licensing. They are alcohol, cigarette, hazardous chemical, electronic Aerospace and defence equipment, and industrial explosives.

- Permitted foreign investment and foreign technology: The New Economics Policy 1991 encouraged direct investment and foreign Technology import in high-priority industries. The number of industries eligible for foreign direct investment has been expanded initially FDI was allowed up to 51 percent.

- Reduces the role of the public sector: The new policy reduces the number of the industry for the public sector from 17 to 3, at present the industries that are reserved for the public sector at present Are (1) Atomic energy and (2) substances notified by (3) Department of Atomic energy and (4) railway transport. Thus core Industries like Iron and Steel, electricity, air, transport, etc., and even strategic Industries like defence production are opened up for the private sector.

- Removal of MRTP limit: Under the Monopoly and Restrictive Trade Practices(MRTP) Act large companies with assets of rupees 100 crores and above Were are not allowed to expand their activities without the government’s permission. This restricted the growth expansion and efficiency of such firms. The new policy removed this threshold limit this eliminated the requirement of prior approval of the government for large Industries houses for expansion, the establishment of the new undertaking mergers, takeover, and amalgamation. The MRTP Act is now replaced by the Competition Act 2002.

(B) Public sector reforms and disinvestment:

- The public sector reforms consisted of disinvestment involving the sale of a portion of the government equity in public sector enterprises to the private sector.

- Since 1991 there have been major changes in the public sector policy in India. Other measures introduced were the rising of equity directly by the public sector from the market greater competition from new private Enterprises and giving greater financial and optional autonomy to public Enterprises.

- It has provided India with a large and diversified industrial base, generated employment, and earned foreign exchange through export and import substitution.

Trade and Capital Flows Reforms:

- Liberalisation of Imports: It helps promote free trade by allowing imported input for the domestic market. import control where visually abolished except for some consumer goods.

- Reduction in tariff structure: It means reducing taxes on imported products. The peak import duty on non Agricultural Products was reduced from more than 300 % to 150 1991-92 it was the lowered to 20% in 2004-5 and to 10% in 2007-8.

- Promotion of Export: Various incentives, tax deductions, and subsidies are provided to exporters in the foreign trade policies of the government.

- Change in exchange rate policy: The exchange rate was allowed to be determined by demand and supply in the foreign exchange market since 1993. This would help to balance payment problems in the RBI intervention in the foreign exchange market to reduce excess volatility in the foreign exchange market and stabilize the exchange rate of the rupee.

- Introduce Current Account Convertibility: The government introduced convertibility of the Rupee first on the trading account, and subsequently on the entire current account in August 1994 this increased the value ability of the foreign exchange to exporters and importers and for studies, travel, medical expenses, and so on.

- Liberalized capital inflows: The government has liberalized capital inflows in the form of foreign direct investment(FDI) and foreign portfolio investment FPI (foreign portfolio investors are allowed to invest in all types of securities traded in the primary and secondary markets.

(A) Banking Sector Reforms

- Lowering of SLR: Statutory liquidity ratio (SLR) has been reduced gradually as on April 2018 it is 19.5%

- Lowering of CRR: The Cash Reserve Ratio(CRR) was reduced gradually from 15% in 1991 to 4.5% in June 2003 this has released more points for lending to other sectors as on April 2018 CRR is 4%

- Deregulation of interest rate: Scheduled commercial banks have now the freedom to set the interest rates on their deposit subject to minimum floor rate and maximum ceiling rate. This is expected to bring healthy competition among the banks and encourage their operational efficiency.

- Introduction of Prudential norms: Prudential norms are guidelines issued by the central bank (RBI) for the proper and accountable functioning of banks.

- Introduction of Capital Adequacy Norms: The capital adequacy ratio measures Bank capital about its risk-weighted assets. It promotes financial stability under based III. it must be a minimum of 8%.

- Access to Capital Market: Public issues allow nationalized commercial banks to access the capital market for funds.

- The entry of a new Private Sector Bank: Government has permitted the entry of new private sector banks. This has provided competition to the public sector banks.

- Freedom of Operation: Scheduled banks have been given the freedom to open new branches and upgrade extension countries they are also permitted to close non-viable branches other than in ruler areas. Bank lending norms have been also liberalized.

- Special Recovery Tribunals: The government has set up a special recovery Tribunal for the recovery of loan arrears.

(B) Capital Market Reforms

The capital market is the market where long-term funds can be raised through debt and equity. Along with reform in the banking sector reforms were also introduced in the capital market the important reforms introduced in the capital market are:

- SEBI as Statutory body: securities and exchange board of India was set up in 1988. SEBI is authorized to regulate all the merchant banks on issue activity, lay the guidelines, supervise and regulate the working of mutual funds, and oversee the working of the stock exchange in India.

- Primary market reforms: Companies raising capital in the primary market are required to disclose all the information. Companies are allowed to determine the power value of shares issued by them. stricter norms have been introduced in all aspects of initial public offering (IPO)

- Online trading and dematerialized training: SEBI has introduced online trading and dematerialized training. This is expected to lead to a reduction in time and cost and the elimination of various risks associated with paper-based or physical settlement.

- Rolling settlement: SEBI has introduced a rolling settlement from January 2000 under the system that trading has been shortened to a day and trades are settled within two working days. This is expected to increase the efficiency and integrity of the securities market.

- Investment by FII: foreign institutional investor FIR is allowed to invest in all types of security traded in the primary market and secondary market.

- Investor protection: measures have been taken for investor protection for this purpose the investor education and protection fund has been established in October 2001.

- Establishment of NSE: National stock exchange of India was set up in November 1992. It started its operation in 1994. It has helped to bring transparency and operational efficiency to the secondary market operation.

- Setting up of national securities clearing corporation: the NSCC was set up in 1996. It guarantees all the traders on NSE. Thus every trade that has to take the place is freed from the risk of the counterparty defaulting. This has ended the risk of failure leading to a payment crisis.

- Strengthening the government securities market: Several measures were taken to strengthen the government securities market. They are in the introduction of the auction system for the sales of government securities setting of the securities trading corporation of India and so on.

(C) Insurance Sector Reforms

Reforms in the insurance sector commenced with the passing of the Insurance Regulatory and Development Authority (IRDA) Act of 1999. The IRDA Act ended the monopoly of the government in the insurance sector. This is done by encouraging private investment in the insurance sector. The IRDA gives licenses to the private sector to do insurance business.

Write notes on Macroeconomics stabilization

In the new government under the Prime Minister PV Narasimha Rao who assumed office in June 1991 the following policy measures relied on a combination of macroeconomics stabilization and structural reforms in Industrial and trade policy together the policy is popularly at LPG policies as they resulted in Liberalisation, Privatisation, and Globalisation of the Indian economy.

Macroeconomic stabilization demand management

These measures are short-measured at demand management to return to low and stable inflation and a sustainable fiscal and balance of payment position the measures consisted of the following

- Control of inflation

- Fiscal correction and

- Improvement in the balance of payment

Control of inflation:

- A combination of policies such as fiscal and monetary policies was undertaken to bring down the high inflation rate, and the fiscal deficit was brought down from 7.7% of GDP in 1990-91 to 4.9% in 1995-98.

- RBI continued with a tight monetary policy aimed at making borrowing costlier by rising bank rates, CRR, and SLR. It was done to reduce the money supply and control inflation. SLR was a rise from 38 % to 38.5% in September 1990.

- Thus the inflation rate was brought down to 8% in 1995 – 96 and further to 4.6% in 1996 – 97

Fiscal Correction:

- Fiscal policy is the use of government revenue collection (mainly taxes) and expenditure (spending) to influence the economy fiscal policy deals with taxation and government spending and is often administered by an executive under the laws of a legislature.

- Government reduces budgetary support to public enterprises and also undertook repayment of old public debt to reduce the interest burden.

- Measures were taken to increase revenue through text reforms. Taxes were rationalized and simplified.

Balance of payment adjustment:

- The Balance of payments is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period.

- Measures were taken to improve the balance of payment of the country. The Rupee was devalued by 18-19 percent in July 1991. This was followed by the introduction of Liberalised Exchange Rate Management System LERMS 1992-93.

- Under this, a dual exchange rate was fixed under which 40% of foreign exchange was to be surrendered at the official rate and the remaining 60% can be converted at the market rate.

- Efforts were made to increase exports to bring about technology upgradation in the export sector, and imports were liberalized.

|

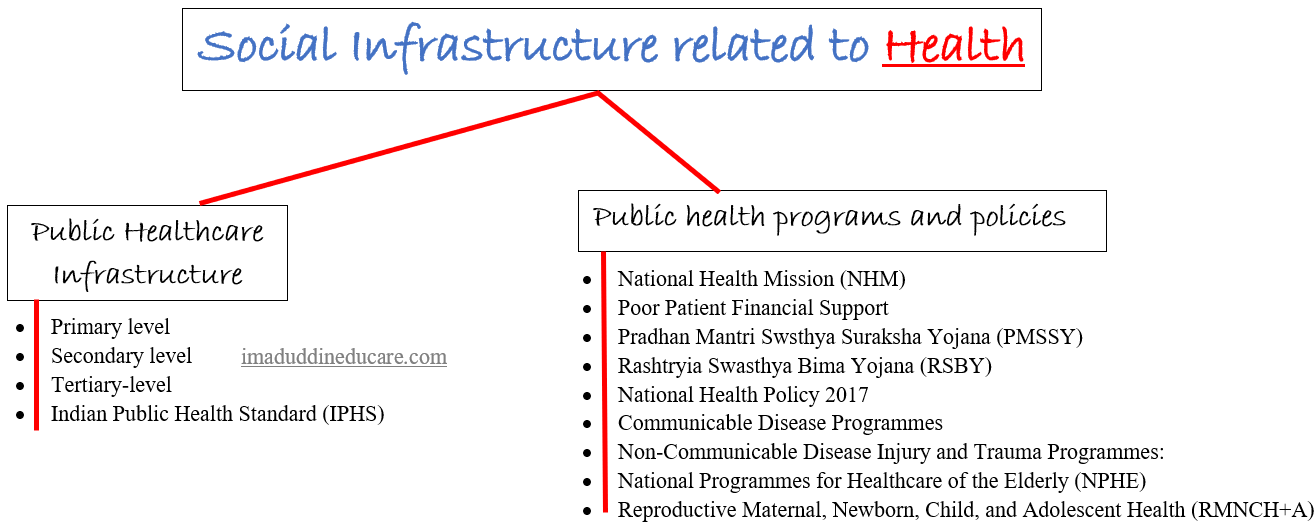

Discuss the role of social infrastructure related to health

- Social infrastructure refers to creating and maintaining facilities and structures that support the delivery of social services to the people. It consists of facilities, places, programs, and policies, that improve the standard of living and quality of life of people. Social infrastructure includes education, healthcare, and family welfare.

- There are two aspects to public healthcare: (a) Public Healthcare infrastructure and (b) Health policy and programs.

Public Healthcare Infrastructure

- Primary level: At this level, healthcare is provided by the Sub Centers and Primary Health Centers (PHC). Sub Centers are located in underdeveloped and remote rural areas covering a population of 3000 to 5000 population and providing basic healthcare and education for healthy living. PHC exists in a large village with a population between 20000 to 30000. These are the clinics with doctors and paramedics.

- Secondary level: At this level, there are Community Health Centers (CHC) and District Hospitals (SH). CHC is primarily in semi-urban areas covering between 80000 to 120000 people they are entirely funded by the state government. SH treats the patient referred by the lower-level health centers. They provide comprehensive secondary healthcare services and have beds ranging between 100 and 500.

- Tertiary-level health infrastructure at this level includes all Indian institutes of medical science and medical College and hospitals. All India Institute of Medical Science (AIIMS) are specialized hospital under the central government they are the country’s primary medical research institute. Medical colleges and hospitals are stated government-owned and founded they play a very significant role in providing general and specialized health services.

- Indian Public Health Standard (IPHS) was published in 2007 to provide a reference point for the functioning of SCs, PHCs, and CHCs DHs. IPHS is a set of uniform standards that should be followed by health centers and hospitals to make public health services more effective. The standards are revised from time to time.

(b) Public health programs and policies

- National Health Mission (NHM) was launched in 2013 to provide universal access to equitable, affordable, and quality health services through the healthcare infrastructure. The NHM includes the National Rural Health Mission and the National Urban Health Mission.

- Poor Patient Financial Support: Rashtriya Arogya Nidhi (RAN) was set up in 1997 to provide financial support to a patient who is below the poverty line and are suffering from major life-threatening diseases like cancer, cardiovascular disease, kidney disease, etc. Financial assistance to such patients is released in the form of a one-time grant given to the hospital where the patient is undergoing treatment.

- Pradhan Mantri Swsthya Suraksha Yojana (PMSSY): The PMSSY was announced in 2003 to correct the regional imbalance in public health infrastructure and improve the quality of medical education by setting up new AIIMS and upgrading Government Medical Colleges in Phases.

- Rashtryia Swasthya Bima Yojana (RSBY) The RSBY was launched in 2008 to provide social health security to workers in the unorganized sector. It was initially designed to provide health insurance coverage to the below-poverty line worker, but now the coverage has been expanded it covers construction workers, Street vendors, MNREAGA workers, etc.

- National Health Policy 2017: The policy was announced to achieve the highest possible level of well-being for all ages, disease prevention, and universal access to healthcare.

- Communicable Disease Programmes control the communicable disease is important for developing countries, as poor living conditions can spread these diseases rapidly. The ministry of health and family welfare implemented programs like HIV and AIDS programs through the department of AIDS Control. The program includes training of the staff, guidelines for testing and treatment, and providing counseling support.

- Non-Communicable Disease Injury and Trauma Programmes: The ministry of health and family welfare implemented programs like National oral health programs, National Mental Health programs, National Programmes for prevention and control of deafness, National Programmes for control of blindness, etc.

- National Programmes for Healthcare of the Elderly (NPHE) The NPHE was launched in 2010 to address the various health-related issue of the elderly population. With the increase in life expectancy, the proportion of the elderly population to the total population is increasing. Many of the elderly population belong to the low-income category with little or no financial support.

- Reproductive Maternal, Newborn, Child, and Adolescent Health (RMNCH+A): India become the first country in the world to launch the National Family Planning Programmes(NFPP) in 1952. The main focus of the program was to lower the fertility rate and slow population growth. The initial, the family planning programs was spread from the National Health Programmes (NHP). Later NFPP was integrated with the NHP and begins to know as the family welfare program. Today family welfare programs are not just restricted to family planning for population control but include the measures that help the maternal and child care and nutrition programs.

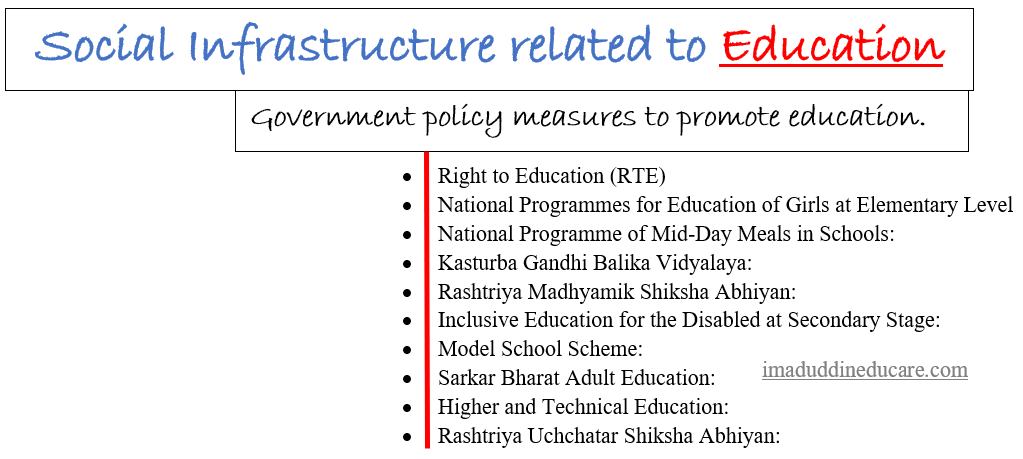

Explain the role of social infrastructure related to Education.

- Social infrastructure refers to creating and maintaining facilities and structures that support the delivery of social services to the people. It consists of facilities, places, programs, and policies, that improve the standard of living and quality of life of people. Social infrastructure includes education, healthcare, and family welfare.

- Education is the most crucial investment in human development education is universally recognized as a central component of human capital. The young population of India, if well equipped with education and skill can contribute effectively to the development of the economy

Government policy measures to promote education.

- Sarva Shiksha Abhiyan (SSA)/ Right to Education(RTE) for all children between the age of 6 and 14 years has been made a fundamental right under the RTE act 2009the act Max it mandatory that every child has the right to elementary education of satisfactory and equipment quality in the formal schools which satisfied search certain essential norms and standards.

- National Programmes for Education of Girls at Elementary Level: This program was approved in July 2003. Its main objective is to provide support for the education of underprivileged/disadvantaged girls at the elementary level. These programs provide for setting up model schools in every cluster with more intensive community mobilization and supervision of girls’ enrollment in school.

- Kasturba Gandhi Balika Vidyalay: This scheme was launched in July 2004 to set up residential schools at the elementary level for girls belonging to the SC, ST, OBC, and minorities. It was implemented in educationally backward blocks where rural female literacy is below 30% and in a selected urban area where female literacy is below the national average.

- National Programme of Mid-Day Meals in Schools: It makes a provision for providing cooked meals to the children studying in government, government-aided and local body schools. It has played a major role in increasing school enrollment and school attendance.

- Rashtriya Madhyamik Shiksha Abhiyan: It is certainly a sponsored scheme of MHRD launched in March 2009 to improve access to secondary education and improve its quality. The scheme aims to achieve an enrollment ratio of 75% for classes 9th and 12th within 5 years and to improve the quality of education at the secondary level.

- Inclusive Education for the Disabled at Secondary Stage: This scheme was launched in 2009-10 replacing the earlier Scheme of Integrated Education for Disabled Children(IEDC). It provides central assistance for inclusive education of disabled children studying in classes 11th-12th in government local bodies and government-aided schools.

- Model School Scheme: A scheme for setting up 6000 model schools as benchmarks of excellence at a block level with one school per block was launched in November 2008. It aims to provide quality education to talented rural children.

- Sarkar Bharat Adult Education: The National Literacy Mission (NLM) was recast as Saakshar Bharat(SB). Saakshar Bharat was launched on 8 September 2019. The main program of the NLM Total Literacy Campaign is to provide basic literacy to the non-literates, the Post Literacy Programme for the reinforcement of the literacy skills to the non-literates, and Continuing Education Programmes to provide the facility for lifelong education to the community at large.

- Higher and Technical Education: Higher and technical education includes graduates, postgraduate, and doctorate courses in the broad streams of the Arts, Science, Commerce, Law, Technology, Medicals, and Pharmacy. A country that aims at higher economic and social achievements must invest heavily in higher and technical education such investment will lead to the creation of a knowledge-based economy.

- Rashtriya Uchchatar Shiksha Abhiyan: RUSA is a certainly sponsored scheme launched in 2013 that aims at providing funding to eligible state higher educational institutes. RUSA would create new universities through the upgradation of existing autonomous colleges in a cluster, create new model degree colleges, and new professional colleges, and provide infrastructure support to the universities and colleges. Its objective improving the faculty quality, research output, innovation in education, capacity building in higher education, and reforms in educational institutes.

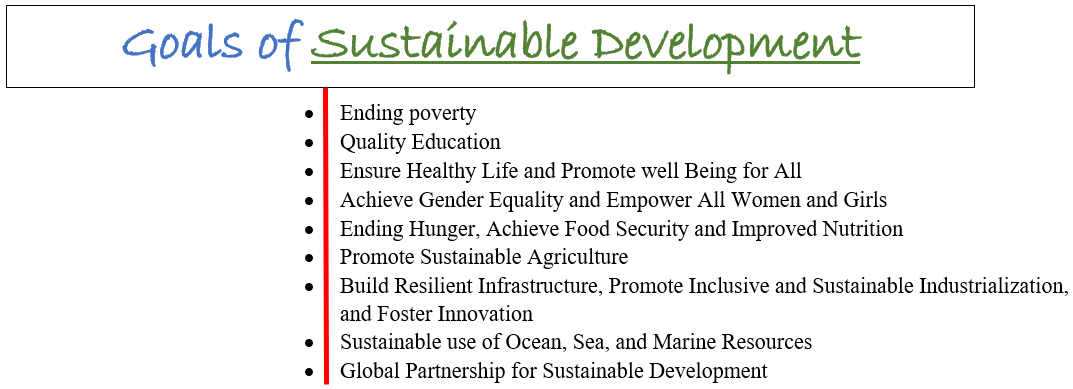

Explain any seven goals of Sustainable Development

- Sustainable Development is defined as development that meets the need of the present without compromising the ability of future generations to meet their own needs. If the country adopts a sustainable development strategy, its GDP growth rate may not be very high but it will be sustainable over a long period.

- The Sustainable Development Goals (SDGs), also known as the Global Goals, were adopted by all United Nations Member States in 2015 as a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030.

- The 17 SDGs are integrated—that is, they recognize that action in one area will affect outcomes in others and that development must balance social, economic, and environmental sustainability.

Sustainable development goals

- Ending poverty: Some of the achievements in the area of poverty reduction are, The Mahatma Gandhi national rural employment act MGNREGA. Deen Dayal Antyodaya Yojana National livelihoods mission provides skills and employment to marginalized communities. Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana provide access to life and accident insurance for 130 million subscribers for a nominal annual premium. Atal Pension Yojana provides pensions to workers in unorganized sectors.

- Ending Hunger, Achieve Food Security and Improved Nutrition, and Promote Sustainable Agriculture: The following are the sum of the achievements and initiatives in this area. Programs under the National Food Security cover more than 800 million people. Digitalization of ration cards using Aadhar for authenticating delivery of benefits. Land under organic farming has increased to 2 lacs hectare. Issuing of 62 million soil Health Cards. Digitalization of agriculture Marketing has taken place support to the farmer in encouraging micro-irrigation.

- Ensure Healthy Life and Promote Well-Being for All: The National Rural Drinking Water Program has expanded its coverage. The government has taken a step to initiate universal health insurance for a family below the poverty line. The national health mission has been expanded in coverage and programs. Target-oriented National health policy was announced in 2017.

- Achieve Gender Equality and Empower All Women and Girls: Initiative has been taken during the last few years for promoting gender equality, women empowerment centers are being established the provide comprehensive service at the village level. The flagship initiative is Beti Bachao Beti padhao. A maternity benefits program has been launched for all pregnant and lactating mothers.

- Build Resilient Infrastructure, Promote Inclusive and Sustainable Industrialization, and Foster Innovation: The initiative in this area is an expansion of all forms of transportation make in India initiative. Startup India program and Atal Innovation Missions have been launched to promote entrepreneurship. Digital India initiative to build a digitally empowered society.

- Conserve and Sustainable use Ocean, Sea, and Marine Resources: The coastal ocean monitoring and prediction system track the level of marine pollution along with the coastline. Significant progress has been made concerning the preservation and management of the Marine ecosystem.

- Revitalise the Global Partnership for Sustainable Development: To make India a destination for global investors the following initiatives are taken, the tax reform in the form of the implementation of Goods and Service Taxes (GST). Further consistent policies have opened up the economy to Foreign Direct Investment (FDI). Enhancing Development Corporation with the neighboring and another country to bring the innovation and expert services of this country.

Examine various skills development and training programs

- The government has launched some ambitious programs to achieve economic development. The core principle of sustainable development growth has been kept in mind while designing the programs.

- Skill India scheme was launched in July 2015 to train over 40 crore people in different skills by 2020. The main goal of the program is to create opportunities and scope for developing the potential talent and skills of the youth and enhance their capacity to be either employed or self-employed.

It includes the following government initiatives

- National Skill Development Mission: The mission has been developed to create convergence across sectors and states in terms of skills training activities. It is a part of the ministry of skill development and entrepreneurship.

- National Policy for Skill Development and Entrepreneurship 2015: The objective of the policy is to meet the challenges of the implementation skills India initiative. It aims to provide common skills skilling standards, align all skilling activities carried out in-country, and identify various institutional frameworks that can help to reach the objective of Skill India.

- Pradhan Mantri Kaushal Vikas Yojana: This is a scheme for skill training of youth to be implemented by the Ministry of Skill Development and Entrepreneurship through the National Skill Development Corporation. This scheme will cover 10 million youth during 2016-20. Training and assessment fee under the scheme is entirely paid by the government.

- Skill Loan Scheme: The scheme was launched in 2015 to support the youth who wish to go through skills training programs in the country. It replaced an earlier similar scheme.

Make In India

Make in India initiative is an initiative of the Government of India to encourage domestic and foreign companies to manufacture their product in India. It was launched by Prime Minister Narendra Modi on 25th September 2014.

The key purpose of the initiative is to create a healthy environment for investments in 25 focus sectors, Automobiles, Road and highway, Tourism and Hospitality and Wellness, food processing pharmaceuticals mining oil and gas renew renewable energy extractors, Aviation auto components, Biotechnology chemical, construction defense, etc.

The four key areas of making in India promote manufacturing and entrepreneurship.

- Policy initiative and new process

- Robust infrastructure

- Focus on sectors

- New mindset/ approach

The objective of the make in India

- To promote the growth of the manufacturing sectors and increase the relative contribution of this sector to the GDP by at least 25% by 2020

- To increase investment in the manufacturing sectors to enhance the production capacity

- To build the best in class manufacturing infrastructures.

- Encourage large-scale job creation and entrepreneurship.

- To improve the ease of doing business in India’s manufacturing sector.

- To project India as a preferred investment destination.

- To make India a global manufacturing and design hub.

- To promote skill development innovation and high quality.

- Protect and attract a high level of intellectual property.

Achievements of make in India

- Foreign direct investment inflow increased from 60.billion USD in 2016-17.

- Ease of Doing Business: India rank 100th in the World Bank Ease Doing Business ranking out of 196 countries according to the World Bank Group’s report in 2018.

- Sectors Specific Achievements: FDI in innovation group 6 times, 7 mega food processing parks made operational, 1.5 lakhs MSM units setup employing 11 lakh persons, pharmaceutical industry grew by 29%, Electricity generation group 5.8%.

Invest in India

Invest in India is the official agency dedicated to promoting facility investment in India. It was set up in 2010, as a joint venture between FICCI, DIPP (Development of Industrial Policy and Promotions), the ministry of commerce and industry, and the state government. It is a not-for-profit organization. It aims to become the first reference point for global investors interested in investing in India. It provides sector-specific and state-specific information to foreign investors. An Investor Facilitation Cells has been launched on the invest India portal in September 2015 to guide and assist investors.

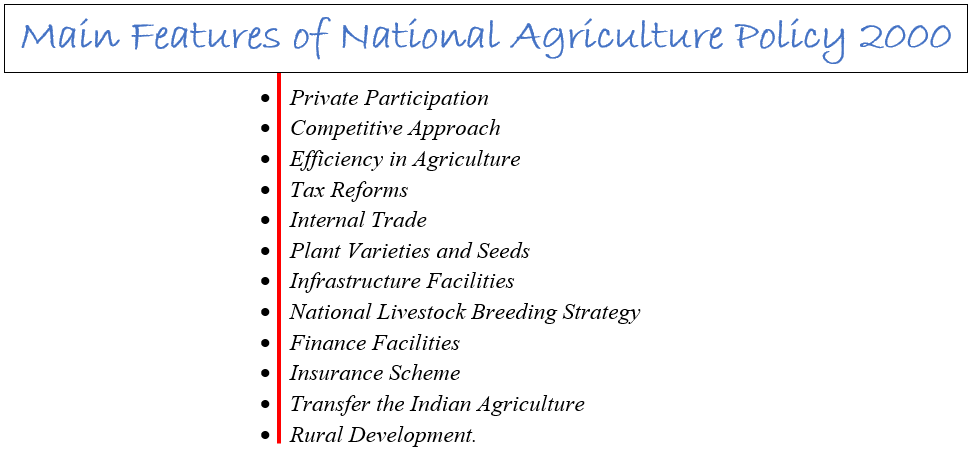

Discuss the Main features of the National Agriculture Policy 2000.

- Private Participation: Private enterprise’s Participation in agriculture is encouraged through contract farming, land lease agreement, technology transfer, capital inflows, and assured markets for crop production, especially of oilseeds, cotton, etc.

- Competitive Approach: Agriculture sector has become more liberalized with fewer quantitative restrictions. There is more international competition in the agriculture sector. Accordingly, the government’s new policy focuses on the efficient use of resources and technology, adequate availability of credit to farmers, and protection from seasonal price fluctuation. Agriculture national policy to promote exports.

- Efficiency in Agriculture: National Agriculture policy aims to increase the efficiency in the agriculture sector by reducing costs by using the latest technology and treating the agriculture activities more like a business rather than a way of life.

- Tax Reforms: The new tax law in the form of GST has expected to be favorable to farmers. Changes in tax structure would be introduced by reviewing the excise duty on materials such as farm machinery and implements, fertilizer, or any other input and activities.

- Internal Trade: Internal trade in agriculture commodities will be liberalized by progressively reducing existing restrictions including tax. Internal trade will encourage the market to play its role in the determination of agriculture prices. The government would also enlarge the coverage of commodity futures markets to minimize the wide fluctuations in commodity prices and also to hedge their risks.

- Plant Varieties and Seeds: Protection through legislation would be provided to encourage the research and breeding of new varieties. It is necessary to protect poor farmers from exploitation by multinationals through their patent rights.

- Infrastructure Facilities: The government is actively providing services like renewable resources of energy for irrigation, rural and farm credit, and infrastructure. An increase in the productivity of agriculture can be achieved if the required inputs will be available. Energy is the most essential input for any economic activity and electricity is one of the important inputs forms of energy required for the modernization of agriculture.

- National Livestock Breeding Strategy: New Agricultural policy plans to meet the requirement of milk, meat, egg, and livestock products and enhance the role of draught animals as a source of energy for farming operations. ( Livestock is animals that are kept on a farm, such as cows, pigs, sheep, etc.)

- Finance: The government has promoted a variety of financial institutions to provide credit on easy terms to the farmers. The major source of agriculture finance from non-institutional such as money lenders, indigenous banks, etc. but efforts is undertaken to bring institutional finance sources through various schemes.

- Insurance Scheme: An insurance policy scheme to be introduced to cover the activities right from the sowing of seeds to post-harvest operations, including market fluctuations in the price of agriculture products.

- Transfer the Indian Agriculture

- Rural Development

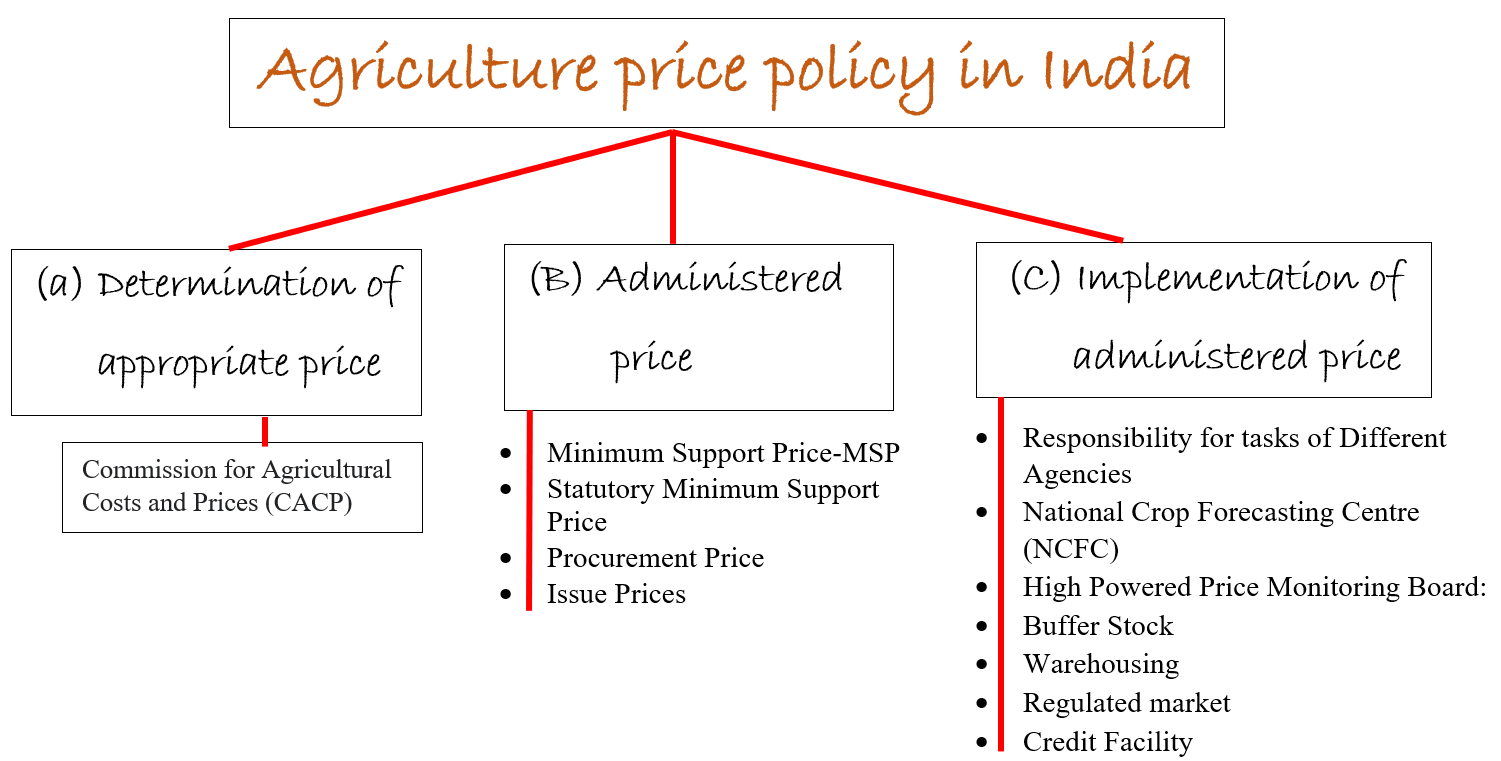

Agricultural Price Policy in India/ Agricultural Price Policy of Government of India.

- The Government of India keeping in mind the need for a price policy, set up a committee under the chairmanship of Prof. Jha in 1964-65. The Jha committee recommended the prices for agricultural commodities for the year 1964-65.

- The committee further recommended setting up Agriculture Pricing Commission.

- Currently, the commission is called Commission for Agricultural Cost and Price (CACP).

- The commission is expected to determine and announce administrative prices every year.

- Determination of Appropriate Level of Price

- Announcement of Administered Prices

- Implementation of Administered Prices

(A) Determination of Appropriate Level of Price

The Commission for Agricultural Cost and Price (CACP) while determining an appropriate level of price is expected to consider the following factors:

- The cost of production

- Changes in inputs prices

- Market prices

- Demand and supply

- Risk factors

- Effect on the general price level

- Effect industrial cost

- Effects on the cost of living

- international price situation

- Parity between the price of different crops,

- Parity between input and output prices and also parity between the price received by the farmers and paid by the consumers and the trend of the price level in the past

(B) Announcement of Administered Prices

Government announces 3 types of Administrative prices, namely MSP (Minimum Support Price), Procurement Price, and Statutory Minimum Support Price

Minimum Support Price: The minimum support price announced each year by the Commission for Agricultural Cost and Price takes into account the factor mentioned above and special consideration is given to cost factors.

The minimum support price fixed by the government in long-term guarantees to enable the producer to pursue his efforts with the assurance that the price of his produce would not be allowed to fall below the level fixed by the government.

It served as a floor price and guaranteed income to the farmers. 24 major crops are covered under MSP.

The formula for MSP can be expressed as:

MSP = C2 + C3

C2 cost includes all actual expenses in cash and kind incurred in production by the actual owner + rent paid for leased land + imputed value of family labour + interest on the value of owned capital assets + rent value of owned land net of land revenue

C3 cost is equal to C2 + 10% of the cost to account for managerial remuneration to the farmer.

Statutory Minimum Support Price: In the case of two commodities, jute and sugarcane, the minimum support price had been assigned a statutory status. It is illegal for anybody to purchase the commodity at less than its minimum support price. In the case of sugarcane, no factory can pay a low price lower than the statutory minimum. In the case of the Jute, the market Infrastructures continue to remain too weak, hence the enforcement of the minimum support price has become a difficult task.

Procurement Price: Procurement price is the price at which the government procured grains from producers usually the procurement price is lower than the open market price but higher than the minimum support price

Issue Prices: The issue price at which the government supplies the food grains at ration shops. They are lower than the procurement prices to protect below the poverty line consumers’ interest. The difference between MSP and the issue price is met by the government through the subsidy. For Antyodaya Anna Yojana (AAY) scheme the issue price was ₹ 300 per quintal. From 2002 to 2003 the issue price for AAY categories remained unchanged. The MSP for these items was much higher than the issue price.

(C) Implementation of Administered Prices

Implementing administered prices for the following measures are taken by the government:

Responsibility task of Different Agencies:

- The Food Corporation of India FCI undertakes the price support operation for most Food grains.

- The NAFED National Agricultural Cooperative Marketing Federation undertakes Pulses and oilseed etc. operations.

- The Cotton and Jute Corporation of India are entrusted with the price support operation for cotton and jute.

- Sugar Mills are required to pay at least the minimum price to the producer in the case of sugarcane.

- For tobacco, the responsibility for implementing the price policy decisions depends on Tobacco Board. Similar specialized commodity boards exist for rubber, coffee, tea, spicy, coconut, oil-seeds and vegetable oils, Horticulture, etc.

National Crop Forecasting Centre (NCFC): It was established by the government in January 1999 to keep a careful watch on the prices of primary products including wage goods and other items of common man’s consumption and recommended vigorous intervention necessary by the government in the market. NCFC will put a warning system that signals likely supply shortfalls. This was found necessary till now in the case of onion, pulses, and edible oil.

High Powered Price Monitoring Board: It was setups in 1999 for monitoring the essential commodity prices and anticipating the needs of the government’s interventions in the market.

Buffer Stock: Buffer stocks are the stocks build-up by the government to stabilize the price. Food Corporation of India and NAFED build up the buffer stocks of essential grains which are utilized when they are shortage of output. From 1992 onwards buffet stocks have gone up continuously. Currently, we have enough buffer stocks of essential grains.

Warehousing: The Government has made arrangements to set up the warehouse including a warehouse of FCI. Such a warehouse helps the formers to store the farm’s products till they are demanded in the market.

Regulated market: Most of the states have regulated markets which have helped stabilizer agriculture prices. Regulated markets fix appropriate prices in the interest of farmers.

Credit Facility: The government has made efforts to provide credit finance to farmers at low-interest rates to enable them to stock their products and sell them later at better prices. This brings about stability in agriculture prices.

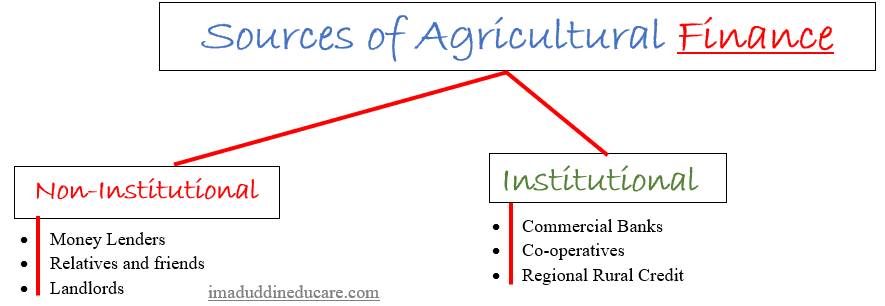

Discuss the different sources of agricultural finance

There are two significant sources of agriculture finance a) Non-institutional and b) Institutional. Agricultural credit is available to farmers and other people who are working in the agriculture sector in India from different sources which can be broadly classified into non-institutional and institutional.

Non-Institutional source of agriculture finance

Non-Institutional sources of agriculture finance include moneylenders, traders and commission agents, relatives, and landlords. In 1951, 92.7 percent of rural agriculture credit was provided by the non-institutional source money lenders providing 69.7 percent of the credit.

At present contribution of non-institutional finance is reduced to about 20 percent. 40 percent of small and marginal farmers’ credit depends on non-institutional sources.

non-institutional credits have decreased due to the nationalization of major banks and the establishment of NABARD (National Bank of Agriculture and Rural Development).

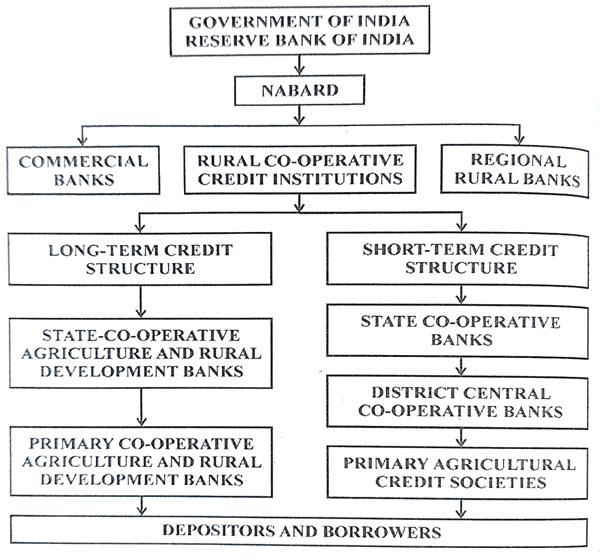

Institutional source of agriculture finance

Institutional sources of agriculture finance include co-operatives, and commercial banks including the SBI Group, RBI, and NABARD. Recently share of Institutional credit has increased after the nationalization of commercial banks and the establishment of NABARD. Cooperative and commercial banks have been playing the important role in rural agriculture credit. let us discuss in the brief the major source of institutional credit.

A) Commercial Banks

75 percent of the total institutional credit to agriculture lending is from commercial banks. Commercial bank lending can be classified as i) short-term, ii) medium and long-term, iii) direct finance and iv) indirect finance.

- Short-term finance is extended for purchasing fertilizers seeds pesticides etc. it provides the required working capital More than 50% of commercial banks’ agriculture finance comes in this category.

- Medium/long term: Commercial banks lend the medium term but do not encourage long-term finance. Money borrowed under this is usually used to purchase cattle, equipment, and the improvement of the land.

- Direct Finance is meant for expenditure on purchasing pump sets, tractors, and other Agricultural Machinery construction of Wells bore Wells and tube wells, etc. lending under direct finance has been around 10% of total lending.

- Indirect finance is granted to the Cooperative Societies of various types to enable them to function more effectively. The commercial bank also subscribes to the debenture of central land development banks besides extending the loan to them. indirect finance is provided to the Food Corporation of India, the State Government, and other Agencies for procurement, shortage, and distribution of food grain.

B) Co-operatives

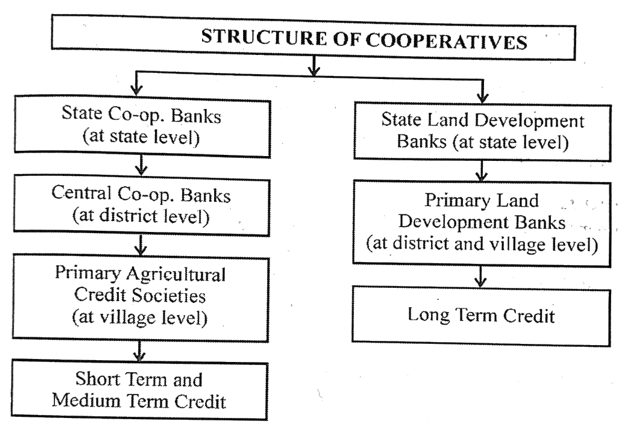

A cooperative credit society was established to provide rural credit at a lower cost. The Cooperative Banks provide short-term and long-term loans through the credit societies via Land Development Banks. They have well-established organizations as shown in the chart

Short-term and medium-term credit

- State cooperative banks are the apex of the cooperative credit structure. They link the central cooperative banks and NABARD (National bank for Agriculture and Rural Development).

- Central cooperative banks function at the district level and provide the link between primary societies and State Cooperative Banks. The primary Society for the money from the State Cooperative Through The Central Cooperatives.

- The primary credit society at the base level is at the village level. They provide short-term and medium-term credit to the farmers. Besides credit, they also help farmers by supplying seeds, fertilizers, Agricultural equipment, marketing, etc.

C) Regional Rural Credit

The regional rural bank was established in 1975 on the Recommendation of the M. Narsimha committee. The banks were originally based, rurally oriented, and generally sponsored by these scheduled commercial banks. Some private sector banks and State Cooperative Banks have supported the RRBs. At present these are 56 RRBs.

The objective of the rural regional banks is to develop the rural economy and to extend finance to the farmers especially small and marginal, village artisans, small entrepreneurs, and agricultural labourers.

Discuss the Structure of the Capital Market

Introduction:

- The capital market is a financial market for long-term funds. The Capital market facilitates medium and long-term funds for borrowing and lending for both equity and debt raised within and outside the country.

- The development of an efficient capital market is necessary for promoting more investments as well as achieving economic growth.

- The demand for long-term funds comes from agriculture, trade, and industry. Individual savers, corporate savings, banks, insurance companies, and specialized financial institutions are the suppliers of long-term funds.

Structure of Capital Market in India

In the capital market, there is a borrower who demands funds and a lender who supplies the funds.

The capital market consists of three different segments a) Government Securities Market which is regulated by the Reserve Bank of India (RBI). It is also known as the Gilt-edged market. b) Corporate debt Market c) Equity Market

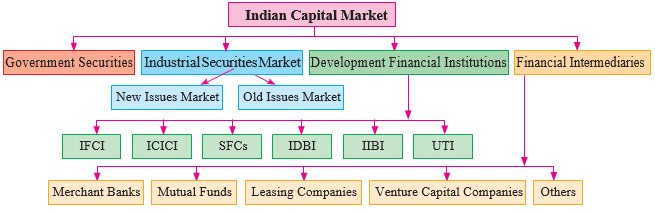

Indian capital market is widely composed of 1) A Gilt-edged market that is a government securities market, 2) an Industrial securities market, 3) Development financial institutions, and 4) Financial intermediaries.

- Government Securities Market: It is also called the gilt-edged market. It deals in government and semi-government securities. government securities are acknowledged as the Government’s debt obligation or certificates. Such securities carry a fixed rate of interest. The investors in government securities are mainly financial institutions such as commercial banks, LIC, GIC, provident funds, pensions, etc. RBI plays a very important role in the capital market.

- Industrial Securities Market: It deals with the shares and debentures issued by old and new companies. This market is further divided into Primary Market (New Issues) and Secondary Market (Old Issues). The primary market helps to raise fresh capital through the sale of shares and debentures. Secondary market deals with securities already issued by companies that are operated through stock exchanges.

- Development Financial Institutions (DFIs): These institutions were set up mainly to provide medium and long-term financial assistance to the private sector. They include the Industrial Finance Corporation of India (IFCI), Industrial Investment Bank of India (IIBI), EXIM Bank, etc.

- Financial Intermediaries: Financial intermediary is an organization that acts as a link between the investor and the borrower to meet the financial objectives of both parties. They consist of merchant banks, mutual funds, leasing companies, venture capital companies, etc.

Discuss the Capital Market Reform in India

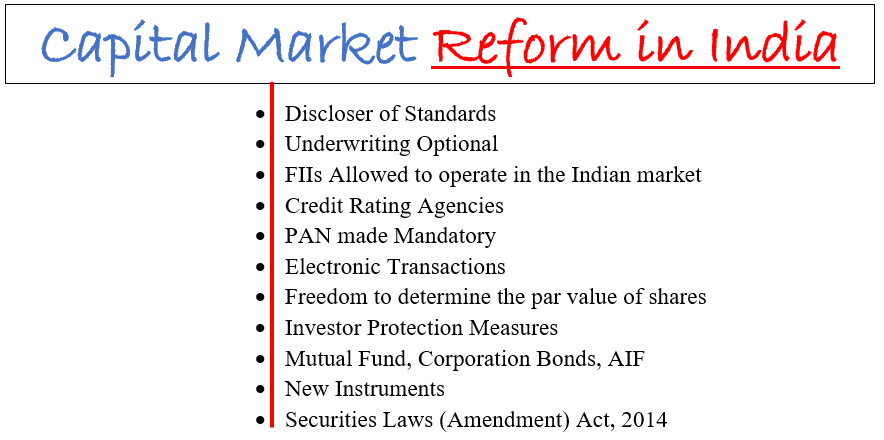

- Discloser of Standards: Companies are required to disclose all material facts and specific risk factors related to their projects. SEBI has also introduced a code of advertisement for public issues for fair and truthful disclosure.

- Credit Rating Agencies: Different credit agencies like CRISIL, ICARE, CARE, etc. are set up to meet the emerging needs of the capital market. Credit rating agencies provide risk and quality investment of instruments by the business units. It helps the healthy discipline of the borrowers and guides investors.

- PAN made Mandatory: PAN has been made mandatory with effect from 1st January 2007 to strengthen the KYC “know your customer.

- Electronic Transactions: Due to technological development in recent. The physical transaction or paperwork is reduced. Now investors make transactions online. It helps to save both money and time for investors. Thus it has made investing safer and hassle-free influencing more people to join the capital market.

- Freedom to determine the par value of shares: SEBI has allowed the companies to determine the par value of shares issued by the company. SEBI has allowed issues of IPOs through the “book building” process.

- Underwriting Optional: It is subject to the condition that if an issue was not underwritten and was not able to collect 90 percent of the amount offered to the public, the entire amount collected would be refunded to the investor.

- FIIs Allowed to operate in the Indian market: Foreign institutional investors (FIIs like mutual funds and pension funds are allowed to invest in equity shares as well as in the debt market.

Access to Global Funds Market: Indian companies are permitted to access the global finance market through ADR, GDR, FCCBs, ECBs, etc., and benefit from the lower cost of funds. - Investor Protection Measures: Discloser and Investors Protection (DIP) guidelines for new issues to proceed with the interest of investors and the development of the securities market. SEBI also introduced an automated complaints handling system to deal with investor complaints.

- Securities Laws (Amendment) Act, 2014: This Act passed in August 2014 enhances powers conferred upon SEBI, including explicit power to disgorge ill-gotten gains, the power to conduct search and seizure, explicit powers for settlement, attachment and recovery, increase in penalties, and constitutions of special courts.

- Mutual Fund, Corporation Bonds, AIF: SEBI notified the Infrastructure Investment Trust Regulation in Sept 2014 which provides a framework for registration and regulation of investment in India. SEBI ( Research Analysts) Regulation, 2014 was notified on Sept 01, 2014.

- New Instruments: Several new financial instruments have been introduced after 1992. Instruments like convertible preference shares, secured premium notes, warrants, Zero Coupon Bonds, deep discount bonds, discount bonds, Flexible bonds, loyalty coupons, etc.

Difference between Primary Market and Secondary Market

Primary Market |

Secondary Market |

| The issue of new shares by the company is done in the primary market. |

The securities issued earlier are traded in the secondary market. |

| Direct investment in the securities. Securities are acquired directly from the company | Indirect investment as the securities are acquired from other stakeholders. |

| The parties dealing in this market are the company and investors. | The parties dealing in this market are only investors. |

| The underwriters are the intermediaries. | The security brokers are the intermediaries |

| The price of security in the primary market is fixed as it is decided by the company. | The price of a security is fluctuating, depending on the demand and supply conditions in the market |

Discuss the Structure of the Indian money market

- The money market is a type of market where lending and borrowing funds for a short period. The Money market deals in short-term funds and financial instruments for the period of one day to one year or less. In the money market financial instruments are highly liquid and converted into cash within a short period.

- In the money market, various instruments are used for lending and borrowing such as call money, commercial bills, treasury bills, certificates of deposits, commercial papers, etc. It is a wholesale market for a short-term debt instrument.

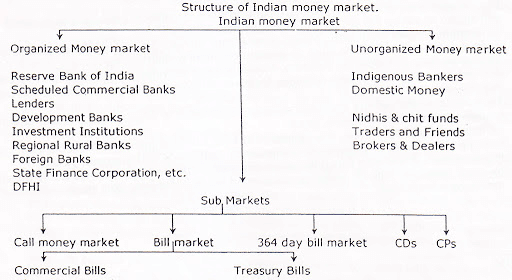

Structure of the Indian Money Market

- Money Market is divided into the organized sector and the unorganized sector. organized money market governed by the Act. the organized market registered the government and follow the rules and regulations.

- The unorganized market is not governed by any Act. It is registered with the government; therefore no rules and regulations are followed by the unorganized sector.

Role of different players and participants in the organized sector:

- RBI: Reserve Bank of India Plays a very important role in the Money market. The objective of RBI operation in the money market is to ensure liquidity and short-term interest rate for achieving the objectives of monetary policy. RBI Plays the role of a middleman and regulator in the money market.

- Government: The government is an active player in the money market and, is the biggest borrower in the money market. The government needs to borrow funds in case of a deficit budget when expenditure is more than revenue. government raising funds by issue of securities in the money market.

- Banks: Banks are very important players in the money market because banks undertake short-term lending and borrowing of funds. The collective operation of banks on a day-to-day basis has a major impact on the structure of interest rates and liquidity positions.

- Financial Institutions: The financial institution undertakes the lending and borrowing of short-term funds. They carry out in large volumes and therefore have an important impact on the money market.

- Discount and Finance House of India(DFHI): The RBI set up DFHI jointly with public sector banks and all Indian financial institutions to provide liquidity in short term. The DFHI deals in treasury bills, commercial bills, CDs, CPs, short-term deposits, call money market, and government securities. The DFHI also participates in repos operations.

- Business Corporates: They deal in the money market mostly to raise short-term funds for satisfying their working capital requirement. they use both the organized and the unorganized sectors of the money market.

- Non-Banking Financial Intermediaries: NBFI consists of Mutual funds, Foreign Institutional Investors (FIIs), etc. they accept a deposit in different forms and lend or invest in different economic activities. Their level of participation depends on the regulations. For example, the level of participation of FIIs in the Indian money market is restricted to investment in government securities.

- Primary Dealers(PDs): RBI introduced PDs in 1995 to develop an active secondary market for government securities. They also act as underwriters to government securities.

The main components of the Unorganized Sector of the Indian Money Market

- Indigenous Bankers: They operate as banks, receive deposits, and give loans and deals in hundies. hundi is a short-term credit instrument. The rate of interest differs from one market to another market and from one bank to another. They are financial intermediaries who provide loans directly to trade and industry and agriculture by money lenders and traders.

- Money Lenders: Moneylenders’ primary business is money lending. They operate mainly in villages but they also operate in urban areas. A large number of loans are given for unproductive purposes. The borrower is agriculture labourers, small farmers, factory workers, small traders, etc.

- Financial Brokers: Financial brokers are middlemen between lenders and borrowers. They are found in all major markets, especially in the cloth market, grain markets, and commodity markets.

- Unregulated non-bank Financial Intermediaries: the Unregulated non-bank Financial Intermediaries consist of Chit Funds, Nidhis, Loan Companies, and others.

a) Chit funds: It is a saving institution. The members make contributions of funds regularly. the collected funds are given to some members based on bids or draws.

b) Nidhis: The deposit from members are the main source of funds and makes loans to members at a reasonable interest rate for house construction or repairs.

c) Loan Companies: It is also knowns as Finance companies. The total capital of the loan companies is borrowings, deposits, and own funds. They offer a higher interest rate.

Difference between Money Market and Capital Market

|

Money Market |

Capital Market |

|

1. Meaning: |

It is a component of the financial market where long-term borrowings take place. |

|

2. Period |

In the capital market, the instruments traded have a maturity period of more than one year. |

|

3. Instruments |

Stocks, Shares, Debentures, Bonds, and Securities of the government are the instrument of the capital market. |

|

4. Purpose of borrowing |

Long-term funds are required to establish a new business, expand or diversify the business, or purchase fixed assets. |

|

5. Institutions |

Stock exchanges, Commercial banks, Non-bank institutions, financial intermediaries, etc. are the participants in the market. |

|

6. Risk |

In The capital market, the risk is more as compared to in the money market. The reason behind this is the instruments have a long maturity period. |

|

7. Return on Investment |

Return on investment in the capital market is comparatively high as they are riskier. |

|

8. Role in Economy |

This market helps in the mobilization of savings in the economy. |

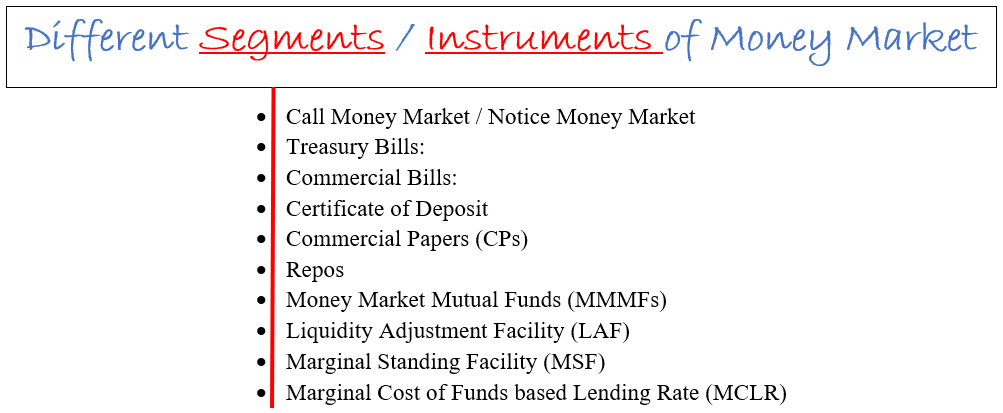

Different Segments / Instruments of Money Market

-

Call Money Market / Notice Money Market

The lending and borrowing of money for one day are called call money. normally banks depend on the call money market to raise funds for a day. And lending of money for one day to 14 days is called notice money. In the case of notice money, no specific date is given for repayment of funds but generally, borrowers have to make the payment on the given date. The rate of interest in call money is called the call money rate which is determined by the demand and supply of funds.

-

Treasury Bills:

Treasury bills are issued by the Reserve Bank of India (RBI) on behalf of the Government of India. It is a short-term and main instrument borrowed by the government. Government issue three types of treasury bills by auction, 91 days, 182 days, and 364 days treasury bills.

-

Commercial Bills:

The commercial bill is a short-term negotiable instrument drawn by a seller on the buyer for the value of goods delivered by the seller. This is a self-liquidating instrument with low risk. These bills also called trade bills are accepted by commercial banks are called commercial bills. The maturity period of commercial bills is generally 90 days but if the seller needs urgent funds, he can rediscount the bill from the banks.

-

Certificate of Deposit

Certificates of Deposits were introduced in India in June 1989. Certificates of Deposits issued by commercial banks and development financial institutions. This helps commercial banks to raise the funds from the market through CDs. The minimum size of issues for a single investor is Rs. 1 lakh and the maturity period is three months to one year.

-

Commercial Papers (CPs)

Commercial Papers were introduced in January 1990 in India to provide highly rated corporate borrowers with to diversify short-term borrowing. It is an unsecured money market instrument issued in the form of promissory notes with a fixed maturity. commercial papers are highly liquid and quite safe. The maturity of commercial papers is a minimum of 7 days and a maximum of one year.

-

Repos:

Repo rate is the rate at which commercial bank borrows money from the Reserve Bank of India by selling their securities in the case of a shortage of funds to maintain liquidity. The Reserve repo rate is the rate at which the Reserve Bank of India(RBI) borrows money from the banks to flow away liquidity from the system.

-

Money Market Mutual Funds(MMMFs):

MMMFs were introduced by RBI in April 1992 to enable small investors to participate in the money market. MMMFs mobilize the savings of small investors and invest in short-term debt instruments or money market instruments like Call money, Repos, Treasury bills, CDs, and CPs.

-

Liquidity Adjustment Facility (LAF)

Reserve Bank of India introduced the Liquidity Adjustment Facility in June 2000. It is a monetary policy that allows banks to borrow money from the RBI by repurchase agreement. LAF consists of the Repo rate and Reserve rate.

-

Marginal Standing Facility (MSF):

Central Bank of India i.e. RBI introduced MSF in its monetary policy on 3rd many 2011 and is effective from 9th many 2011. Under this scheme, banks allow borrowing money for one day. This Scheme can be used when banks exhaust all borrowing options including LAF.

-

Marginal Cost of Funds based Lending Rate(MCLR):

MCLR is a new method introduced by RBI on 1st April 2016. It is based on the marginal cost of borrowing and returns on net worth for banks. for example, if one-year deposits are 7.5%, then one-year MCLR will be 7.50% plus CRR, operation cost, and tenor premium.

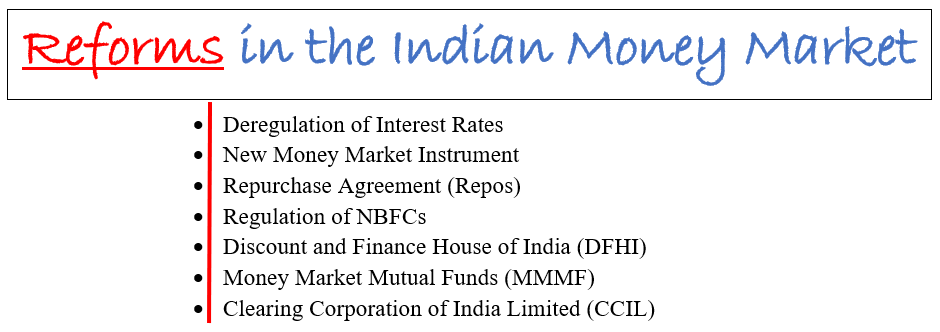

- Deregulation of Interest Rates: The restriction on the interest rate on call money, and inter-bank short-term deposits were removed and rates were permitted according to market forces.

- New Money Market Instrument: Introduction of New money market instruments by the RBI like treasury bills, CDs, and CPs. Through these instruments governments, banks, the financial institutes can raise the funds from the Indian money market.

- Repurchase Agreement (Repos): In December 992 RBI introduced Repos in government securities and reserve repos in November 1996. Repos and Reserve Repos help to maintain liquidity and avoid fluctuation in the money market.

- Regulation of NBFCs: The RBI Act was amended in 1997 to provide for comprehensive regulation for the NBFC sector. According to the amendment no Non-Banking Financial Corporation(NBFCs) can carry on any business of a financial institution, including acceptance of public deposit, without obtaining a Certificate of Registration(CoR)

- Discount and Finance House of India(DFHI): DFHI was set up in 1988 jointly by RBI, public sector banks, and financial institutions. It facilitates liquidity to money market instruments and the development of the secondary markets in such instruments.

- Money Market Mutual Funds(MMMF): In April 1992 RBI introduced MMMFs to enable the individual investor to participate in the money market. To make the scheme flexible and attractive RBI makes many modifications.

- Clearing Corporation of India Limited(CCIL): The CCIL ccallstransactionstionsn in government securities and repos reposted on the Negotiated Dealing System(NDS) of RBI and also rupee/Us $ foreign exchange spot and forward deals. The CCIL was registered under the companies act 1956 on 30 April 2001, with the State Bank of India as the chief promoter.

- There are many reforms such as Liquidity Adjustment Facility, Marginal standing facility, and development of inter-bank call and Notice Money Market.

More Business Economic Notes Click Here

Reference: Manan Prakashan

It’s enough to score 80+ ????

will update for module 3 and module 4

Sir please upload module 3 and 4 🙏

ok

Please upload tybcom sem 5 important question of econmic and business management paper

check-in tybcom section we have updated many subjects

Thank you so much sir.. it’s very helpful to us

What is module 3 and 4

I have added Module 4

will update 3 till Sunday

Pleasure provide answer for role of SEBI in development of capital market

Sir please upload module 3 notes

It’s this inough for score 80+ ???

yes

Sir this are notes enough for 80 marks ?

yes

MSME sector and industrial polloution ?

Please update Module 3 and 4

If we study only these questions will we pass?

yes

Module 3 or 4 Plzz sirr

How to download this note of ecomomics sem v.

It’s in our app Visionary Commerce Academy

Nice 👍

Sir ji please update 3 & 4 Please. We have exams of sem 5 soon

sure

Sir you were going to update module 3 and module 4 during september of 2022. It is august 2023 and still no update. Please help and do the needfull. Update the notes on both Markerting & Economics of Semester 5 so we can study.

ok sure

Sir security and exchange board of india SEBI wala answer upload karona